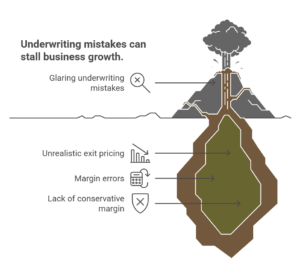

What I am serious about: The identical obtrusive underwriting errors, week after week, that might stall your corporation for months (or worse).

Lately, I reviewed land offers from a wide range of operators, some operating 7+ determine companies, and 80% of the offers had been off by as a lot as 100% on their exit pricing estimate.

Not 10-15% margin errors. We’re speaking about operators underwriting properties at market worth buy costs, anticipating fully unrealistic exits.

For context, we cannot entertain funding (or recommending your individual fairness buy) except there’s roughly 2X gross conservative margin (these offers are nonetheless on the market, belief me, we’ve constructed a considerable operation ONLY funding these).

Most properties despatched over would wish their anticipated buy value reduce in half (or extra) to even get within the neighborhood of what may work.

The $180-Acre Actuality Verify: When Exit Pricing Goes Improper

Here is a obtrusive instance from a Land Each day Diligence session:

- ~180-acre play north of Dallas, anticipating to subdivide into 60-75 baby parcels of ~2 acres every.

- Highway set up required.

- Prompt exit pricing of ~$100K per acre was despatched to me based mostly on comps.

My evaluation:

- Most parcels within the space are not any smaller than ~20 acres.

- Possibly 1-2 latest offered comps within the 2ac vary over the previous 3 months, with superior traits.

- Offered comps within the 10-20-acre vary (which appeared a extra viable pathway) had been transferring at ~$20K PPA.

- Smorgasbord of energetic listings (a sea of inexperienced pins on Redfin) with comparable/superior traits, many available on the market for 300+ days.

- Like many sunbelt markets, north of DFW is in a serious pricing downtrend proper now, particularly for residential tons, including additional strain.

- The topic property had some good options, however with the entire above, I couldn’t justify providing the vendor greater than ~$10K per acre, lower than ~80% of what they had been in search of.

Just about each level above was a punch to the intestine for the potential of the subdivide. Alarm bells had been going off instantly.

And I preserve having to ask myself, “How is that this stage of danger not registering with different land buyers?”

Look, I get it. Lots of you’re operating undermanned operations managing lead gen, varied advertising channels, comping, biz ops, and dispo… Whereas we’re a Class of One enterprise specializing in land deal underwriting all day, on daily basis.

We don’t anticipate you to be pretty much as good as us in that regard, similar to it’s unrealistic to anticipate me to be pretty much as good at speaking with sellers as your staff could also be.

The purpose I’m getting throughout is that there nonetheless appears to be a MASSIVE hole throughout a lot of the business with correctly pricing properties. Even with all of the schooling we, and others, have put out, there’s nonetheless a LONG technique to go, an issue that couldn’t excite me extra since we have now been engaged on an answer for some time; see beneath…

(And for these of you, saying, “Chris, we’re locked in on comping properties, no points right here,” mad props to you; preserve going and preserve your key benefit. For anybody routinely studying this weblog put up although, even one of the best falter, and the ability wants honing repeatedly.)

It is a subject I’ll return to typically and possibly might write about each week given the information hole.

Present Market Situations Each Land Investor Should Know

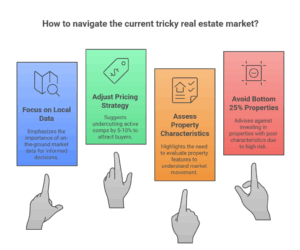

Backside-up market situations over every part. We now have tendrils and dealer relationships, plus energetic stock, throughout a lot of the US. Native, on-the-ground market information is your greatest buddy.

On common, we’re seeing much more trepidation/slowness than initially of Q2 2025, when the commerce warfare fears kicked off. At greatest, situations are the identical.

BE CAREFUL on the market, of us! That is the trickiest total market we have now seen in 5+ years.

Customary sell-through charges are ineffective proper now. Usually, they contemplate the previous 12 months, however we have had excessive volatility — a giant bull market on the finish of 2024/early 2025, then main issue in most markets after Q2 2025 began.

The Attribute Blind Spots Costing You Offers

Observe offered comps that went pending after April 1, 2025, particularly. Any comps exterior of that vary ought to be considered with excessive skepticism.

You’re most likely not undercutting energetic comps sufficient. Until you’ve disgustingly superior traits (which most buyers overestimate), that you must undercut ALL energetic market pricing by not less than 5-10% (extra when you introduce 3 or extra baby parcels).

Be good, after all: get a basic baseline of energetic comp traits. You don’t essentially must undercut landlocked listings, as an illustration.

Assess traits religiously. The one latest offered comps may need newly positioned cell houses, put in utilities, or proximity to city facilities – benefits explaining why they moved in a tough market.

For goal properties which might be within the backside 25% of traits, we gained’t contact them, no matter pricing. The chance and potential mind injury simply ain’t value it proper now.

The Systematic Resolution: Why Even Consultants Want Course of

At the same time as specialists, my staff will get overwhelmed pricing properties when there are 20-50+ viable comps to contemplate. I catch myself dashing by $500K+ choices for effectivity’s sake.

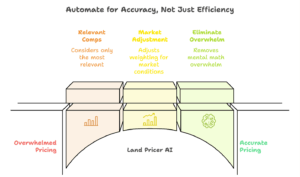

For this reason we created Land Pricer AI. It considers solely probably the most related comps, adjusts weighting for present market situations, and eliminates psychological math overwhelm whereas accounting for property traits.

Keep in mind: Amateurs automate for effectivity. Professionals automate for accuracy.

That 180ac north Dallas deal made my eyes glaze over, and I am speculated to be the most effective within the business. Correct software program is the one viable route ahead.

We’re constructing probably the most dependable pricing instrument available on the market as a result of our personal enterprise depends upon it:

Know the Actual Worth Earlier than You Flip