Your greatest likelihood to develop grocery gross sales isn’t a brand new advert marketing campaign or a deeper low cost.

It’s discovered within the consumers already in your database.

By partaking the best clients, high regional grocers are incomes hundreds of thousands in incremental income with out growing advert spend.

The newest U.S. eGrocery Gross sales Report highlights why grocers see larger returns by deepening engagement with present clients slightly than chasing new ones.

Final month noticed a report variety of energetic customers shopping for groceries on-line—up practically 11% from a 12 months in the past.

However that development didn’t come from new consumers. It got here from rare and lapsing clients returning after two or three months away.

July’s report additionally highlights the significance of “tremendous customers.”

These are consumers who place 4 or extra on-line orders over three months. This prized phase now accounts for greater than half of all energetic on-line grocery consumers, spending 50% greater than different segments, buying extra incessantly, and staying loyal longer.

This aligns with our personal analysis that exhibits how digitally engaged clients who log in 4 or extra instances a month make 2.5x extra journeys and spend 2.6x extra per particular person than evenly engaged consumers who log in as soon as a month or much less.

It additionally factors to a key development technique for grocers primarily based on catching rare and lapsing consumers early and turning them into loyal tremendous customers.

The issue is most grocers can’t see these segments clearly sufficient to behave as a result of their buyer information sits in silos, unstructured and underutilized.

Each journey, each buy, each clipped coupon, each on-line order is a sign telling you how one can hold consumers coming again.

However these indicators solely work when you can accumulate them, join them, and act on them in time.

The Price of Letting Information Idle

Think about two separate retailers who deal with their buyer information otherwise.

One grocer prompts their information and grows their enterprise whereas the opposite watches as their numbers slide.

In case your present information system is nearer to A than B, you possibly can’t afford to attend and see what occurs any longer. It is advisable to begin placing your buyer information to raised use.

Grocers utilizing DXPro, the brand new digital expertise platfrom from Mercatus, have already seen what’s attainable when buyer information is put to work.

Its embedded Buyer Information Platform has been utilized by one main grocer to re-engage 65% of at-risk clients, ship a 90% retention charge amongst these returning, and earn $2 million in incremental gross sales over simply six months.

Activate Your Buyer Information with Standardized Engagement Applications

The bridge between buyer information and people sorts of outcomes are standardized engagement packages.

These packages—shared under—present ready-made methods for figuring out the best clients, segmenting them primarily based on their precise habits, and sending well timed, related provides that get them to buy extra typically and spend extra after they do.

As an alternative of scrambling to design one-off campaigns each time you see a dip in journeys, these are confirmed, repeatable methods focused to your most essential segments.

1. Lapsing Shopper Program

Who They Are

Excessive-value loyal consumers who’ve gone inactive for 60–120 days. These are clients who’ve skipped anticipated purchases, drifting out of their regular cadence, however nonetheless stay aware of your model.

Information to Watch

- Final buy date (60–120 days)

- Historic journey frequency and basket composition

- Missed anticipated purchases in latest months

- Classes bought most frequently

Concepts for Engagement

Begin with a easy basket low cost to decrease the barrier to return, like $5 off a $25 buy.

Then, add high-convenience touches like one-click reorders, saved buying lists, or reminders for staples they’ve bought earlier than.

Proof it Works

As we talked about earlier, Mercatus labored with one retailer on a win-back-and-retain marketing campaign that re-engaged 65% of focused consumers in simply two weeks. Of those that redeemed a suggestion, 90% stored purchasing for months and their baskets grew by 40%.

Large Takeaway

Lapsing consumers aren’t misplaced—but. However they’re ready for the best nudge to return. Present it to them and hold giving them a motive to buy with you. They’ll quickly turn out to be the tremendous customers that each grocer needs.

2. Prime Shopper Program

Who They Are

Your highest-value phase. These are consumers with constantly excessive engagement and spend, sometimes within the Gold/Silver loyalty tiers. They’re steady or rising, however want ongoing recognition and reinforcement to take care of their habits.

Information to Watch

- 12-month patterns: frequency, spend, basket measurement, class range

- 3-month loyalty tier stability

- Days between orders

- Engagement periods

Concepts for Engagement

Month-to-month basket reductions or deep reductions on signature objects reinforce worth and encourage repeat journeys. Pair these with customized replenishment reminders timed to their buying cycle.

Proof It Works

Earlier, we talked about how our personal analysis confirmed that tremendous customers drive a disproportionately massive share of grocery gross sales.

These findings are primarily based on a retailer who needed to see if there was a connection between engagement periods and total spend.

