If the worth doesn’t really feel proper, many homesellers are prepared to say, “neglect it.”

Delistings jumped 48 % nationally in June 2025 from a 12 months earlier, based on the Realtor.com® July month-to-month housing developments report. It’s a stunning signal that nearly half of all sellers can be prepared to attend quite than negotiate.

Delistings are up 38 % from the identical interval. (Delisting knowledge is reported with a one-month lag with a purpose to decide whether or not a delisted dwelling was really offered or really delisted.)

The rise is partly because of the general enlargement in energetic stock — up 25 % in July from a 12 months earlier. Newly listed houses elevated 7.3 % 12 months over 12 months.

Delistings are outpacing new listings — with 21 houses delisted in June for each 100 houses newly hitting the market.

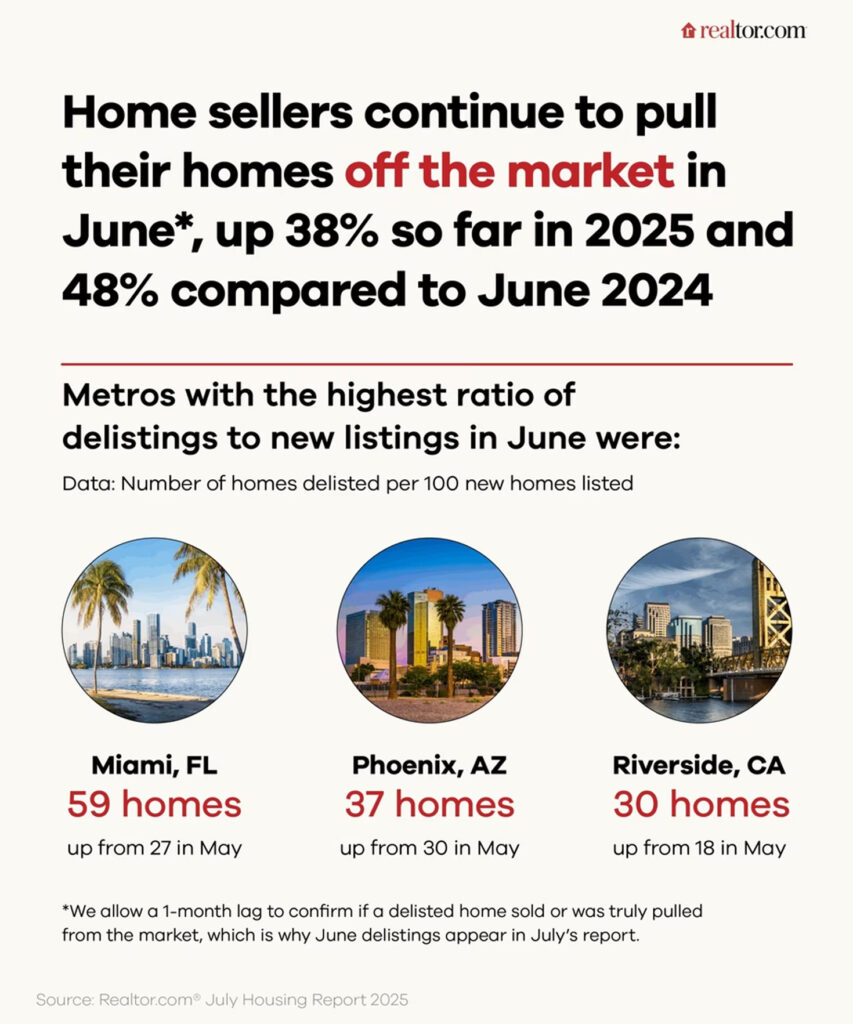

Miami leads the nation in delistings

Whereas the nationwide delisting common was 0.21 in June 2025, this pattern is very noticeable within the South and West.

The metros with the best ratio of delistings to new listings in June have been:

- Miami, Florida: 0.59 (59 houses delisted per 100 new houses listed — up from 27 in Could)

- Phoenix, Arizona: 0.37 (37 houses delisted per 100 new houses listed — up from 30 in Could)

- Riverside, California: 0.30 (30 houses delisted per 100 new houses listed — up from 18 in Could)

