This version of Trendy Restaurant Administration (MRM) journal’s Analysis Roundup options evolving eating developments, GLP-1 affect on F&B, lunch developments, and most talked about attributes in Google evaluations for small companies.

Why Are Individuals Eating Out?

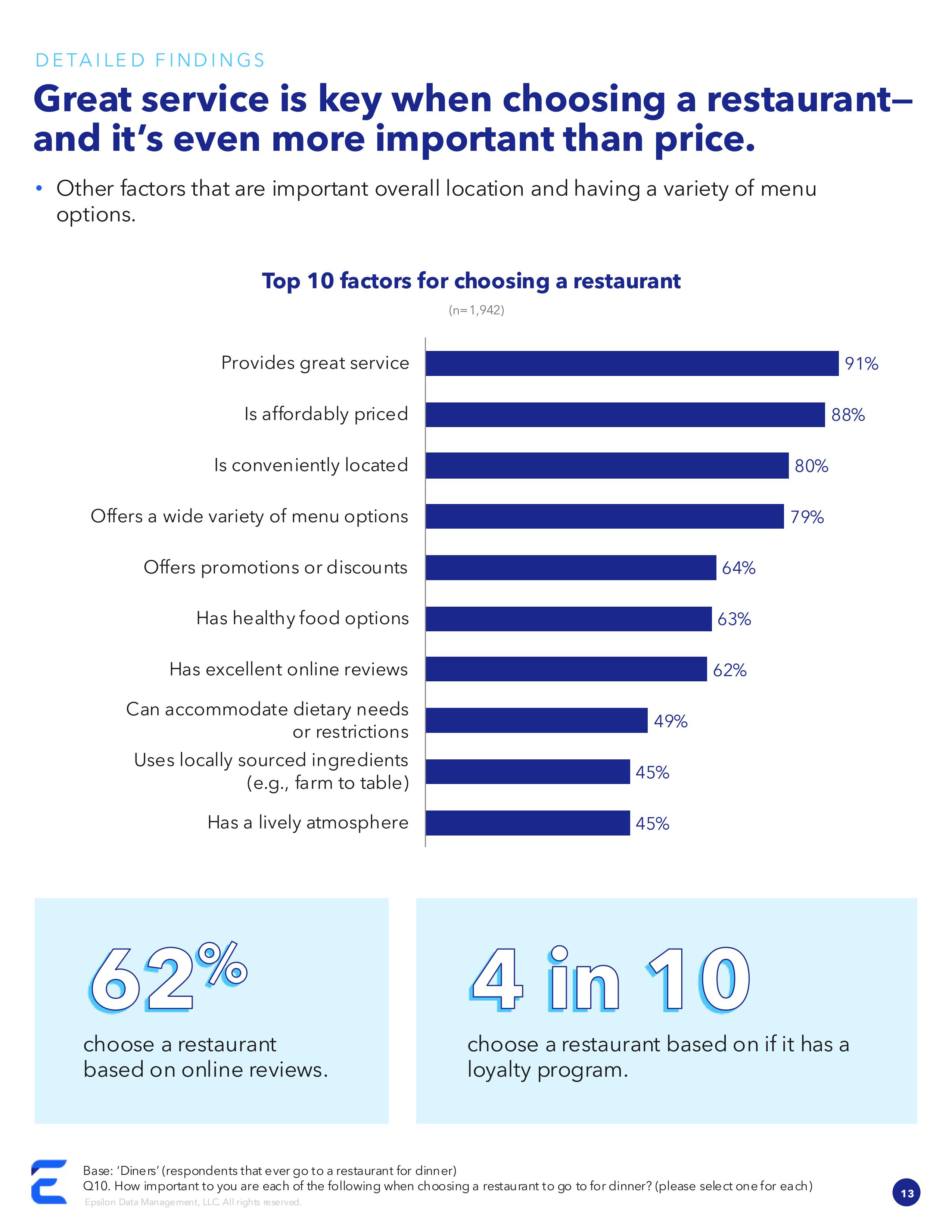

Epsilon’s current examine requested shoppers about their causes for eating in or eating out, particular events and different motivations. With rising prices, individuals have began to get artistic, whether or not that’s by forgoing appetizers or sharing entrées, going out much less continuously or prioritizing informal over effective eating.

51 % of individuals say they plan to exit for dinner simply as usually as they do now.

Second to socializing, the highest motive to exit to eat for Millennials is for a deal with or indulgence, whereas for Gen Z and Gen X, it is once they don’t really feel like cooking.

On common, Gen Z goes out for dinner probably the most at a median of 4.1 instances per thirty days.

4 in 10 select a restaurant primarily based on if it has a loyalty program.

As dinner developments evolve, how are shoppers spending?

Eating—and particularly going out to dinner—is experiencing an evolution.

With rising prices and inflation, individuals have began to get artistic, whether or not that’s by forgoing appetizers or sharing entrées, going out much less continuously or prioritizing informal over effective eating.

