What I am eager about: How a fraudster walked right into a U.S. embassy within the Center East with pretend paperwork…and walked out with notarized closing papers for our Gulf-front FL deal.

We had been actually an hour away from wiring $350K for a luxurious infill lot when the title firm pulled the plug on insuring the property.

When a “Good” Deal Began Displaying Cracks: The SIN Drawback

Let me paint you an image:

Even on this difficult market (and our common aversion to infill tons), the deal appeared stellar. Conservatively price $700K (possible nearer to $800K), underneath contract for $350K.

The vendor was Canadian and had owned the property since selecting it up from a financial institution for $220K in the course of the 2009 crash (it had beforehand offered for $1.6M in 2006, and that vendor instantly defaulted). Story checked out with having monetary troubles, and I personally reviewed each line of the vendor name transcripts.

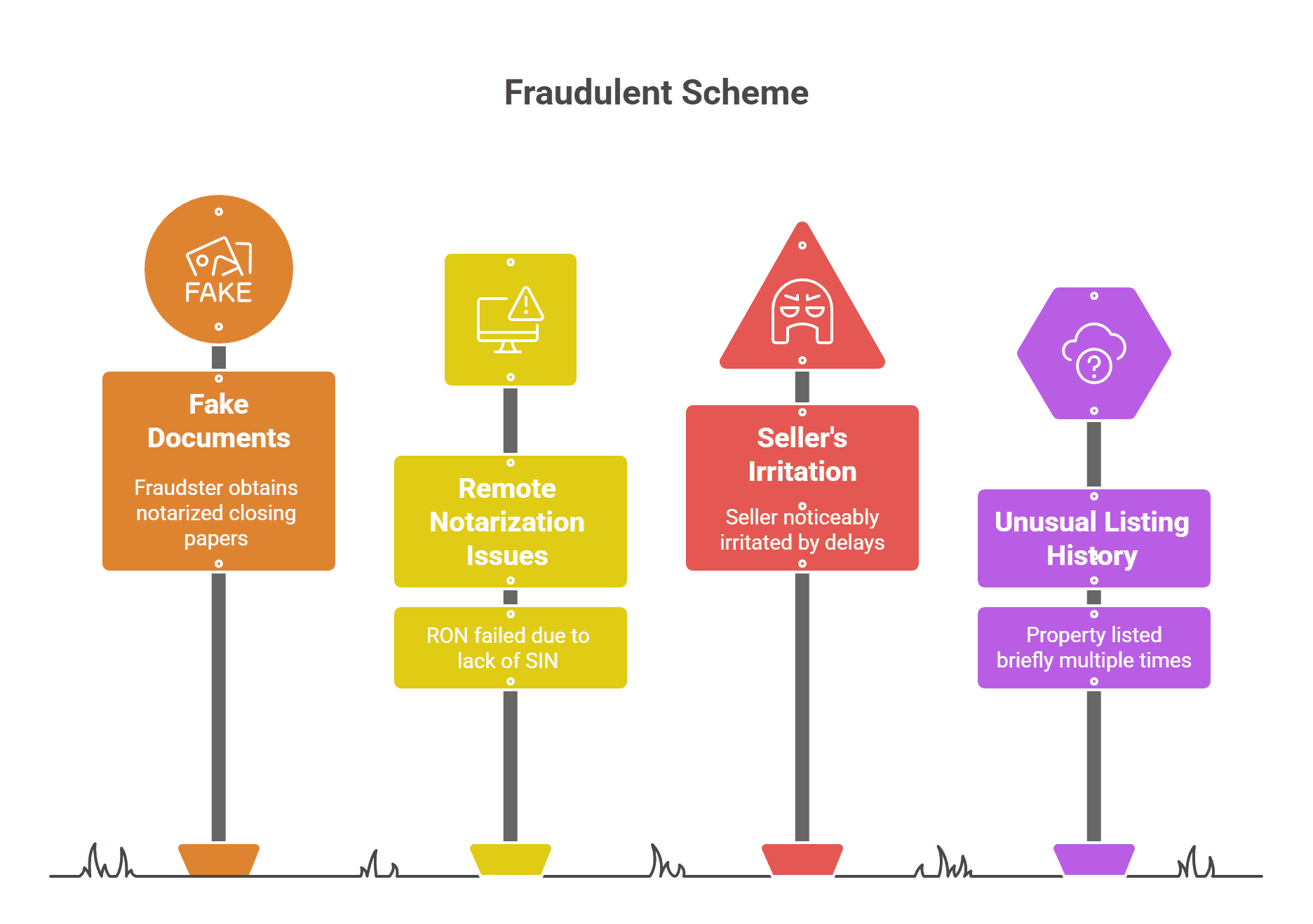

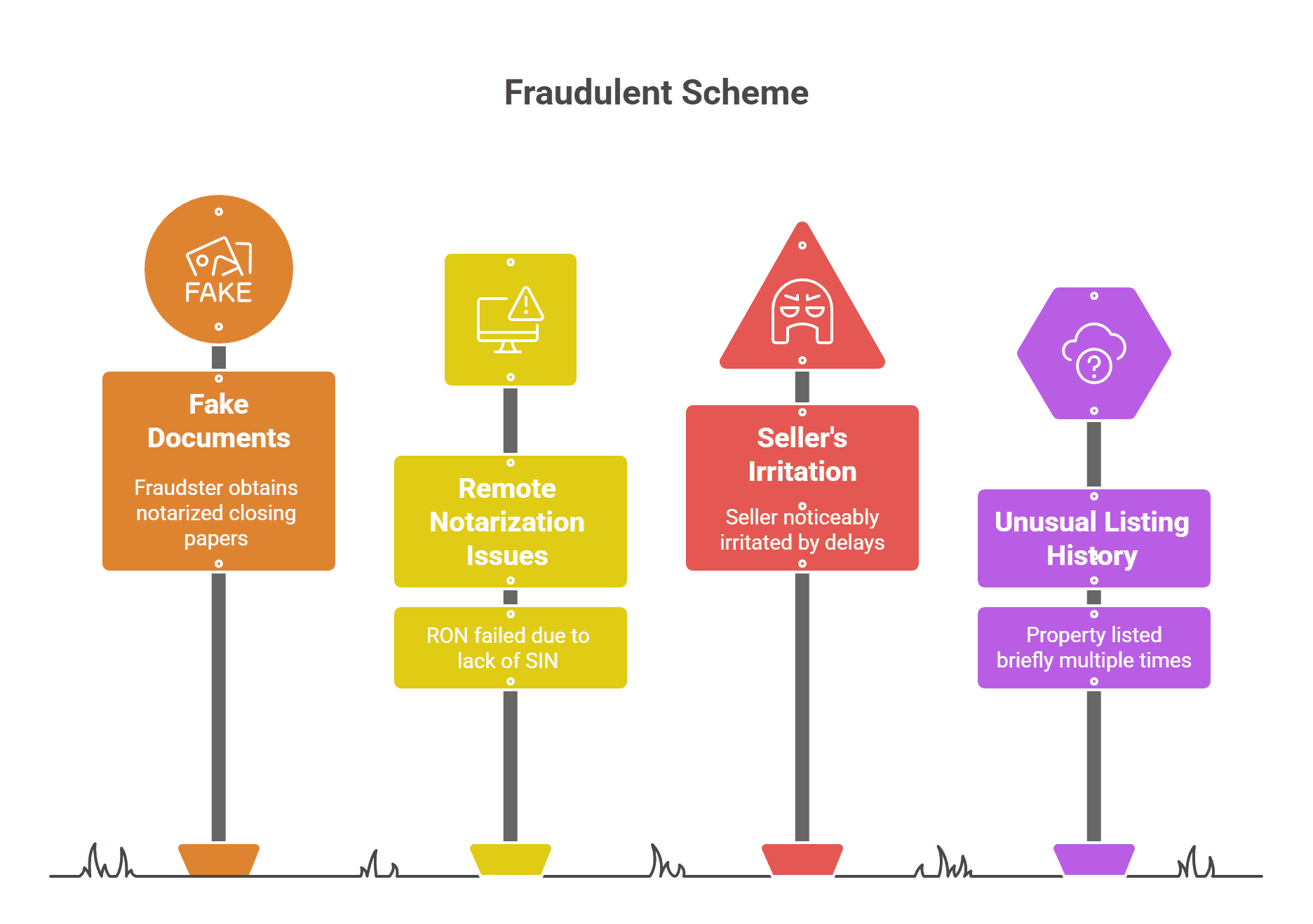

The property had been listed twice throughout the previous 3 years (however for just a few days every time. Uncommon, however we’re used to free cannon motivated sellers).

