On the earth of vitality, easy solutions are sometimes deceptive. Whereas political narratives like to credit score (or blame) presidents for gasoline costs, the fact is way extra complicated. On this article, we dive deep into the interaction between gasoline costs and U.S. oil coverage, separating reality from fiction.

Understanding the Political Spin on Gasoline Costs

A current NBC article from Montana attributes falling gasoline costs to President Trump’s “pro-energy” stance. The story opens with:

“There has not too long ago been a surge in oil and gasoline manufacturing because of President Donald Trump’s pro-energy insurance policies.”

Earlier than we tackle current manufacturing traits, let’s discover the historic context of U.S. oil manufacturing over the previous 20 years

The primary line of the article states: “There has not too long ago been a surge in oil and gasoline manufacturing because of President Donald Trump’s pro-energy insurance policies.”

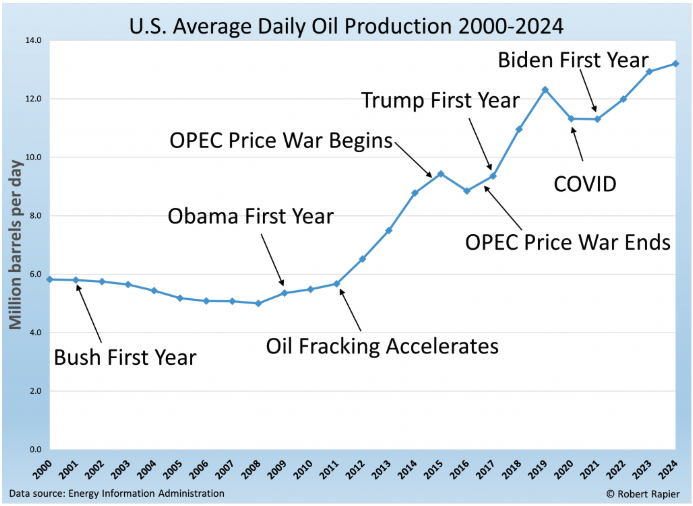

Earlier than we zoom in on current oil manufacturing, it might be useful to step again and take a look at the main oil manufacturing occasions of the previous 24 years, proven within the following graphic.

There have been many occasions which have impacted oil manufacturing since 2000. Throughout President George W. Bush’s two phrases, oil manufacturing continued the gradual decline that had been ongoing because the early Nineteen Seventies. Nevertheless, oil and gasoline producers had been perfecting the wedding of horizontal drilling and hydraulic fracturing, which might usher within the “shale growth”, or “fracking growth” that might quickly observe. The value of oil steadily rose throughout Bush’s presidency–cracking $100 a barrel in February 2008–and that offered important financial incentive for the fracking growth.

President Obama’s two phrases oversaw the most important growth of U.S. oil and pure gasoline manufacturing in historical past. Although Obama was largely seen as being hostile to grease and gasoline, know-how and market forces had been essentially the most important components in driving oil manufacturing larger throughout his presidency.

One exception throughout his time period occurred in late 2014, when Saudi Arabia led OPEC in growing output regardless of falling costs, aiming to undercut U.S. shale producers and defend market share. This led to an oil worth collapse in 2015 and 2016 from over $100 to under $30 per barrel. U.S. shale producers in the end reduce prices and improved effectivity, however U.S. oil manufacturing was negatively impacted for some time.

Nonetheless, by November 2016 it was clear that the U.S. shale business would survive, so OPEC modified course and reached a landmark settlement with Russia and different non-OPEC producers to chop manufacturing by 1.2 million barrels per day (bpd). This marked the tip of the worth battle and the start of the OPEC+ alliance. It additionally subsequently led to a worth restoration, and a rebound of U.S. oil manufacturing progress.

President Trump took workplace in January 2017, and oil manufacturing returned to the expansion mode seen throughout Obama’s first seven years in workplace. Producers broke the earlier month-to-month oil manufacturing file set in 1970 in October of Trump’s first yr in workplace. Trump did cross pro-oil insurance policies, however the OPEC+ manufacturing cuts that started elevating oil costs had been the largest issue that returned progress again to pre-OPEC worth battle ranges.

Typically misplaced within the dialogue is that on account of rising oil costs, the typical gasoline worth within the U.S. really elevated throughout Trump’s first three years in workplace–till the COVID-19 pandemic arrived.

The pandemic famously collapsed each oil costs–which briefly turned destructive as stay-at-home orders had been carried out–and oil manufacturing, which dropped by a staggering 3 million barrels per day in April and Could 2020. When folks fondly bear in mind gasoline costs that dropped under $2.00 a gallon beneath President Trump, that was the one time it occurred.