“Understanding how client preferences and expectations are evolving is vital, particularly in a class like Eating, which is so emotionally pushed and expertise centered,” says Brian Giannone, Epsilon’s Senior Vice President of its Eating Vertical. “Manufacturers that achieve creating loyalty with visitors are those who harness the ability of information and know-how to ship on personalization and relevance alongside the visitor journey. Analysis like this helps why it’s crucial to grasp what motivates every visitor in order that manufacturers can create worth that resonates throughout their buyer base.”

Gen Z Eating Habits

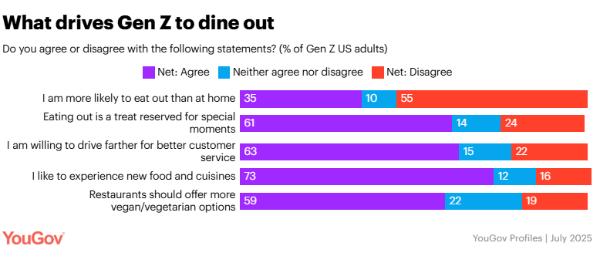

From late-night quick meals runs to foodie Instagram posts, Gen Z is reshaping what it means to “eat out.” A brand new YouGov Profiles evaluation uncovers how this era views eating places, what motivates their selections, and which manufacturers are successful their loyalty.

Key findings:

Eating out is a deal with – 61 % of Gen Z say consuming out is for particular events, not an on a regular basis routine.

Meals discovery issues – Practically three in 4 (73 %) like attempting new cuisines, however 37 % admit they aren’t adventurous eaters.

Takeout is widespread however not dominant – 43 % often order in, whereas 38 % say they don’t.

Group and repair depend – 58 % say supporting native eating places is essential, and 63 % will drive farther for higher service or tech-enabled comfort.

Eco-conscious—however not totally dedicated – 31 % eat extra regionally sourced produce, 25 % extra natural, 24 % much less meat, however 35 % haven’t made any eco-related meals modifications.

Prime fast service manufacturers – McDonald’s (21.6) leads in buy intent, adopted by Chick-fil-A (13), KFC (10.6), and Taco Bell (8.7).

Prime informal eating manufacturers – Wingstop (12.3) and Texas Roadhouse (10.4) outpace rivals, with IHOP, Cheesecake Manufacturing facility, and Olive Backyard within the subsequent tier.

This analysis paints a nuanced image: Gen Z desires reasonably priced, handy meals, however additionally they care about service, selection, and values. For restaurant operators and types, it’s a roadmap to the place eating {dollars} are headed subsequent.

What’s Driving QSR Visits?

Client confidence has grow to be one of many important components impacting quick-service restaurant (QSR) visitors, marking a major shift in how and why shoppers select to dine out, in keeping with restaurant know-how chief Income Administration Options (RMS).

In an evaluation of the previous 15 years’ lowest-performing visitors intervals, RMS examined 10 key macroeconomic indicators to find out what really drives visitor visits within the fast-food sector. The outcomes reveal a marked transformation in client decision-making patterns.

From Gasoline Costs to Confidence: A Paradigm Shift

Traditionally, fuel costs and unemployment have been extremely correlated with reducing visitors. Nevertheless, in 2025, financial components stay secure, but visitors report fewer restaurant visits, and QSR visitors is on the decline.

The distinction? Client confidence – which has dropped 14 index factors since 2023.

“Proper now, confidence is king,” stated RMS CEO John Oakes. “Whereas conventional financial components corresponding to inflation, wages and gasoline prices nonetheless matter, client confidence tells us how visitors will behave within the weeks and months forward. For instance, our specialists estimate {that a} 10-point decline in confidence may result in a 0.5 % to 2 % decline in visitors inside simply two months.”

Value Sensitivity is Rising Amid Shifting Perceptions

For QSR operators, the message is evident: The {industry}’s future success depends upon client notion, which is essentially reliant on pricing methods that shield visitor visitors and margins.

In RMS’s most up-to-date client survey, 75 % of respondents consider that restaurant costs are larger than the earlier month, regardless of precise QSR value will increase stabilizing.

In Q2 2025, QSR common costs have been up +1.3 % year-over-year, considerably decrease in comparison with +2.9 % in Q2 2024 and +10.6 % in Q2 2023. But, practically 40 % of respondents report spending much less of their discretionary revenue on eating places, underscoring a widening hole between notion and actuality.

A Knowledge-Pushed Look Again: Understanding the Developments

Under are the primary macroeconomic indicators which have had an affect on QSR restaurant visitors over the previous 15 years:

2009-2011: Visitors was down as a lot as -4 %, pushed primarily by fuel costs and unemployment.

2020-2022: COVID-19 restrictions and inflation drove visitors declines of as much as -15 % year-over-year.

2023 to Current: Rising inflation has created uncertainty, inflicting visitors to drop a median of -1.0 %, along with the already vital drops throughout the COVID years.