Understanding the FIRPTA Withholding Tax Necessities

The value we had been getting was strong, however not “too good to be true,” and there was some hair on the property, similar to burrowing owl nests that must be addressed, and an previous seawall that will have to be changed for round $40K. The whole lot aligned.

The vendor appeared to (legitimately) work on oil rigs off the EU coast or within the Center East. He needed to finish the closing by way of distant on-line notarization (RON), however that’s solely allowed throughout the US and Canada.

We organized a 2-day window for closing, when he could be again in Canada, to deal with it remotely earlier than flying to Dubai for two months.

Closing was scheduled for a Friday afternoon, however as (often) occurs, the RON begin time was considerably delayed till 7:30 p.m. ET, clearly after enterprise hours, and no title firm assist. The vendor was noticeably irritated, and I could not blame him.

We adopted up the subsequent day, and the RON couldn’t be accomplished. His ID was verified, however as a result of he did not have his SIN readily available (the Canadian equal of an SSN), the notary could not proceed.

This was a crimson flag, however not a deal killer. The vendor claimed a number of citizenships, and upon additional analysis, an SIN isn’t granted to each Canadian citizen and primarily serves a tax objective slightly than an ID objective. The truth that he could not get any assist on a late Friday night was additionally a mitigating issue.

The land investor who introduced us this deal had a scanned copy of the vendor’s passport, which appeared legit, and so they had run it by way of an anti-fraud verify. Plus, this land investor is among the bigger ones within the business, has encountered scams earlier than, and has checks in place.

There was wholesome skepticism, however issues continued to take a look at, together with the vendor having a legit Canadian cellphone as an alternative of a VOIP quantity typical of most scammers.

Both manner, the Canadian time zone he was in had handed by, and we must work by way of a US embassy in Dubai to get the notarization finished.

The vendor confirmed an appointment on the embassy. Within the meantime, we confirmed with the title that we might nonetheless shut with out the vendor having a SIN or a US TIN (for FIRPTA functions).

Once more, all of us considered this as uncommon, but when the vendor was making an attempt to skirt by on tax necessities, that wasn’t our downside.

(We additionally had a historical past of getting closed a international vendor FIRPTA deal up to now with a vendor that did not have a TIN, and there have been no repercussions from the IRS…and thoughts you, that was when the federal government wasn’t shut down, with half the employees furloughed.)

On condition that Florida deeds require two witnesses, the vendor wanted to carry these people to the embassy.

We had been skeptical of his means to ship, however he saved his appointment and despatched again scanned copies of all of the paperwork. The whole lot appeared legit, the title firm gave preliminary approval, and we deliberate to fund the deal and shut 2 days later when the originals arrived by way of DHL.

Notably, the vendor requested that funds be distributed throughout three financial institution accounts in Dubai in installments, however once more, this was believable as a result of we weren’t aware of how every monetary establishment operates, significantly internationally. And we routinely see limits on home wire transfers, particularly outbound.

The unraveling occurred on funding day.

The An identical Images No One Seen: How AI Caught What People Missed

The title firm needed to substantiate the wire directions as the ultimate step earlier than closing. The vendor offered a U.S. home account in another person’s title.

The title firm flagged this and requested an evidence from the vendor. The vendor stated they had been a joint account proprietor with that “relative” and really useful organising the account to make it extra handy than the a number of installments of the Dubai accounts.

I referred to as the title co. VP at that time, asking that since we had come this far, verify into the Dubai accounts, and if legit, let’s shut, even when they cost extra wire charges to the vendor for the installments.

The title firm went again to reviewing, then shortly after, despatched a PDF discover saying, “We can’t insure this transaction. We’re unable to offer any additional particulars.”

Nonetheless, although they cannot usually share particulars about these selections (legal responsibility issues), I referred to as them and pushed for information, given how deep we had been.

They had been cagey, however stated the financial institution accounts didn’t try, and stated, “We’re very assured this isn’t the true vendor. A number of flags all through, and we can’t threat insuring this. The vendor’s package deal was additionally suspect; take one other take a look at these IDs.”

I am staring on the paperwork. They appear respectable. Handed my threshold. Handed everybody’s threshold.

He could not share extra particulars, however: “Actually take note of the IDs.”

