Rising debit and credit score service provider charges are escalating prices for Australian companies and customers, with RBA information revealing regular will increase because the COVID-19 pandemic.

As I’ve acknowledged earlier than, the present system is anti-competitive, inefficient, and unfair. This proposal will exacerbate it. Now I help debit as a default cost technique, which is Labor coverage, however this extends far past.

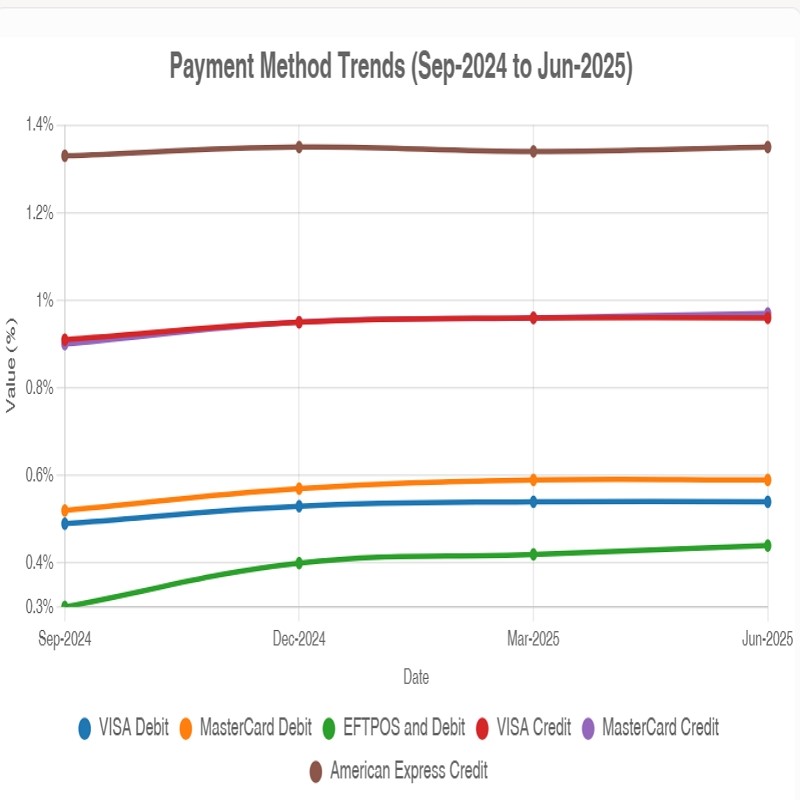

The RBA’s figures paint a tricky image of the surcharge ban. Click on right here for his or her newest statistics. They assume competitors and charge reductions will assist SMBs take up prices. However my evaluation reveals the RBA’s figures present they’re rising as a substitute.

Equity in Fee Defaults.

A key difficulty is equity: Money because the default equalises acquirer charges for all companies, no matter dimension. Switching to debit disadvantages smaller ones, as massive organisations negotiate decrease charges.

Card Sort Charge Breakdown

Let’s begin with the details. The RBA expanded its service provider charge reporting in December 2024, giving us a clearer view of cost prices. By June 2025, verify the desk C3 Common Service provider Charges. It highlights will increase in charges throughout the board. These are main blips, and a part of a broader pattern that is been happening because the COVID pandemic. Now I’ve gone over these figures, and that is what I can see.

Eftpos

These charges rose 10% in simply six months, hitting 0.44% of transaction worth. That is primarily because of service provider service charges climbing from 0.37% to 0.41%, whereas different prices like terminal charges stayed flat at 0.03% to 0.04%. Traditionally, Eftpos charges have fluctuated, however since December 2022, they’ve jumped from 0.26% to 0.44%, a 69% improve total, which seems fairly excessive.

MasterCard and VISA

Debit charges went from 0.57% to 0.59%, and credit score charges from 0.95% to 0.97%. Visa charges are somewhat higher, however nonetheless up their debit charges now are 0.54%, and curiously, their credit score fee is held at 0.87%.

Different playing cards

It is no surprise that so many individuals don’t settle for American Specific, as its credit score charges are 1.35%, and Diners Membership is even worse at 1.70%.

Worldwide transactions

Now these would damage as Visa credit score worldwide charges are 12.6% from 2.47% in December 2023 to 2.78% by June 2025. In case your retailer attracts vacationers, these hikes will damage.

This challenges the assumptions behind the proposed surcharge ban; interchange charges are solely one in every of a number of charges, and these charges are going up. It is a large disconnect between coverage and actuality.

Given these rising charges and the RBA’s disconnect from actuality, listed below are sensible steps to optimise your operations.

Sensible Tricks to Optimise Your Operations

Your POS collects transaction particulars, letting you analyse charge patterns. Evaluate them to RBA benchmarks. Overview the figures, and if they’re larger, take them to your suppliers. There may be nothing mistaken with you asking them, “My charges are above the 0.41% Eftpos common, why cannot we regulate?” I’ve helped retailers save 1000’s this manner.

Overview your worldwide playing cards. Many have, after doing this, both launched a much bigger surcharge or refused to just accept them.

Assist money.

In case you are in on-line gross sales, verify your charges.

(This text attracts from the newest RBA information as of June 2025)

Written by:

Bernard Zimmermann is the founding director of POS Options, a number one point-of-sale system firm with 45 years of business expertise, now retired and in search of new alternatives. He consults with numerous organisations, from small companies to massive retailers and authorities establishments. Bernard is keen about serving to firms optimise their operations by means of progressive POS expertise and enabling seamless buyer experiences by means of efficient software program options.