2025 Hospitality Developments

Knowledge-driven analytics helps form visitor experiences in 2025, with over 90 % of cruise firms utilizing it for personalization.

96 % of hoteliers are investing in contactless know-how this yr.

Over half of the shoppers (64 %) embrace biometric authentication, with a rising belief in its security.

The U.S. hospitality {industry} is forecasted to succeed in practically $250 billion in 2025 and climb to $313.87 billion by 2030. A current article by Escoffier analyzed key statistics within the hospitality {industry} to focus on the largest developments, client conduct, and the newest tech improvements. The evaluation considers the most recent applied sciences, from contactless funds to AI and biometrics, in addition to suggestions from inns, eating places, cruises, and travellers.

Contactless and Cellular-Pleasant Tech

Contactless providers proceed to develop throughout all industries, together with hospitality. QR codes scanned to this point in 2025 (globally) are 433 % above 2021 ranges, and the U.S. leads exercise with a 38.31 % share of whole scans. Shifting even additional, surveys present that as much as 95 % of people who’ve made a minimum of one cellular contactless fee say they’ve left their pockets at house a minimum of as soon as, counting on simply their telephone to make funds.

AI and Automation: From Chatbots to Biometrics

Fingerprints or Face ID are part of one other pattern of superior tech, with 64 % of survey respondents embracing biometric authentication. Lodges are probably the most superior hospitality sector to make use of AI, with round 89 % of lodging utilizing AI for customer support. Eating places comply with second, with 75 % of institutions planning or already utilizing AI and automation providers. In the case of the shopper’s aspect, 77 % of visitors are thinking about utilizing automated messaging or chatbots for customer support.

The Personalised Visitor Expertise

Past comfort and automation, personalization is changing into a defining pillar of recent hospitality, with 58 % of manufacturers saying personalization is considered one of their prime priorities in 2025. Cruises are main in data-driven analytics, and over 90 % of the cruise firms use it for personalization. Lodges and eating places are virtually tied, and about 70 % of eating places ship prospects personalised choices, together with reductions on standard orders and birthday offers.

The Expertise Economic system: Wellness, Micro-Occasions, and Way of life Choices

Vacationers, particularly Gen Z, are prioritizing genuine, distinctive, and immersive experiences over conventional luxurious facilities. Over 80 % of Gen Z vacationers choose area of interest experiences, whereas 61 % of the identical era wish to concentrate on wellness experiences of their journey plans. Over half of all vacationers (52 %), whatever the era, say genuine cultural experiences are essential for his or her trip, together with festivals, studying crafts from native artisans, and taking part in regional traditions.

Stress Factors and Tradeoffs

Whereas the hospitality {industry} continues to evolve, there are some inner frictions. Whereas 47 % of restaurant operators fear that tech would possibly have an effect on the human expertise, solely 18 % report the precise hurt. Nevertheless, when eating places go totally contactless, with no private interplay, they do undergo from poor buyer expertise. Moreover, many categorical concern for biometrics, particularly relating to privateness and management.

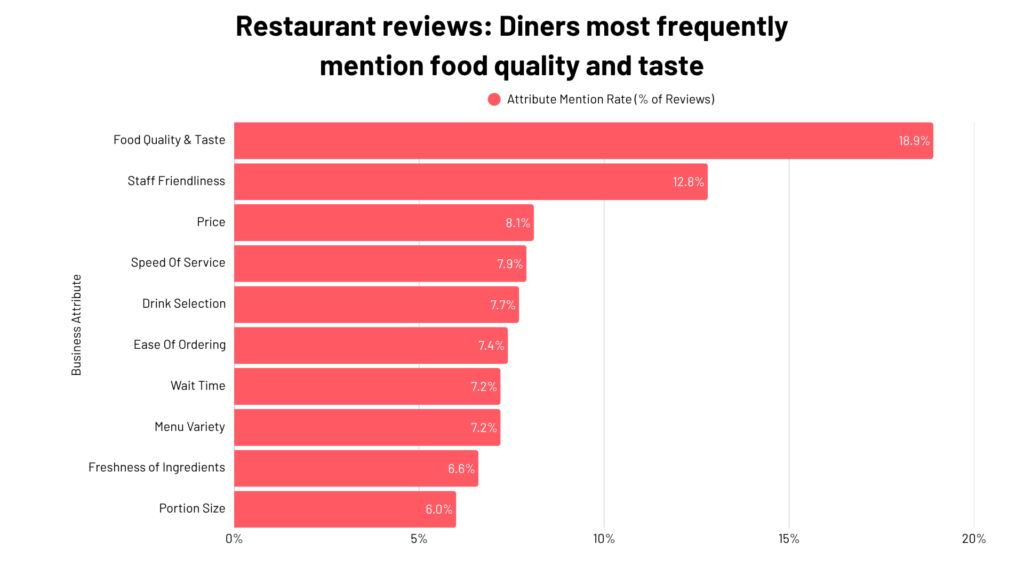

Most-Talked about Attributes in Small Enterprise Google Critiques

Workers friendliness is the most-mentioned attribute by prospects in small enterprise Google evaluations, in keeping with a examine by Lanc Native.