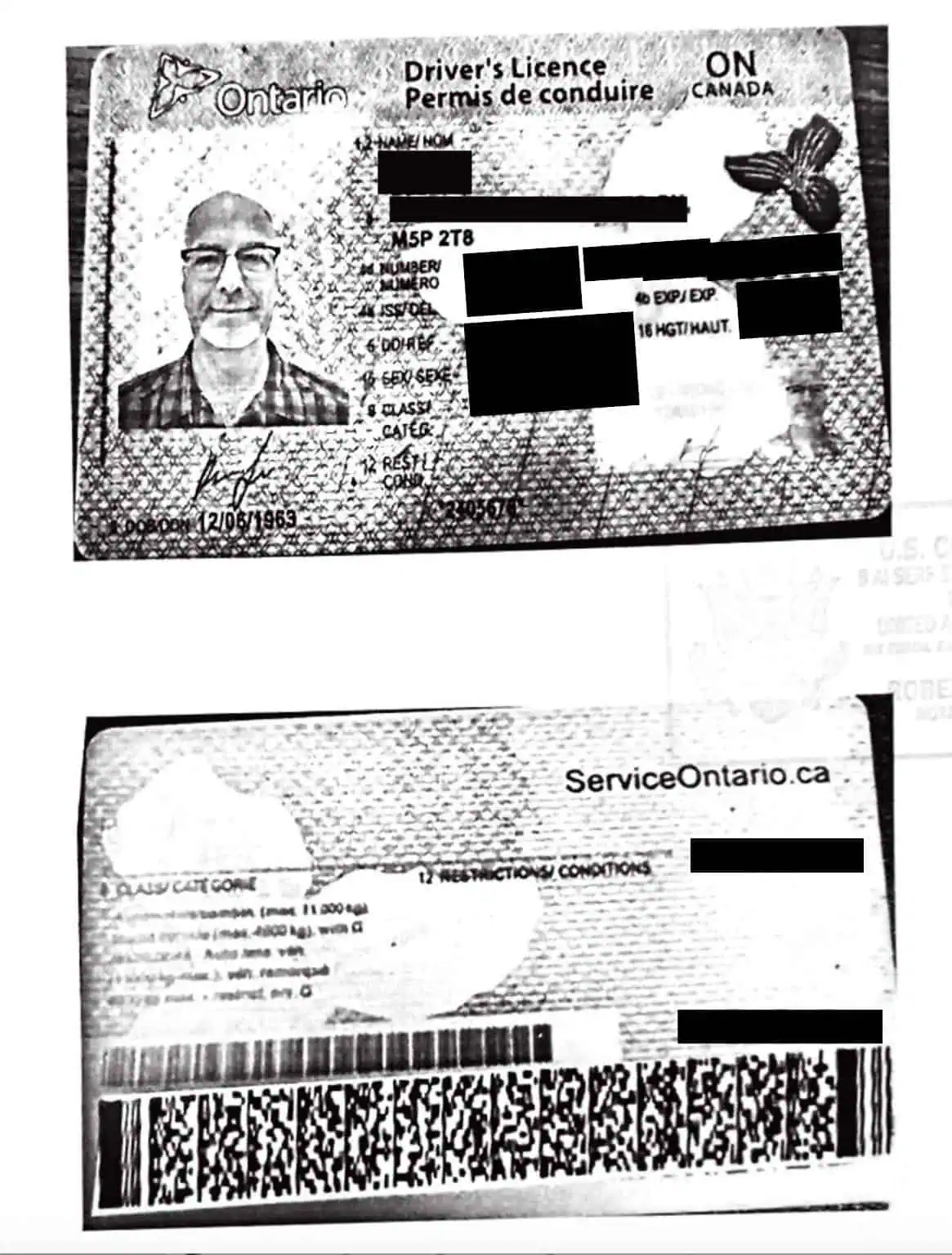

(Here is the passport and driver’s license – names and addresses redacted. Take 30 seconds. Discover something off?)

