The pressures going through regional grocers have by no means been higher.

Margins are narrowing, promotions are costing greater than they return, and the most important gamers in grocery retail maintain pulling prospects into their ecosystems with reductions that regionals and independents can’t afford to match.

The intuition is likely to be to look outward for progress. However when grocers chase new prospects, the campaigns are too broad, the reductions minimize too deep, and the trial gives not often result in repeat enterprise.

A greater strategy is likely to be to take a cue from the philosophers.

Nice thinkers have lengthy stated that solutions come from wanting inside. On this case, nonetheless, it’s not about self-reflection. It’s in regards to the prospects already in your orbit. Extra particularly, prospects making in-store purchases.

They’re already spending steadily with you, however they haven’t taken the step into your digital channel.

After they do, it has the potential to vary the whole lot.

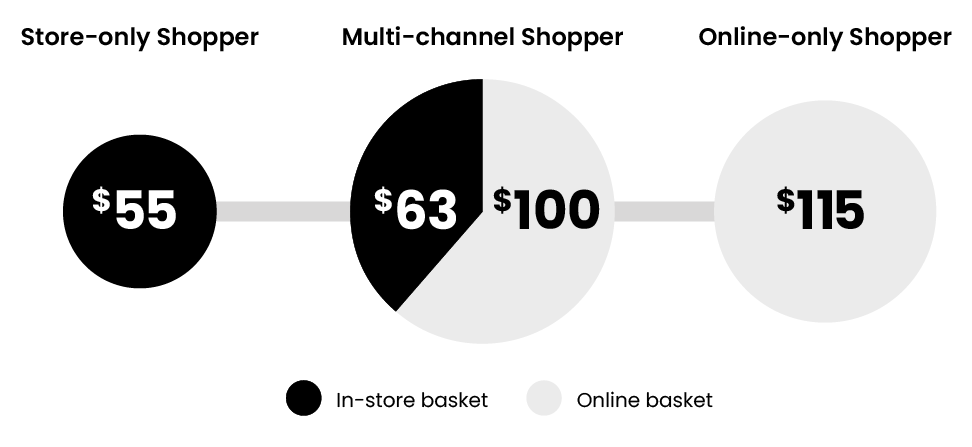

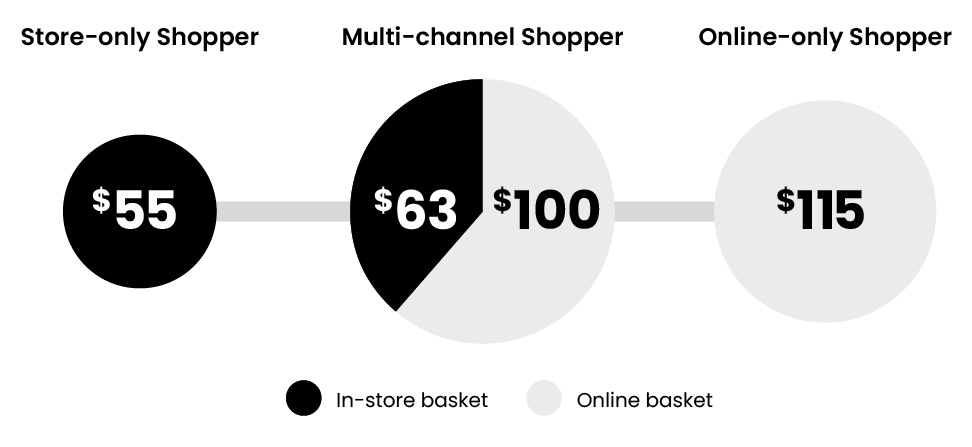

In a current examine with a Mercatus retail accomplice, we discovered that multi-channel buyers averaged $5,300 in annual spend, whereas store-only buyers averaged simply $3,500.

That’s an infinite elevate in annual income.

By wanting deeper into this potential, we found that multi-channel buyers don’t simply substitute one channel with one other. They maintain procuring in-store, make extra whole journeys, and rapidly turn into a few of the most worthwhile prospects in your system.

Why Multi-channel Buyers Matter

Earlier than we go additional, we must always deal with the elephant within the checkout lane.

There’s a persistent worry amongst grocers that digital orders will cannibalize in-store visits. It’s comprehensible. If a consumer clicks, why would in addition they are available in?

The numbers, nonetheless, inform a distinct story.

Prospects who add on-line procuring to their routine don’t abandon the shop. The truth is, our case examine reveals multi-channel buyers nonetheless common greater than 60 in-store journeys a yr, whereas layering on-line orders on high.