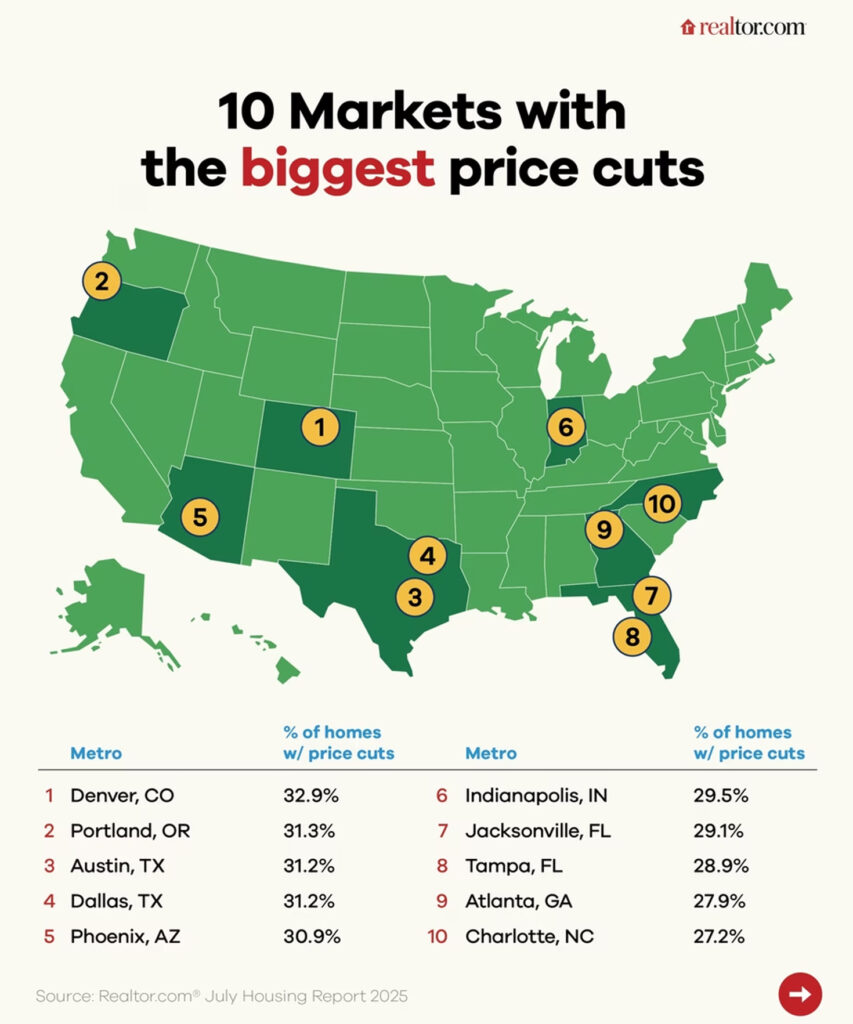

The rise in delistings follows a surge in worth reductions, as some sellers with unrealistic expectations confronted a softer market with restricted patrons.

“In contrast to previous housing cycles the place falling costs pressured underwater owners to promote, immediately’s owners profit from record-high ranges of dwelling fairness, so that they have the pliability to attend it out,” says Realtor.com® senior economist Jake Krimmel. “This enables many sellers to withdraw their houses from the market if their asking worth isn’t met.”

That’s to not say that some sellers aren’t nonetheless slashing their costs. In July, 20.6 % of dwelling listings had worth reductions.

Even with extra worth cuts, nevertheless, the nationwide median listing worth in July held regular at $439,990, however was basically flat over the previous two months.

“Whereas the market could also be changing into extra buyer-friendly, sellers nonetheless maintain a trump card: delist the house and fish for that prime asking worth at a later date,” says Krimmel.

With houses staying in the marketplace longer than pre-pandemic norms (about 58 days in July), many sellers are contemplating pulling their itemizing quite than slashing the worth.

“Patrons are seeing extra selections than they’ve had in years, however many sellers, anchored by peak worth expectations and upheld by sturdy fairness positions, are deciding to step again in the event that they don’t get their quantity,” says Danielle Hale, chief economist of Realtor.com.

Elevated stock is shifting the market

Nationally, energetic listings topped 1.1 million.

Location additionally has an impact on the variety of houses on the market, with stock in metro areas within the Northeast and Midwest remaining comparatively tight, whereas these within the South and West are tilting in a extra buyer-friendly path.

“This market susses out the true sellers from those that will solely promote in the event that they get their worth, and we’re not in a marketplace for that — until a house is the trifecta in that it has structure, lot and placement, plus updates, in a extremely coveted space the place hardly ever something ever comes on the market,” says Cara Ameer, a bicoastal agent with Coldwell Banker who’s licensed in California and Florida.

These sellers who can afford to attend could select to step out of the scene till issues equilibrate.

“Delisting could assist the market, as a result of there is no such thing as a sense for patrons to take a look at overpriced houses the place the vendor isn’t really interested by negotiating,” says Ameer.