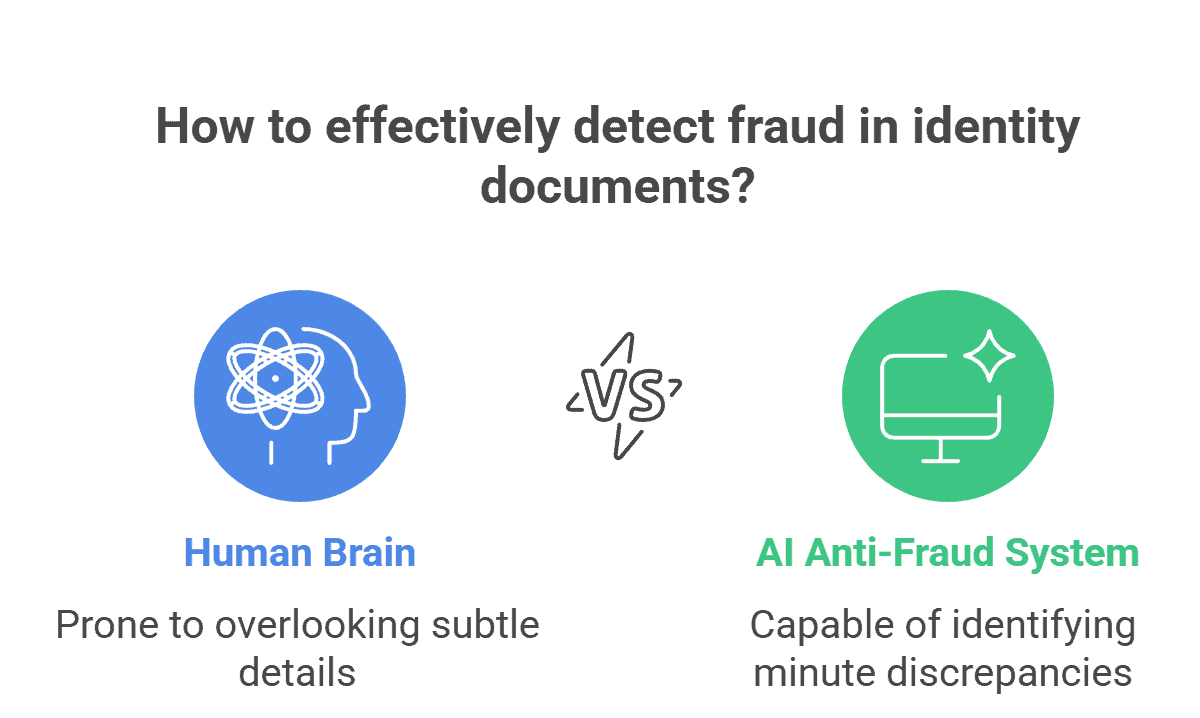

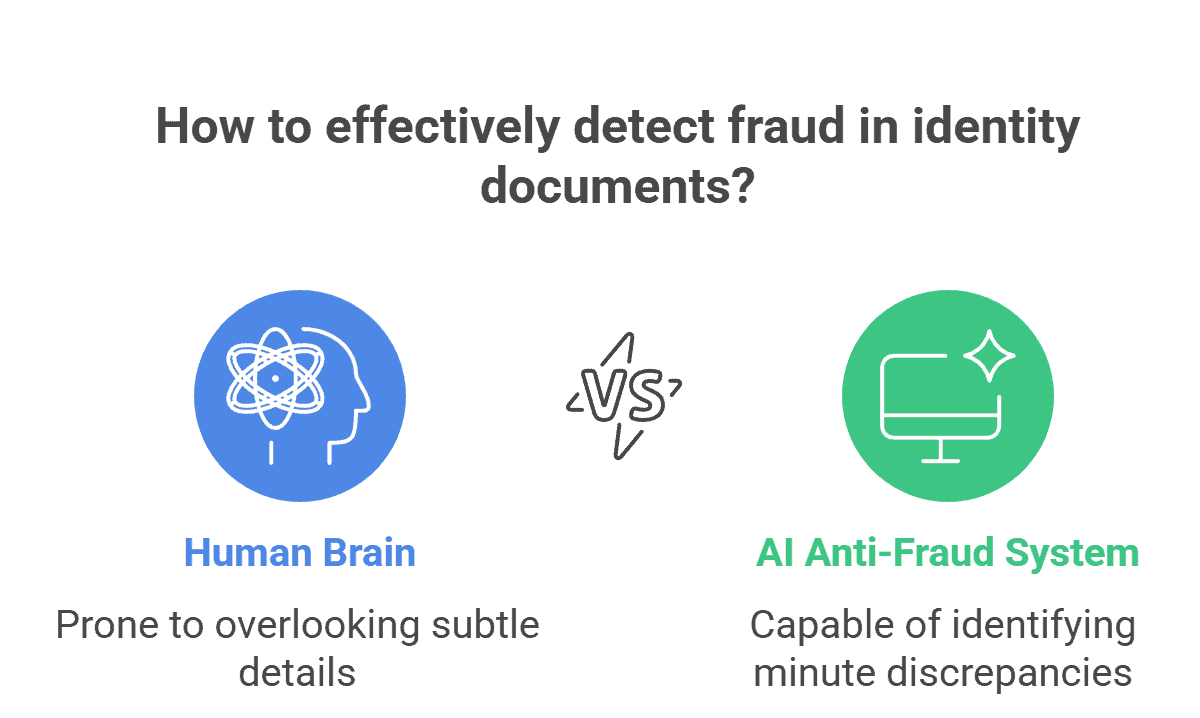

So, I threw them into a classy ChatGPT anti-fraud immediate, and the AI flagged about ten completely different points we had all missed.

Essentially the most manifestly apparent one…

The motive force’s license photograph and passport photograph are equivalent.

(In the event you caught that instantly, kudos to you!)

That by no means occurs. Ever. Totally different images, completely different angles, completely different occasions. However in case you’re not particularly searching for it? Your mind simply would not register it.

And when you do see it, it is like a slap within the face.

Different crimson flags the AI caught:

- Passport prefix discontinued earlier than his claimed issuance date

- Signature overlays off by ~5-7 millimeters

- A number of formatting inconsistencies are solely seen with forensic-level evaluation

How a Fraudster Walked Right into a US Embassy With Faux IDs – And Succeeded

As soon as the truth of this near-miss began to settle in, I needed to sit again, frankly in awe of the extent of sophistication of this rip-off.

Give it some thought:

He did have a base of operations in Canada. He focused a real proprietor of a Florida property with whom he shared an analogous background, and it was a near-perfect ‘motivated vendor’ state of affairs.

(Open query: The earlier itemizing historical past of the property, was it the scammer, or the true proprietor?)

He handed the preliminary ID necessities for an RON (together with a passport scan), exterior of the SIN… which suggests he was capable of reply the ID verification q’s like “What coloration is your [model/year] automobile?” or “What handle did you reside at?”

And most astonishingly, he walked right into a U.S. embassy within the Center East (?!) with pretend identification, and two witnesses (had been they in on it or did they assume he was legit?). And he efficiently bought his paperwork notarized!

Take into consideration the nerve required to drag that off.