Their digital baskets averaged round $100, which is a bit smaller than online-only prospects at $115. Nevertheless, these extra in-store orders pushed their whole annual spend properly previous their single-channel friends.

What emerges is just not a trade-off however a reinforcement.

In-store and on-line behaviors complement one another, widening the consumer’s pockets fairly than splitting it.

That is what makes multi-channel buyers so helpful.

They might not be the most important group in your buyer base, however they persistently ship a disproportionate share of your income.

Develop Your Multi-channel Base

And that brings us again to what we acknowledged originally of this text.

The most important alternative grocers have isn’t brand-new prospects. It’s with the loyal prospects who already purchase from you in-store however haven’t but tried your digital channel.

These are the purchasers with probably the most room to develop.

The query, then, is how do you make that shift occur?

The trail is simple: take away friction, reinforce the conduct, after which construct it right into a behavior.

Step 1: Decrease the Barrier

The primary hurdle is getting a store-only shopper to attempt digital.

A free pickup choice or a digital-only deal might be sufficient to immediate that first order. That single trial opens the door to a higher-value sample of spending.

Step 2: Comply with Up

The second hurdle is ensuring digital doesn’t substitute in-store however enhances it.

A coupon tied to the subsequent retailer journey or a replenishment reminder helps keep cadence throughout each channels. The information exhibits this twin conduct really will increase in-store spend by 15%, fairly than eroding it.

Step 3: Create Behavior

Then, the ultimate hurdle is popping sporadic conduct into behavior.

Over time, the rhythm of retailer → on-line → retailer turns into second nature.

That’s the place the true payoff is available in.

Multi-channel buyers within the examine spent about $1,800 extra per yr than store-only buyers. For a mid-sized to bigger regional grocer with 500,000 in-store prospects, changing simply 1% of them would add almost $9 million in annual income.

From right here, each share level of conversion steadily compounds into a bigger share of worthwhile gross sales.

From Technique to Execution

Whereas hundreds of thousands in extra income sounds nice, we nonetheless haven’t answered the query we initially posed: How do you really make that shift occur?

Most grocers don’t battle with the concept of opening up new channels for his or her prospects to buy. They battle with execution.

That’s just because their buyer knowledge sits in too many locations—POS, loyalty, eCommerce, cellular apps, third-party marketplaces—and it not often connects.

By the point knowledge is stitched collectively to identify a store-only shopper able to convert, the second has handed. (And most of the time, that buyer has already been tempted away by a competitor.)

Handbook campaigns aren’t the repair. They’re too sluggish, too scattershot, and too onerous to measure.

What grocers want is a strategy to see the best prospects on the proper time, and act earlier than it’s too late.

Flip Missed Moments into Well timed Motion

That’s the place DXPro is available in.