When President Biden assumed workplace in January 2021, oil manufacturing had recovered again to 11.2 million bpd, which was nonetheless 1.8 million bpd under the pre-pandemic peak. However oil manufacturing progress would resume in Biden’s second yr. In every of his final two years in workplace, the U.S. would once more set manufacturing data for each oil and pure gasoline manufacturing. Oil manufacturing progress was considerably helped by the worth surge that occurred within the wake of Russia’s invasion of Ukraine, demonstrating as soon as once more the ability of macro components to maneuver manufacturing (though Biden additionally made choices that had an affect on oil costs).

Earlier than we zoom in on President Trump’s second time period to this point, let’s overview. There have been main components transferring the oil markets over the previous 24 years, however few of them are associated to actions by a president. It’s true that Presidents Obama and Biden handed clear vitality insurance policies and had been typically hostile to grease and gasoline manufacturing. Nonetheless, Obama presided over the best growth of oil and gasoline manufacturing in U.S. historical past, whereas Biden oversaw manufacturing data in pure gasoline all 4 years he was in workplace, and oil manufacturing data his final two years in workplace.

Word that this isn’t to present credit score however reasonably spotlight the significance of macro components in setting oil costs and influencing oil manufacturing. Sure, every president, together with President Trump, handed insurance policies that seemingly had some affect on oil and gasoline manufacturing. However these insurance policies often have comparatively small impacts towards macro components like a fracking growth or an OPEC worth battle. An exception one might argue can be the long-term implications of fracking that had been primarily developed beneath George W. Bush.

President Trump’s Second Time period “Surge”

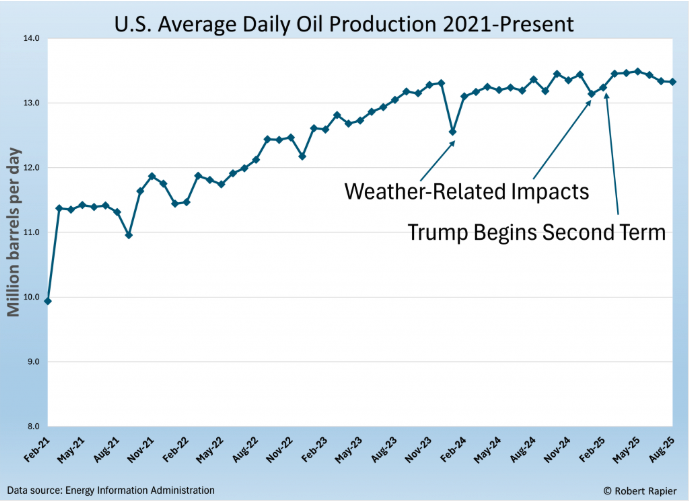

Returning to the declare from the NBC affiliate, let’s zoom in on the primary seven months of President Trump’s second time period, and distinction this with President Biden’s time period. If there’s a surge, we should always see it within the following graphic, which begins in February 2021–Biden’s first full month in workplace–and extends by mid-August 2025. Supporting information might be discovered on the EIA right here and right here.

The very first thing to notice is that there are a variety of weather-related impacts. The bounce proper at the start of Biden’s time period was restoration from the impacts of Winter Storm Uri. Thus, the preliminary surge was actually simply bouncing again to the place manufacturing was simply earlier than the storm. Likewise, in January 2024, a extreme winter storm drastically slashed oil manufacturing in Texas. And in January 2025, chilly climate as soon as once more negatively impacted manufacturing in North Dakota and Texas. Following every of those occasions, manufacturing bounced again.

The primary full month of President Trump’s second time period was February 2025. Manufacturing rebounded that month from the earlier decline, because it had following earlier dangerous climate occasions. However even if you wish to give President Trump credit score for the February bump–when his insurance policies hadn’t had time to take impact–there’s nonetheless no surge when considered over the course of the previous 4.5 years. Actually, you see considerably bigger “surges” throughout a number of intervals of Biden’s presidency.

Oil manufacturing in 2023 beneath Biden set a file that was 7.9% larger than 2022 manufacturing, and 5.0% larger than the earlier 2019 file beneath Trump. The brand new file in 2024 was 2.1% larger than in 2023. Manufacturing did rise barely to a brand new month-to-month file in March 2025, and 2025 year-to-date manufacturing is operating about 2.0% forward of final yr’s file tempo (though it has fallen over the previous two months). So, certainly we’re on tempo to set a brand new oil manufacturing file this yr, however the tempo of manufacturing is slowing. There’s actually no surge as claimed.

