Influence on charges is determined by the construction of rumored IPO. Regardless of the plan seems to be, the Trump administration has stacked the boards on the mortgage giants with its supporters.

Shares in mortgage giants Fannie Mae and Freddie Mac soared Friday on reviews that the Trump administration is planning to take the businesses public once more by the tip of the 12 months.

The plan would worth the businesses at $500 billion, with the federal government elevating $30 billion, The Wall Road Journal reported, citing nameless “individuals accustomed to the matter.”

Shares in Fannie Mae and Freddie Mac had been up 20 p.c on the information, though it stays to be seen how the federal government will deal with present shareholders.

The Treasury Division holds a big stake within the mortgage giants, which had been positioned in authorities conservatorship in 2008. Relying on how the IPO is structured — and whether or not the federal government retains an possession stake — present shareholders like Pershing Sq. billionaire Invoice Ackman may very well be richly rewarded or all however worn out.

For actual property brokers, homebuyers and homesellers, the larger query is how an IPO may affect mortgage charges.

Releasing Fannie and Freddie from conservatorship by privatizing them with out an “specific assure” that the federal government stands behind them may drive mortgage charges up by 60 to 90 foundation factors, Moody’s Analytics Chief Economist Mark Zandi estimated in June.

However the Trump administration has signaled that relatively than privatizing Fannie Mae and Freddie Mac, it intends to maintain them in conservatorship and proceed offering an specific assure.

Treasury Secretary Scott Bessent mentioned in March that the federal government’s stakes in Fannie and Freddie — which the Congressional Funds Workplace estimated in December is value about $270 billion — may very well be swept right into a sovereign wealth fund.

In that state of affairs, the federal government may be capable to carry charges down if it lowered the charges it fees lenders to offset danger, with out alarming buyers in mortgage-backed securities who fund most U.S. dwelling loans. However that might additionally put taxpayers on the hook for an additional bailout if dwelling costs crash and foreclosures rise.

Actual property trade teams just like the Nationwide Affiliation of Realtors and the Mortgage Bankers Affiliation have proposed a “utility-style” mannequin for Fannie and Freddie that would offer an specific authorities assure whereas limiting the businesses’ dangers and earnings.

Regardless of the plan seems to be, the Trump administration is more likely to face little opposition from the mortgage giants’ boards of administrators.

Trump’s choose to go their federal regulator, Invoice Pulte, fired nearly all of Fannie and Freddie’s boards in March and made himself the chair of each corporations. Freddie Mac CEO Diana Reid was additionally dismissed.

Banker and investor Omeed Malik — a enterprise companion of Donald Trump Jr. — joined Fannie Mae’s board in April, and Barry Habib, founder and CEO of mortgage software program platform MBS Freeway was appointed to the board on July 21.

Showing on Republican strategist Roger Stone’s podcast in June, Habib mentioned taking Fannie and Freddie public whereas holding them in conservatorship may assist carry rates of interest down.

Barry Habib

“As an alternative of getting the good thing about simply the money that’s thrown off [by selling the government’s stake all at once] … they form of can pull the cash out in buckets,” Habib mentioned.

By taking the corporate public, Habib advised Stone, “they might then be capable to promote parts of it, and have these parts which might be bought off generate important buckets of money that might go in direction of issues like decreasing the debt and decreasing the deficit, which then would truly assist to carry rates of interest down.”

The Trump administration remains to be debating whether or not to IPO the businesses as a single entity or whether or not to maintain them separate, the Journal reported.

Fannie Mae was created as a authorities company in 1938, and Freddie Mac was fashioned in 1970 to compete with it.

Whereas Fannie Mae stays the larger firm when it comes to internet value and whole mortgage ensures, final 12 months Freddie Mac backed extra buy loans ($286 billion) than its older sibling ($270 billion).

Throughout this 12 months’s spring homebuying season, Freddie Mac backed 206,000 buy mortgages totaling $76 billion, with greater than half (53 p.c) taken out by first-time homebuyers. Fannie Mae backed $64.3 billion in buy loans throughout Q2.

Whereas Fannie Mae generated $3.3 billion in Q2 earnings, that was down 26 p.c from a 12 months in the past, because the mortgage big boosted provisions for future losses by $946 million. Freddie Mac’s $2.4 billion in internet revenue was additionally down 14 p.c from a 12 months in the past as the corporate earmarked $783 million for anticipated future losses.

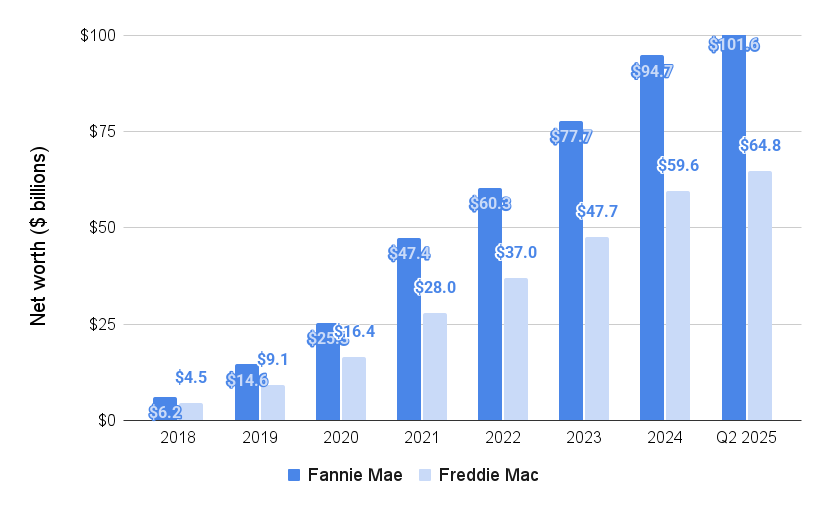

Fannie and Freddie internet value climbs to $166B

The mortgage giants have been worthwhile for the previous seven years, and the primary Trump administration’s choice in 2019 to discontinue the Treasury’s “sweeps” of Fannie and Freddie’s earnings allowed the businesses to start rebuilding their internet worths, which totalled $166 billion as of June 30.

Get Inman’s Mortgage Temporary E-newsletter delivered proper to your inbox. A weekly roundup of all the largest information on the planet of mortgages and closings delivered each Wednesday. Click on right here to subscribe.

E-mail Matt Carter