The examine, which analyzed greater than million small enterprise Google evaluations, additionally examined continuously talked about attributes inside particular industries, corresponding to inns, the place 41 % of evaluations talked about room cleanliness.

The first objective of this examine was to determine what issues most to small enterprise prospects by utilizing the attributes talked about of their evaluations as a proxy.

The dataset included one million Google evaluations from 6,000 small companies throughout numerous industries. Evaluation dates vary from 2006-2025, with a heavy emphasis on the final 5 years. Lanc Native used Python-based pure language processing to determine and quantify over 150 buyer expertise attributes.

Influence of Workers Friendliness: This examine discovered that workers friendliness is probably the most continuously talked about attribute in on-line evaluations for small companies, showing in 13.1 % of all evaluations.

Strongest Drivers of 5-Star Critiques: The examine found that the strongest drivers for purchasers leaving a five-star overview are workers professionalism, product/service choice, and honest pricing.

Causes for Low-Star Critiques: Low-star evaluations are most frequently attributable to issues with the fee course of and inaccurate on-line details about the enterprise.

Elevated Significance of a Easy Course of: Prospects are more and more on the lookout for a easy course of, with mentions of this attribute rising by 162.4 % during the last two years in comparison with the 2 years prior.

Trade-Particular Findings: The examine additionally revealed key industry-specific drivers, corresponding to style and meals high quality being probably the most talked about attribute for eating places, and workers helpfulness being a key issue for retail shops.

Among the many restaurant-related findings:

- Style and meals high quality comes up in 18.9 % of all restaurant evaluations.

- Meals or drink high quality is talked about in 29.1 % of espresso store evaluations.

Whereas components like workers, pricing, and velocity additionally affect buyer opinions, the first focus stays on the meals itself.

GLP-1 Progress Spurs Volatility in F&B

A report by OC&C Technique Consultants reveals how the fast progress in use of GLP-1 drugs is impacting the Meals and Beverage {industry}, driving reductions in consumption habits throughout key demographics and disproportionately impacting particular product classes.

GLP-1 drugs, corresponding to Ozempic and Wegovy, are poised for sustained progress, pushed by a big addressable market linked to rising weight problems and wellness developments.

Accessibility is bettering via product innovation with new supply codecs and broader insurance coverage protection, which is lowering the monetary burden on the patron.

OC&C Technique Consultants reveal that whereas there are early indicators that adoption charges might gradual, excessive churn and restart cycles are anticipated to gasoline ongoing disruption. In consequence, buyers and Meals and Beverage (F&B) companies should put together for continued volatility and long-term shifts in client consumption patterns.

Key themes for 2025

- Structural shift in client conduct

- Three dimensions of disruption

- Biking & reengagement volatility

- Strategic implications for manufacturers & buyers

- Key insights and information from the 4 developments:

Structural Shift in Client Behavior:

GLP-1 drugs like Ozempic and Wegovy are altering how individuals eat by lowering urge for food, meal frequency, and cravings, resulting in materials reductions in F&B consumption, notably amongst high-fat, high-sugar, and impulse-driven classes.

Three Dimensions of Disruption:

Class-Degree Influence: Probably the most vital consumption declines amongst GLP-1 customers are occurring in classes like salty snacks, baked items, and cookies. Whereas there’s little proof of a corresponding rise in more healthy class spending, protein-rich and useful meals are exhibiting notable resilience within the shifting panorama.

Event-Primarily based Modifications: GLP-1 drugs are impacting consuming habits by lowering meal frequency, portion sizes, and total meals consumption. Non-essential consuming events, like late-night snacking and social dinners, have seen notable declines. Away-from-home (AFH) eating has been particularly affected, with early analysis indicating a 6 % drop in spending throughout the first six months of use.

Demographic Skew: GLP-1 utilization is at the moment concentrated amongst higher-income, middle-aged adults (35+), who very seldomly symbolize “tremendous customers” – high-frequency and high-value shoppers – in key F&B classes. In consequence, quite a lot of meals & beverage classes are considerably insulated from the affect of adjusting behaviors of GLP-1 customers.

Biking and Reengagement Volatility

Sixty % of customers discontinue inside six months, however usually regain weight and categorical curiosity in restarting, that means it is troublesome to foretell quantity and demand.

Strategic Implications for Manufacturers and Traders

GLP-1s should not a brief fad, however a structural headwind for the F&B {industry}. Nevertheless, they’re navigable with sensible, adaptive technique. As utilization turns into extra widespread, regulatory and labelling shifts are additionally prone to reshape how merchandise are marketed and offered.