Additional, the NBC article linked beforehand cites former White Home financial advisor Steve Moore as stating, “Trump is into, as you known as it, ‘Drill, child, drill,’ and we’re seeing among the fruits of that.”

Actually, the variety of rigs drilling for oil has steadily fallen this yr, which is the precise reverse of what Moore implies. He’s right that we’re more likely to set one other manufacturing file this yr, but it surely ought to be clear from the graphics that it is a continuation of a long-term development that seems to be slowing.

Word that I didn’t tackle pure gasoline, however the traits are a lot the identical. Manufacturing has grown steadily since about 2005, and we’ll seemingly set one other manufacturing file this yr, however there was no surge at any level.

Why Are Gasoline Costs Falling?

Gasoline costs have slipped noticeably this yr, monitoring the broader decline in crude oil. That’s raised a well-known political speaking level: some Trump supporters insist the drop is because of a surge in drilling unleashed by the president’s insurance policies. As now we have seen, there was no surge. The fact is extra difficult. Vitality markets are world, and costs transfer in response to provide, demand, and inventories—components that hardly ever hinge on the occupant of the White Home.

The largest driver proper now’s surging world provide. OPEC+ introduced that it’s going to absolutely unwind its 2.2 million barrels per day of voluntary manufacturing cuts by September 2025—a full yr sooner than deliberate. On the identical time, non-OPEC producers just like the U.S., Brazil, and Guyana proceed to ramp up output. Altogether, world provide is ready to rise by 2.5 million barrels per day this yr, outpacing demand and placing clear downward strain on costs.

On the demand aspect, progress has been softer than anticipated. Consumption in China, India, and Brazil has underwhelmed, whereas within the OECD nations, demand is actually flat. Japan is hitting multi-decade lows, and U.S. GDP progress has slowed to simply 1.4%, which has translated into weaker gas consumption at residence.

Lastly, oil inventories are swelling. Stockpiles have risen for 5 straight months, hitting a 46-month excessive of seven.8 billion barrels worldwide. Rising inventories are a textbook signal of oversupply, and historical past exhibits that sustained builds like this typically precede sharper worth declines.

In brief, as we speak’s decrease gasoline costs aren’t the results of any single politician’s actions. They’re the end result of a worldwide provide surge colliding with tepid demand progress and rising stockpiles. The political spin could also be irresistible, however the market forces at work are far bigger than any administration.

It’s price noting that previously, falling oil costs had been a transparent win for the U.S. financial system. Again in 2005, the nation imported round 12.5 million barrels per day of crude oil, so cheaper oil meant a smaller import invoice and extra money in customers’ pockets.

However the U.S. has since flipped from being the world’s largest importer to a internet exporter of crude and refined merchandise. That modifications the calculus. Decrease oil costs nonetheless profit customers on the pump, however in addition they pressure one in every of America’s most vital industries, cut back export revenues, and widen the commerce deficit. For a rustic that now depends on vitality exports as a pillar of financial power, low-cost oil is a double-edged sword.

Conclusion

It’s tempting to present an excessive amount of credit score or blame to a president for what’s occurring on the pump. However the actuality is that gasoline costs are dictated by forces a lot larger than anybody administration. Technological shifts like fracking, geopolitical choices by OPEC+, climate disruptions, and world demand traits form oil markets much more decisively than government orders or marketing campaign slogans.

That doesn’t imply coverage is irrelevant—it will possibly tilt the enjoying area on the margins. However the current slide in costs is a reminder that vitality is a worldwide enterprise, and the U.S. is each a beneficiary and a casualty of its volatility. Shoppers welcome reduction on the gasoline station, but as an energy-exporting nation, we additionally soak up the draw back of weaker costs.

The underside line: partisans might spin the worth of gasoline, however the true story lies within the world interaction of provide, demand, and funding. And that story is at all times larger—and extra difficult—than Washington.

Keep In The Know with Shale

Whereas the world transitions, you’ll be able to depend on Shale Journal to carry me the most recent intel and perception. Our reporters uncover the sources and tales you should know within the worlds of finance, sustainability, and funding.

Subscribe to Shale Journal to remain knowledgeable concerning the happenings that affect your world. Or take heed to our critically acclaimed podcast, Vitality Mixx Radio Present, the place we interview among the most attention-grabbing folks, thought leaders, and influencers within the broad world of vitality.

Subscribe to get extra posts from Robert Rapier