In the event you get caught impersonating somebody with fraudulent paperwork within the Center East, I do not even wish to take into consideration what occurs subsequent.

Sweating bullets, holy cow…

(Makes me marvel if he handed by way of airport safety with the identical pretend docs.)

And he virtually walked away with $350K.

Nearly.

Fraud Prevention Protocol: AI-Powered ID Verification Earlier than Due Diligence

We’re now requiring vendor IDs upfront and operating them by way of refined AI anti-fraud prompts earlier than investing any DD sources.

Here is the customized GPT that we constructed: [Access the Fraud Detection GPT here]

Will that catch every part? No. However it might have caught this man instantly.

Observe: Florida is the largest fraud state within the nation, and worldwide sellers require additional scrutiny. However even with home offers, run the IDs by way of AI earlier than you go deep.

(After uncovering one other fraudulent sale try just lately, we’re additionally skip tracing each single vendor, along with reviewing their IDs, so we will detect if there are any crimson flags related to their strategies of communication. Fraud threat is larger for chilly name, textual content, or PPC leads.)

The title firm in the end saved us as a result of they face essentially the most legal responsibility. In the event that they’d insured this, and the true proprietor filed a title declare? We would need to return any earnings from the sale of the property. They’d need to unwind the whole title chain and refund our preliminary cost to buy the property.

Absolute nightmare state of affairs that might hang-out us even years down the highway.

Credit score to them for catching it after we had been all prepared to shut.

Actuality verify: We dodged a bullet and realized a helpful lesson.

Subsequent time? We’ll catch it on the ID verification stage…not on the day of funding.

=====

Searching for funding from operators who study from near-disasters? Critical Land Capital now runs AI fraud detection on each vendor ID earlier than investing important DD sources. $50K minimal buy worth. Very liquid and able to transfer at a second’s discover.