Franchisors Falling Behind in Assembly Client Expectations

A brand new examine from LT highlights a widening hole within the franchise {industry}: whereas client expectations have quickly advanced, franchisor investments haven’t stored tempo. The report “The Gaps That Might Be Killing Your Franchise: Altering Client Expectations & The place to Make investments” attracts on enter from 83 franchisor leaders and greater than 1,000 shoppers, analyzing how nationwide manufacturers throughout industries are navigating altering calls for and the way a lot floor they nonetheless should cowl.

Key findings embrace:

Shoppers anticipate consistency, and 63 % can pay extra for it. Throughout industries, the vast majority of shoppers are keen to spend further for constant experiences, and belief performs a significant position in driving repeat enterprise, but solely a 3rd of franchisors really feel assured delivering it.

Social platforms at the moment are major discovery engines: 50 % of shoppers have used Instagram, TikTok, YouTube or Reddit to seek for native companies. And that quantity will increase considerably with youthful audiences (77 % of Gen Z & 65 % of Millennials).

Solely 39 % of franchisors plan to undertake AI instruments within the subsequent two years, whilst prospects demand extra personalization, velocity and are utilizing these instruments to look.

76 % of shoppers say they belief companies they understand as native, and solely 34 % consider franchises supply higher customer support than native companies.

Lunchtime Developments

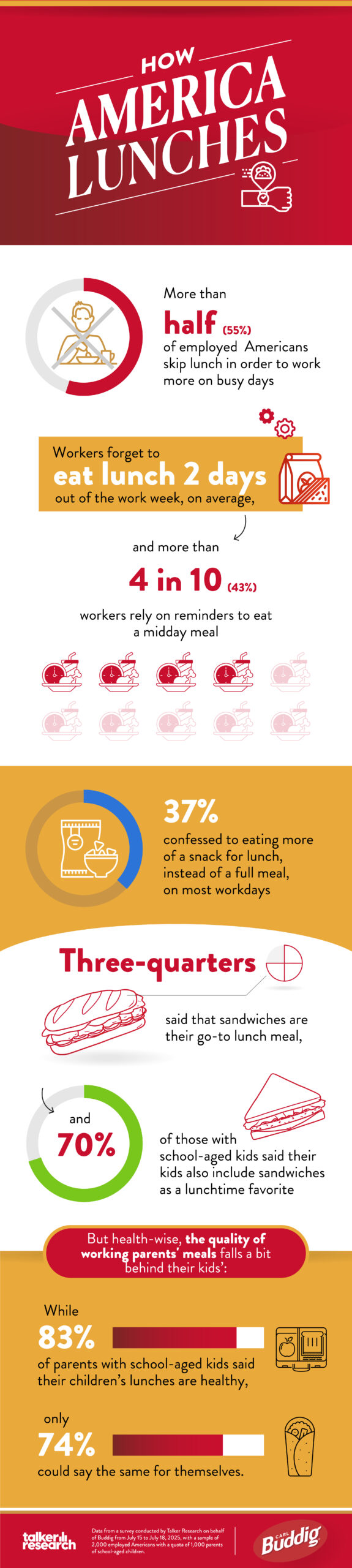

Greater than half of People skip lunch with a view to work extra, in keeping with a current survey.

The ballot of two,000 employed People, with a quota of 1,000 working dad and mom with school-aged youngsters, revealed that 55 % forgo consuming lunch on hectic days to be extra productive.

Respondents additionally admitted to fully forgetting to eat lunch two days out of the work week, on common.

In actual fact, greater than 4 in 10 employees (43 %) depend on reminders to eat a noon meal, with girls being considerably extra seemingly than males (63 % vs. 48 %) to wish a reminder to eat throughout the workday.

Commissioned by Buddig for Nationwide Sandwich Month in August and carried out by Talker Analysis, the survey discovered that though 63 % of working People eat a full, substantial meal for lunch most days, a major quantity (37 %) confessed to consuming extra of a snack for lunch, or grazing on little snack meals all through the day rather than a meal.

A couple of in 10 (13 %) additionally admitted they’ll sometimes work and eat lunch on the similar time on a daily workday, as a substitute of taking a break from their duties to eat.

variations between subgroups, males (91 %) are extra seemingly than girls (85 %) to pause their work to eat lunch, and hybrid employees (94 %) are extra seemingly than distant (85 %) and in-person staff (87 %) to take a real lunch break.

A 3rd of employed People (33 %) additionally revealed that they’ll often eat their noon meal at their desk or workstation, with distant employees being extra responsible of this (41 %) than hybrid (38 %) and in-person (28 %) respondents.

On common, employees eat lunch at 12:48 p.m., and their typical lunch hour is definitely solely 35 minutes, on common.

For individuals who step away from their work to eat, many (43 %) multitask throughout their downtime, with girls being extra seemingly than males (51 % vs. 33 %) to multitask whereas consuming lunch.