Customers who logged in 4 or extra instances monthly weren’t simply extra energetic, they have been much more beneficial than much less engaged cohorts. These “digitally engaged” consumers took 2.5× extra journeys and spent 2.6× extra per particular person than these logging in as soon as a month or much less.

The impression exhibits up in {dollars}: transferring from 2–6 periods to 25+ periods raised income per family from $639 to $1,547. On high of that, engaged consumers grew basket measurement by 8%, including margin with out counting on deeper reductions.

And the trail upward is evident.

By nudging clients to log in only one extra time a month, retailers can persuade clients to buy extra typically, spend extra per journey, and stay a buyer longer.

Large Takeaway

Your high consumers don’t simply magically seem and stick round. They’re nurtured and maintained by way of common engagement that reaches them on a private stage.

3. At-risk Shopper Program

Who They Are

Loyal, high-value consumers whose engagement is slipping. This phase are sometimes regular spenders—like midlife, family-based professionals—whose journey frequency or basket measurement is trending downward.

Information to Watch

- Unfavourable tendencies in journeys or basket measurement over a 3-month window

- Declining provide redemption charges

- Decreased session frequency in apps or on web site

- Drop-off in class purchases they used to purchase repeatedly

Concepts for Engagement

A baseline basket low cost can be utilized to drive instant conversion, nevertheless it must be supported by category-specific provides in departments they favor.

Time sends early within the week: Tuesday/Wednesday campaigns constantly seize peak redemptions.

Proof it Works

A high grocer that works with Mercatus used DXPro to focus on at-risk clients. Three months after their marketing campaign launched, 90% of re-engaged clients have been nonetheless buying with the grocery store.

Six months later? The grocery store had protected $2 million in incremental gross sales.

Large Takeaway

A slide into churn is reversible, however to avoid wasting hundreds of thousands just like the retailer above, grocers have to supply significant engagement earlier than the patron drifts too far.

4. Digital Buyer Acquisition Program

Who They Are

Retailer-only regulars who store typically in particular person, however have by no means positioned an internet order. These are extremely loyal clients, however they solely store at your bodily location. They haven’t but skilled the comfort or incentives of your digital channel.

Information to Watch

- Excessive in-store spend with no corresponding eCommerce exercise

- Classes with robust on-line potential (bulk, packaged items)

- Loyal in-store patterns that recommend readiness for multi-channel growth

Concepts for Engagement

Supply a first-order perk like free pickup or an unique digital-only deal to take away the trial barrier. Then, comply with each on-line journey with an in-store coupon to take care of cadence throughout each channels.

Proof it Works

After analyzing all loyalty-tagged purchases throughout the bodily shops and eCommerce web site for one of many retailers working with Mercatus, we discovered that on-line and in‑retailer journeys complement, slightly than cannibalize, one another.

Prospects utilizing each spend ~$1.8K extra per 12 months which was about 50% greater than store-only consumers. They common barely smaller baskets ($100 vs. $115 for online-only), however place extra on-line orders whereas nonetheless buying 60+ instances in-store every year.

Large Takeaway

Introducing on-line buying to in-store clients isn’t about changing in-person journeys. It’s about growing whole pockets share by giving consumers extra methods to purchase.

Why All These Applications Work

The standardized packages we’re sharing are profitable as a result of they’re constructed on 4 fundamentals: exact buyer identification, focused engagement, related provides, and steady measurement.

They work throughout banners, areas, and shopper demographics as a result of they concentrate on precise habits as a substitute of broad assumptions.

However with out related information and automatic concentrating on, these methods are practically unattainable to implement.

Even when a grocer manually sifted by way of their buyer database to determine particular segments, monitoring and analyzing the outcomes of these campaigns would nonetheless be an exhausting, time-consuming course of.

That makes having the best platform to attach information to engagement to commerce all of the extra essential.