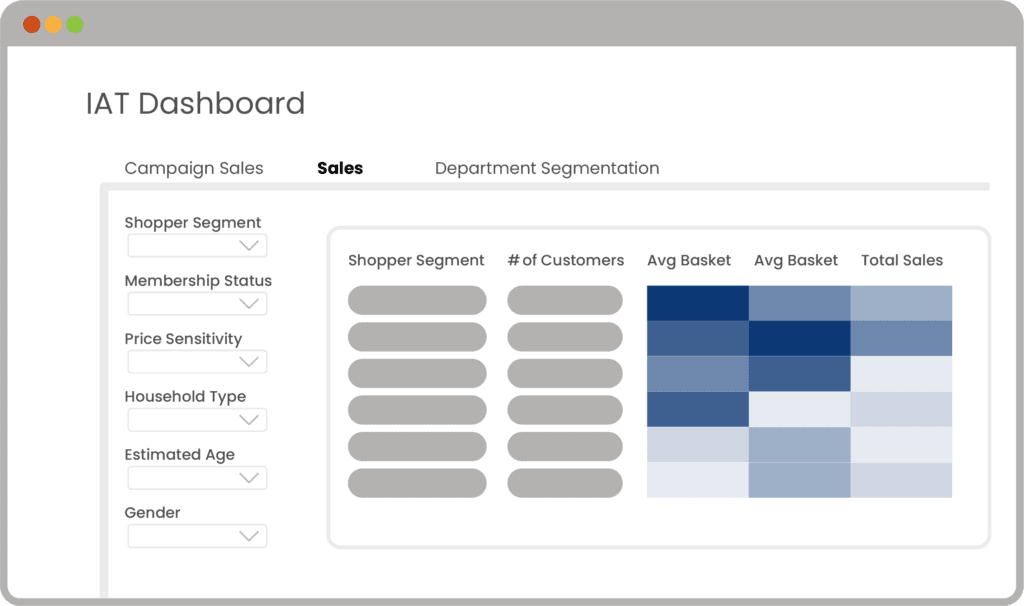

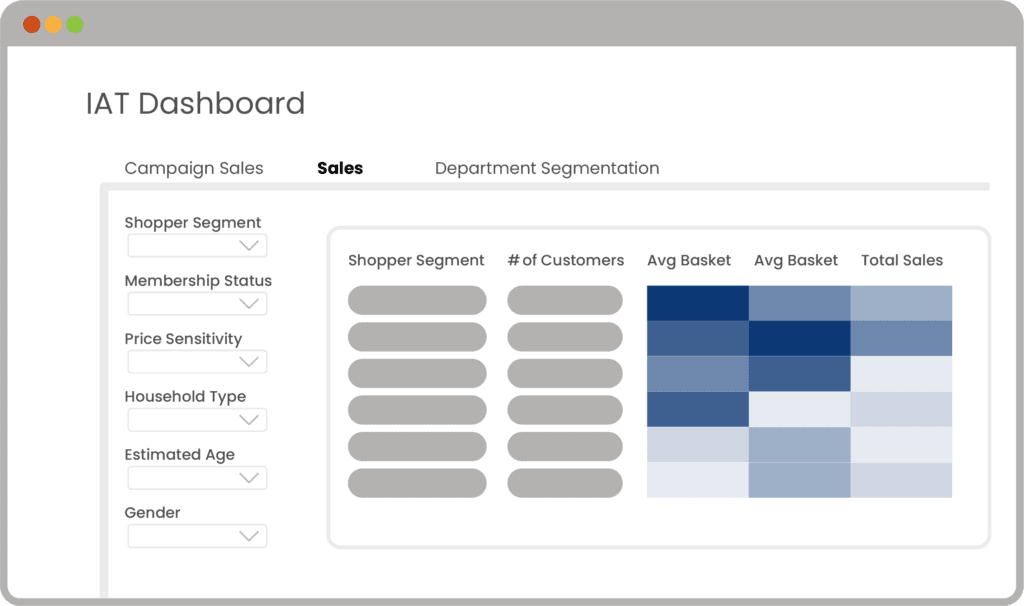

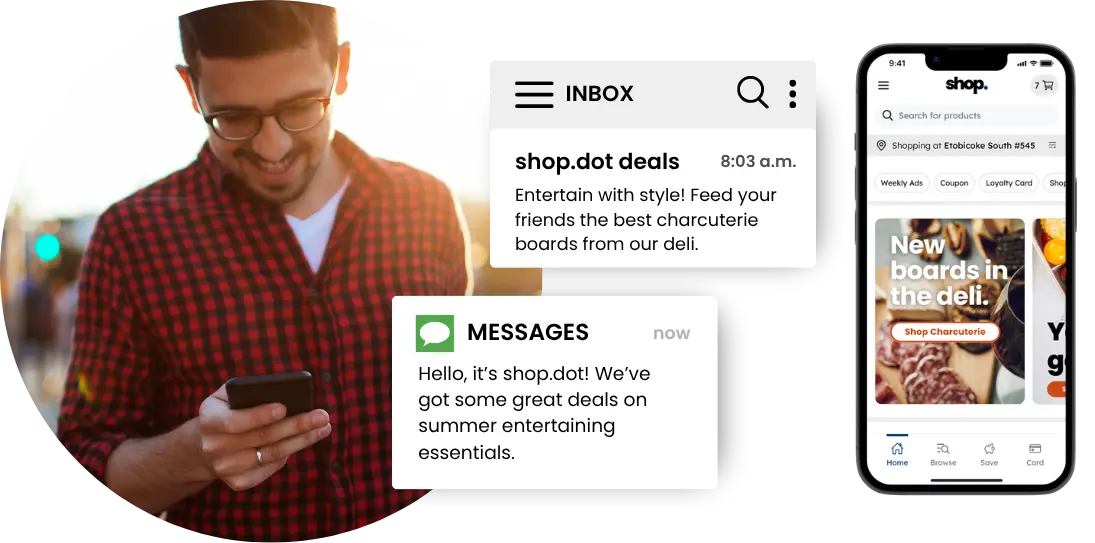

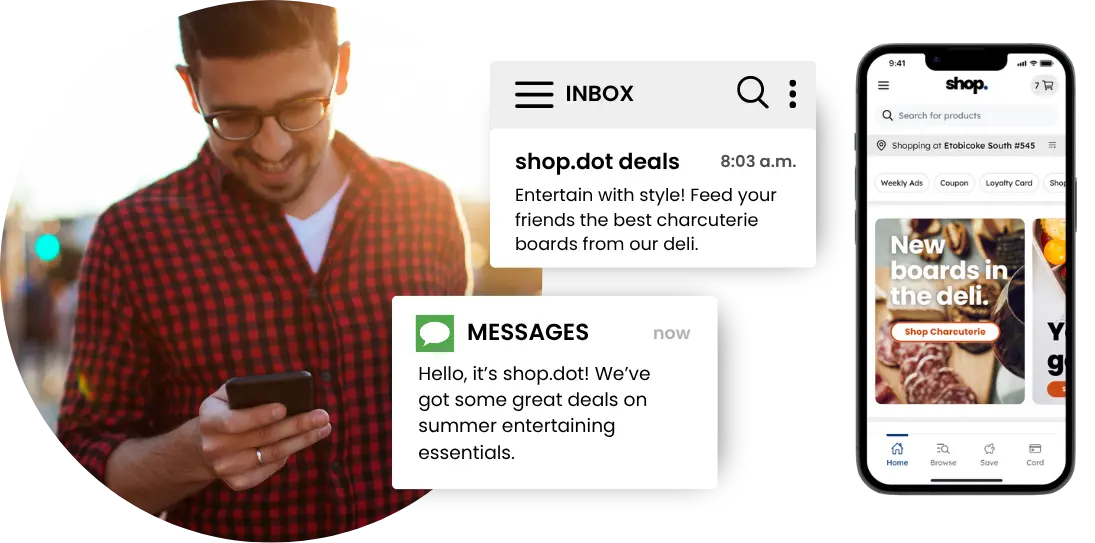

The brand new digital expertise platform from Mercatus unifies all of your buyer knowledge—POS, loyalty, eCommerce, and app exercise— inside an embedded CDP and makes use of it to interact prospects on an entire new stage.

Which means you don’t simply know who your store-only buyers are. You understand which of them are more than likely to attempt digital, which of them are slipping, and which of them are displaying indicators of higher-value conduct.

From there, DXPro does what no guide marketing campaign can: It triggers the best engagement in actual time.

Earlier, we mapped out the three steps to develop your multi-channel base: decrease the barrier, comply with up, and create behavior.

Right here’s how DXPro automates that three-step information:

Decrease the Barrier

When a store-only loyalist exhibits indicators they’re prepared, DXPro delivers the first-order perk that will get them to attempt digital.

Comply with Up

When a consumer completes that first order, DXPro sends the best follow-up—a coupon for his or her subsequent retailer journey or a replenishment reminder that retains each channels energetic.

Create a Behavior

By monitoring buyer conduct over time, DXPro reinforces the shop → on-line → retailer rhythm till it turns into second nature.

And it doesn’t cease at one-off campaigns.

DXPro comes with standardized engagement applications already confirmed to work for High Shopper, At-Threat, Lapsing, and Lapsed buyer segments.

As an alternative of reinventing the wheel every time, you launch methods with DXPro which have already delivered outcomes for main grocers.

The proof is within the outcomes.

One retailer used DXPro to focus on at-risk buyers and re-engaged 65% of them in simply two weeks. Of those that redeemed, 90% stored looking for months afterward, their basket sizes grew by 40%, and the retailer protected greater than $2 million in gross sales in simply six months.