And multitaskers mostly examine social media (70 %), textual content (64 %) and make telephone calls (55 %) throughout their lunch hours, regardless that most respondents (84 %) agreed that taking offline lunch breaks, sans screens or know-how, is nice for his or her well being.

On a typical workday, 62 % of employed People often deliver lunch from house, a 3rd (33 %) will purchase it and 5 % are fortunate sufficient to have their meal offered by their employer.

Three-quarters of employees (75 %) stated that sandwiches are their go-to lunch meal, and 70 % of these with school-aged youngsters stated their youngsters additionally embrace sandwiches amongst their lunchtime favorites.

Trying nearer at mealtime menus for each dad and mom and youngsters, working People cited sandwiches (64 %), salads (45 %) and hamburgers (33 %) as their commonest lunch staples, and people with youngsters in class stated their kids will eat sandwiches (58 %), pre-made meal kits (36 %) and pizza (30 %) most frequently.

Well being-wise, the standard of working dad and mom’ meals falls a bit behind their youngsters’. Whereas 83 % of oldsters with school-aged youngsters stated their kids’s lunches are wholesome, solely 74 % may say the identical for themselves.

The outcomes additionally revealed that hybrid employees reported consuming the healthiest lunches (79 %) in comparison with distant (71 %) and in-person (65 %) employees.

And surprisingly, these whose lunches are catered by their employers reported having more healthy lunches (75 %) than those that deliver home made lunches (72 %) and purchase lunch (62 %).

Drinks of Selection

A brand new report from the Harris Ballot that provides contemporary insights into People’ beverage selections when restaurant eating.

The examine reveals compelling developments that replicate shifting preferences throughout age teams:

Water and soda stay well-liked throughout all generations, however alcohol nonetheless holds a robust place, particularly amongst millennials and Gen Xers. Over a 3rd of People say alcohol is their “go-to” restaurant beverage, edging out soda and water.

Millennials stand out as loyal repeat prospects for alcoholic drinks, ordering beer, spirits, and wine considerably greater than Gen Z previously 30 days.

Gen Z reveals a extra diversified strategy to ingesting, balancing alcoholic and non-alcoholic choices, with a specific curiosity in novelty and “Instagram-worthy” drinks.

Non-alcoholic drinks like mocktails have a gradual following however are largely loved by those that additionally drink alcohol, somewhat than by younger adults who abstain totally.

Beverage preferences usually fall alongside generational traces: millennials and Gen X choose alcoholic drinks, whereas Gen Z favors soda, and child boomers select water.

Alcohol manufacturers are suggested to concentrate on their core shoppers: millennials and Gen X. Nonetheless, these manufacturers shouldn’t overlook Gen Z, who reply properly to artistic and enjoyable new beverage choices.

“We’re watching two completely different philosophies play out on the similar desk: millennials deal with alcohol as their ticket to rework unusual meals into curated experiences, whereas Gen Z approaches ingesting like a strategic alternative – they’re going to sip a craft cocktail or a soda with equal enthusiasm, relying on what matches their temper and pockets,” stated Libby Rodney, Chief Technique Officer at The Harris Ballot.