How DXPro Makes It Attainable

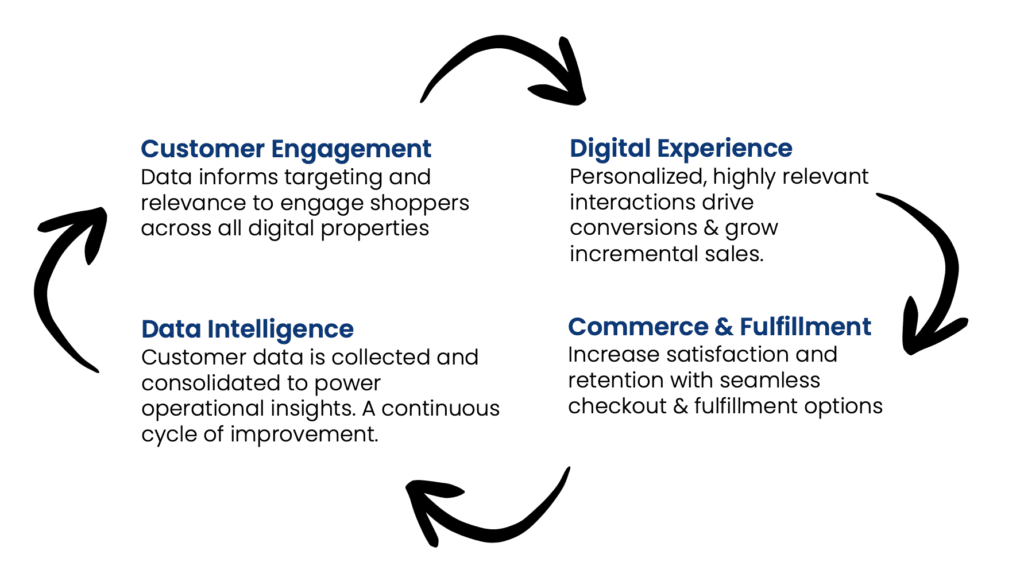

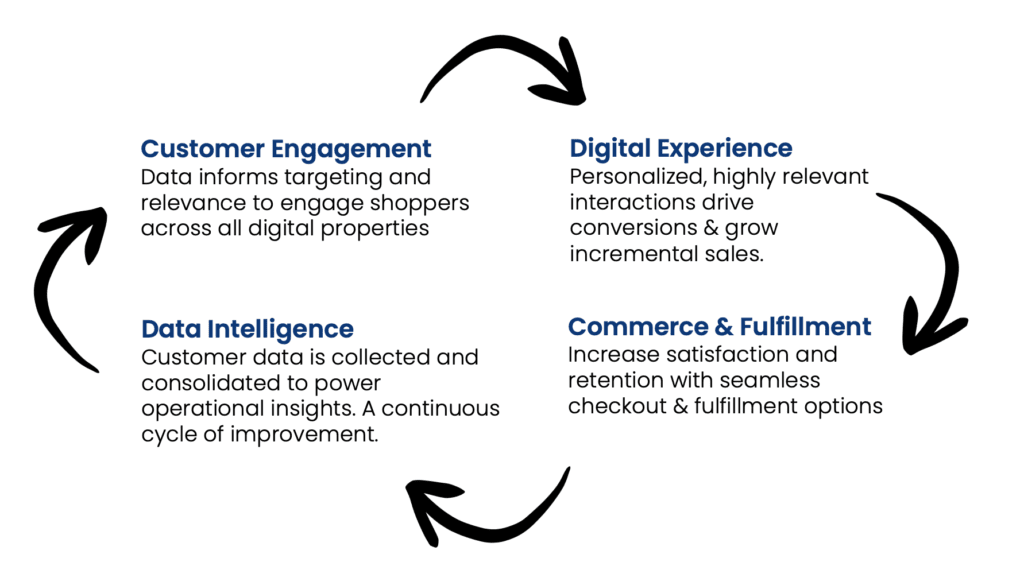

DXPro is constructed to deal with your complete loop that makes these packages work:

DXPro unifies buyer information from each channel—POS, loyalty, eCommerce, and cellular—right into a single view. It routinely updates behavioral segments, triggers provides primarily based on actual exercise, and measures the impression in journeys, basket measurement, and retention.

Right here’s what that appears like in motion:

We’ve seen the outcomes of what this platform can do already: Higher retention, greater margins, extra incremental gross sales.

To make your buyer information give you the results you want the way in which it was meant, right here’s what you should do:

1. Assess your present information setup

Discuss to Mercatus about how your buyer information is collected immediately, the place it’s siloed, and the place you’re seeing drop-off in engagement. We’ll present you what’s attainable utilizing DXPro’s embedded CDP.

2. Align on enterprise priorities

Whether or not your focus is win-back campaigns, basket development, or increasing your omnichannel base, set clear targets so DXPro can goal the highest-impact segments.

3. Activate and measure

Let DXPro construct the best segments, launch the best provides, and supply a transparent ROI dashboard that ties campaigns on to income.

Customary engagement packages are simply the place to begin.

When you’ve carried out these methods and witnessed the outcomes with DXPro, the platform’s flexibility permits you to increase into bespoke methods that suit your banner, market, and aggressive setting—constructing on the identical basis of confirmed outcomes retailer by retailer and area by area.

Prepared to show your buyer information into measurable development on your grocery enterprise?

Discuss to us about DXPro and how one can start partaking the best consumers on the proper time.