That is what makes DXPro such an interesting choice for grocers. It doesn’t simply handle campaigns. It ensures that each supply goes to the best buyer, on the proper time, with a transparent line again to income.

It takes the three-step path we outlined earlier and makes it repeatable, measurable, and scalable throughout banners, markets, and areas.

DXPro Redefines Buyer Retention

After we speak about retention in grocery, we normally think about holding onto prospects—protecting them from slipping away, protecting their spend regular.

However that mindset units the bar too low.

DXPro reframes retention capabilities into one thing meaning greater than merely defending the established order.

A store-only loyalist doesn’t simply should be held in place. They should be nudged into digital.

An informal digital shopper doesn’t simply should be prevented from lapsing. They should be nurtured into repeat behaviors.

With DXPro, retention shifts from “not shedding floor” to rising the worth of each buyer already in your system.

And that’s precisely what grocers want proper now. Margins are shrinking. Competitors is relentless. Standing nonetheless isn’t an choice. The one manner ahead is to extend the worth of the purchasers you have already got.

The Subsequent Step

The chance is true there in your database. What issues now could be appearing on it.

DXPro provides you the instruments to see the purchasers prepared for extra, to maneuver them into higher-value behaviors, and to measure each step of the best way.

Mercatus constructed DXPro to make that shift doable. Guide a method session at present, and we’ll present you learn how to determine your highest-potential prospects, convert them into multi-channel buyers, and maintain them transferring up the ladder towards changing into your Most worthy prospects.