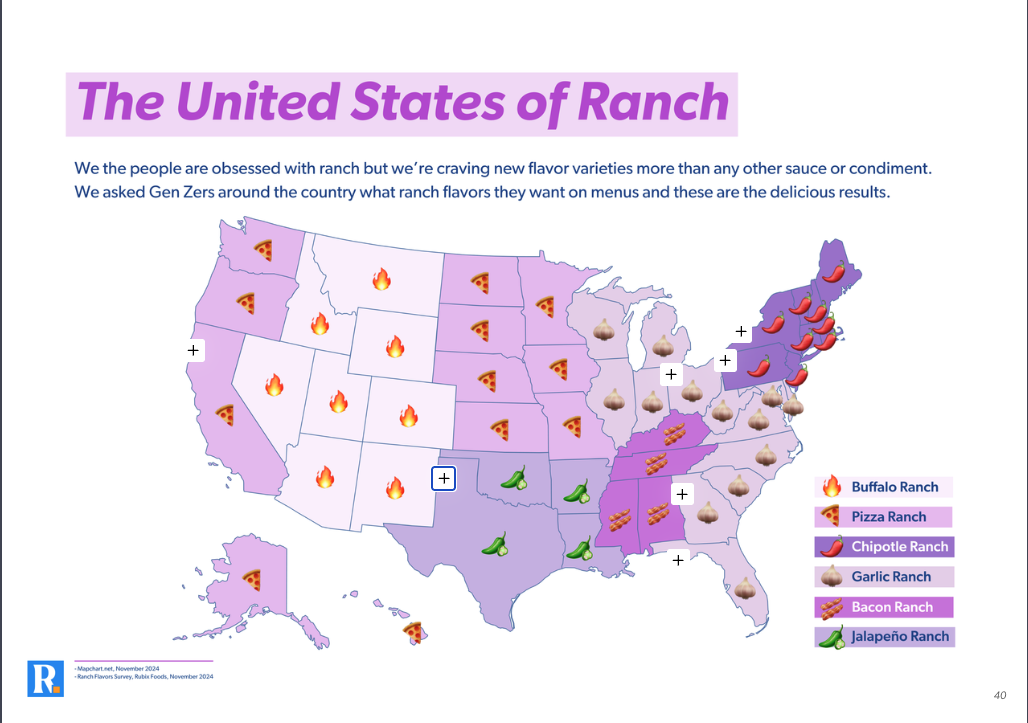

The US of Ranch

Neglect politics; America’s actual divide is likely to be over ranch dressing. Throughout the nation, youthful diners aren’t simply consuming ranch, they’re reinventing it. And relying on the place they stay, their concept of “the proper ranch” appears to be like fully completely different.

Rubix Meals’ United States of Ranch map reveals a patchwork of taste loyalties throughout the nation, providing operators perception into native menu relevance. Within the Mountain West, Buffalo ranch dominates from Nevada to Nebraska. On the West Coast and all through the Midwest, Pizza Ranch is the fan favourite.

Some respondents strayed from their regional choice: whereas Ohio primarily demonstrates a style for garlic ranch on menus, 44 % of Ohio Gen Zers have been additionally thinking about attempting bacon ranch. Fifty % of Gen Zers in Georgia need to combine it up with sizzling honey ranch, and 45 % of Gen Zers in Pennsylvania are thinking about attempting ghost pepper ranch.

The information, collected by Rubix Meals, signifies greater menu developments hinged on ranch:

- 21 % of Gen Z say basic ranch is overrated, twice as many as every other taste.

- 44 % of Gen Z need contemporary takes on ranch, proving the basic is ripe for reinvention.

- Google searches for “new ranch flavors” are up 250 % previously yr.

This map has the potential to function a literal street map for operators. With 90 % of Gen Z keen to go to a restaurant only for a sauce they love, sauce technique isn’t one thing to scrimp on. Menu builders can tailor LTOs and regional drops that really feel custom-built for his or her markets, whereas nationwide manufacturers can design multi-market promotions with hyperlocal enchantment.

Buyer Acquisition and Retention in an Imperfect World

A new report by Publicis Sapient and Adobe, “Buyer Acquisition and Retention in an Imperfect World,” sheds gentle on the developments reshaping the Journey and Hospitality {industry}. It’s primarily based on a survey of over 250 executives in North America throughout the Journey and Hospitality {industry}, together with the eating sector.

The findings underscore a vital juncture for the eating sector. As buyer acquisition prices rise and loyalty turns into more and more elusive, eating manufacturers should pivot in direction of more practical personalization and id decision methods, whereas additionally innovating to satisfy the expectations of the following era of shoppers. The advantages are clear: substantial value financial savings and enhanced buyer experiences that drive long-term loyalty.

Among the many findings:

1. Buyer Acquisition Prices Are on the Rise: From 2022 to 2025, the fee to accumulate a buyer within the eating {industry} surged by 24.7 %, from $13 to $16. Regardless of this enhance, buyer lifetime worth solely rose 10.2 % from 2022-2024.

2. Personalization Hindered by Lack of Refined Segmentation: Personalised presents have confirmed to be the simplest retention tactic, delivering the best ROI for 75 % of journey and hospitality corporations. Nevertheless, the {industry} faces a major problem in implementing refined personalization methods, highlighting a spot between the acknowledged significance of tailor-made engagement and its sensible execution. For instance, solely 4 % of executives within the eating sector stated that they use refined segmentation. The dearth of refined segmentation capabilities is a barrier to eating institutions delivering really personalised experiences.

3. Improved Id Decision Can Scale back Prices: 77 % of journey and hospitality corporations unknowingly focused their very own loyalty program members via paid media in 2024. An estimated 27 % of digital buyer acquisition budgets are wasted on focusing on current prospects. With excellent id decision, eating institutions may cut back buyer acquisition prices by an estimated 31 %. This creates a chance for eating manufacturers to realize aggressive benefit via extra refined information infrastructure, lowering spending whereas additionally delivering extra personalised experiences that drive conversion and loyalty.

4. Alternative for Elevated AI Integration Throughout Journey and Hospitality: Whereas some journey and hospitality corporations have applied AI in customer-facing channels like chatbots (14 %) and cellular apps (11 %), extra refined purposes that might drive vital enterprise affect stay largely unexplored. Solely 8 % have applied AI for presents and promotions, 7 % for loyalty applications, and 5 % for CRM.

5. Manufacturers Should Deal with Generational Technique Gaps: A staggering 82 % of corporations throughout the journey and hospitality {industry} both haven’t any generational technique or solely advert hoc efforts. Within the eating sector, 54 % of executives stated they consider they meet the digital expectations of Gen Z prospects. Gen Z represents 28 % of loyalty program members within the eating sector. With Gen Z poised to grow to be a dominant client group, eating manufacturers should innovate to satisfy their digital expectations and have interaction them meaningfullyin loyalty applications to maintain this momentum.

The State of Tipping

California leads the listing of states the place prospects are tipping the least in 2025, with the smallest suggestions of 17.8 % of the full invoice within the rating.

Standing out with the bottom waitstaff wages is Minnesota, at 11.8 USD per hour.

Connecticut is third, with small suggestions, however the highest annual revenue at 78.8K USD.

2025 information reveals that just about 9 in 10 People assume tipping tradition has gone too far, which is a pointy enhance from round 75 % who thought the identical final yr. A current examine by BLogic Methods analyzed tipping habits throughout the U.S. to determine the states the place prospects are tipping the least in 2025. The analysis centered on wages of each prospects and waitstaff, in addition to common suggestions and tipping fatigue rating. The ultimate rating relies on the generosity index, which displays the general public sentiment of the state residents in direction of tipping.

Right here is the abstract of the findings:

State | Avg Tip % | Annual Actual Earnings of Inhabitants USD) | Waitstaff Median Wage ( USD) | Waitstaff Median Hourly Wage ( USD) | Tipping Fatigue Rating | Generosity Index |

California | 17.8 | 72K | 35K | 17 | 91.71 | 24.5 |

Washington | 18.3 | 73K | 47K | 22.8 | 96.27 | 24.8 |

Connecticut | 19.8 | 78K | 36K | 17.5 | 92.41 | 25.1 |

Massachusetts | 20 | 78K | 36K | 17.5 | 86.82 | 25.4 |

New Jersey | 19.5 | 72K | 38K | 18.6 | 86.17 | 26.8 |

New York | 19.1 | 71K | 46K | 22.3 | 87.64 | 26.8 |

Maryland | 19.7 | 67K | 35K | 16.9 | 90.05 | 29.3 |

Virginia | 19.7 | 67K | 36K | 17.8 | 86.7 | 29.3 |

Minnesota | 19.3 | 65K | 24K | 11.8 | 99.03 | 29.6 |

Florida | 18.5 | 62K | 29K | 14.2 | 84.69 | 29.6 |

The state the place prospects are tipping the least in 2025 is California, with a generosity index of 24.5, reflecting low public sentiment in direction of suggestions. The state stands out with the bottom suggestions within the prime 10, at solely 17.8 % of the full invoice, in addition to with a excessive tipping fatigue. On the similar time, the media hourly wage for the waitstaff in California quantities to 17 USD.

Washington is in second place among the many U.S. states that tip the least, with a generosity index of 24.8. The waitstaff wages in Washington are the best within the prime 10, at 22.8 USD per hour, which may clarify low curiosity in tipping. The state residents even have the second-highest tipping fatigue rating, and their suggestions are the second-lowest at 18.3 %.

Connecticut ranks third, getting a generosity index of 25.1. The ideas listed below are often larger than in Washington and Connecticut at 19.8 %, however waitstaff wages quantity solely to 34.6K USD yearly, whereas Connecticut residents have the best revenue at 78.8K USD.

Massachusetts follows carefully with fourth place and an index of 25.4. The state stands out with the best suggestions within the prime 10, at 20 % of the full invoice, however waitstaff wages stay low, at the same 17.5 USD per hour.

New Jersey is fifth on the listing of states the place prospects are tipping the least in 2025, with a generosity index of 26.8. Individuals in New Jersey tip lower than in Massachusetts or Connecticut, whereas tipping fatigue stays excessive, with a rating of 86.1.

In sixth place is New York, getting the same index of 26.8. Individuals within the state of New York tip lower than in New Jersey, leaving solely 19.1 %. On the similar time, New York waitstaff wages are fairly excessive, in comparison with different states on the listing, with 22.3 USD per hour, getting the second-highest waitstaff wage of 46.4K USD.

Maryland is available in seventh, with a generosity index of 29.3. Maryland residents tip rather less than in Connecticut, with 19.7 %, however the waitstaff wages listed below are a lot decrease. On common, waiters right here earn solely 16.9 USD per hour, the third-lowest wage within the prime 10.

Virginia follows carefully in eighth place, with the same 29.3 index. Individuals right here tip the identical 19.7 % on common, simply as in Maryland, however the tipping fatigue amongst residents is a bit decrease, with a rating of 86.7.

Minnesota is ninth, getting a generosity index of 29.6. The state stands out with the bottom waitstaff wages, with waiters right here incomes solely 11.8 USD per hour. On the similar time, suggestions listed below are one of many lowest within the prime 10, totalling 19.3 % of the invoice.

Florida rounds up the highest 10 U.S. states that tip the least, in tenth place, getting an index of 29.6. The state presents the second-lowest wages to the waitstaff, at 29.5K USD yearly, making suggestions essential for the waiters. Residents in Florida often tip 18.5 %, even with the bottom tipping fatigue within the prime 10.