Telecom operators stay in two parallel worlds. On one aspect: ducts, ODFs, routers, switches, GPON splitters, DWDM cabinets. The bodily and logical stock that makes networks run. On the opposite: stability sheets, depreciation schedules, CapEx forecasts, and audit stories. The monetary actuality that makes the enterprise run.

The issue? These worlds barely discuss to one another.

Stock will get managed by operations. Depreciation will get dealt with by finance. CapEx forecasting sits someplace in between, and no person has the whole image. The result’s disjointed planning, inefficient investments, and hidden monetary threat that exhibits up months or years too late.

Property seem within the monetary register however not within the stock. Depreciation schedules outlive the precise tools lifecycle. Spare components get bought “simply in case” as a result of planners don’t know what’s already in inventory. CapEx flows to areas with underutilized tools whereas different areas wrestle with outdated infrastructure nearing collapse.

The problem isn’t lack of information. It’s that knowledge lives in silos. Operations monitor ports, fibers, and logical overlays. Finance tracks buy orders, invoices, and depreciation curves. With out integration, choices get made on partial footage, and the monetary penalties pile up silently.

This disconnection prices operators actual cash. Dell’Oro Group stories that worldwide telecom CapEx declined 8% in 2024, with capital depth ratios projected to drop from 16% in 2024 to 14% by 2027. In an atmosphere the place each greenback of CapEx must ship measurable ROI, operators can’t afford the waste that comes from misaligned operational and monetary knowledge.

Depreciation: Extra Than Simply an Accounting Train

Depreciation usually will get handled as a finance-only activity. Apply a straight-line or accelerated mannequin, depreciate property over 5 to seven years, shut the books. Performed.

However what occurs when that mannequin doesn’t replicate actuality?

Gear that fails after three years nonetheless exhibits as an asset on the stability sheet for an additional 4. A router that will get retired sits in a warehouse however continues depreciating on paper. In the meantime, a GPON splitter operating at 95% capability in a rising market will get the identical depreciation remedy as equivalent tools sitting idle in a declining area.

The repair requires linking depreciation on to asset efficiency, utilization, and lifecycle occasions. When stock knowledge connects to monetary fashions, operators can:

Observe precise lifespan towards deliberate lifespan. Property that fail early or outlive expectations get flagged so depreciation adjusts accordingly. No extra ghost property depreciating on stability sheets whereas sitting unused in storage.

Tie depreciation to service affect. A core router serving premium enterprise clients carries totally different monetary threat than one dealing with low-density residential visitors. Weighting depreciation by enterprise affect creates extra correct monetary planning.

Assist audit traceability. Each depreciation entry will get backed by stay stock information displaying location, utilization, and upkeep historical past. Auditors see not simply numbers however the community actuality behind them.

Consumer Suggestion: Begin by reconciling your monetary asset register towards stay community stock. Most operators uncover 10-15% of their depreciated property not exist within the community, whereas energetic tools isn’t displaying up in monetary information in any respect. Fixing this hole instantly improves each operational accuracy and monetary reporting.

This transforms depreciation from a static compliance activity right into a dynamic monetary planning device that displays what’s truly occurring within the community.

CapEx Planning That Displays Community Actuality

Operators face fixed stress to stability CapEx spending. Make investments sufficient to take care of high quality and assist development, however not a lot that margins erode. The problem is understanding the place cash will truly ship the most important affect.

Conventional CapEx planning depends on forecasts, historic patterns, and educated guesses. Higher CapEx planning makes use of stay stock intelligence mixed with monetary forecasting to make data-driven choices.

Grid Introduction: Connecting stock to monetary planning modifications how operators method CapEx allocation. Right here’s how unified operational and monetary knowledge creates higher funding choices throughout totally different planning situations:

| Planning State of affairs | Conventional Method | Built-in Stock + Finance | Monetary Impression |

|---|---|---|---|

| Gear Refresh | Substitute based mostly on age | Substitute based mostly on utilization + situation | Keep away from untimely substitute prices |

| CapEx Allocation | Distribute by area | Goal capability bottlenecks with demand knowledge | Increased ROI per greenback spent |

| Depreciation Planning | Fastened schedule | Alter for precise asset efficiency | Extra correct monetary forecasting |

| Spare Components Stock | Order based mostly on estimates | Observe precise inventory + utilization patterns | Scale back stock carrying prices |

| Finish-of-Life Administration | React to failures | Predict based mostly on efficiency traits | Forestall service disruptions |

When stock and monetary knowledge work collectively, a number of capabilities grow to be attainable:

- Refresh cycle planning. Robotically forecast when routers, switches, or optical tools will attain end-of-life and align substitute budgets with precise community want moderately than arbitrary timelines.

- Depreciation-aware CapEx allocation. Prioritize spending on property nearing full depreciation to keep away from monetary write-offs whereas extending the helpful lifetime of infrastructure that also delivers worth.

- Capability-driven investments. GIS-based utilization metrics spotlight which fiber routes or entry nodes are approaching saturation, making certain CapEx flows to areas with clear demand and ROI potential.

- State of affairs simulation. Check totally different fashions: what occurs to depreciation and CapEx forecasts if GPON rollout accelerates? Or if DWDM refresh cycles get delayed by a yr? Operating these situations with related knowledge produces correct monetary projections as a substitute of guesswork.

Analysys Mason forecasts that capital depth in telecom will fall from round 20% to 12-14% by the tip of the last decade. On this tightening atmosphere, CapEx planning can’t be finance-driven alone. It must be service-driven, customer-driven, and ROI-driven with operational knowledge feeding instantly into monetary fashions.

How Unified Visibility Modifications the Sport

Making this connection requires three parts working collectively:

- Reconciled stock. Bodily property like fiber, ODFs, routers, and switches merge with logical overlays together with VLANs, tunnels, and GPON splits right into a single stay mannequin. This eliminates the discrepancies that plague most operators.

- Lifecycle and upkeep monitoring. Property get tagged with buy dates, guarantee intervals, vendor agreements, and efficiency historical past. This knowledge feeds each operational planning and monetary forecasting.

- Monetary integration. Depreciation fashions, CapEx forecasts, and asset registers hyperlink to stock knowledge, creating a whole chain of proof from bodily deployment to monetary stories.

The end result: each asset turns into each a technical merchandise and a monetary merchandise concurrently. Operations is aware of the monetary implications of selections. Finance understands the operational actuality behind the numbers.

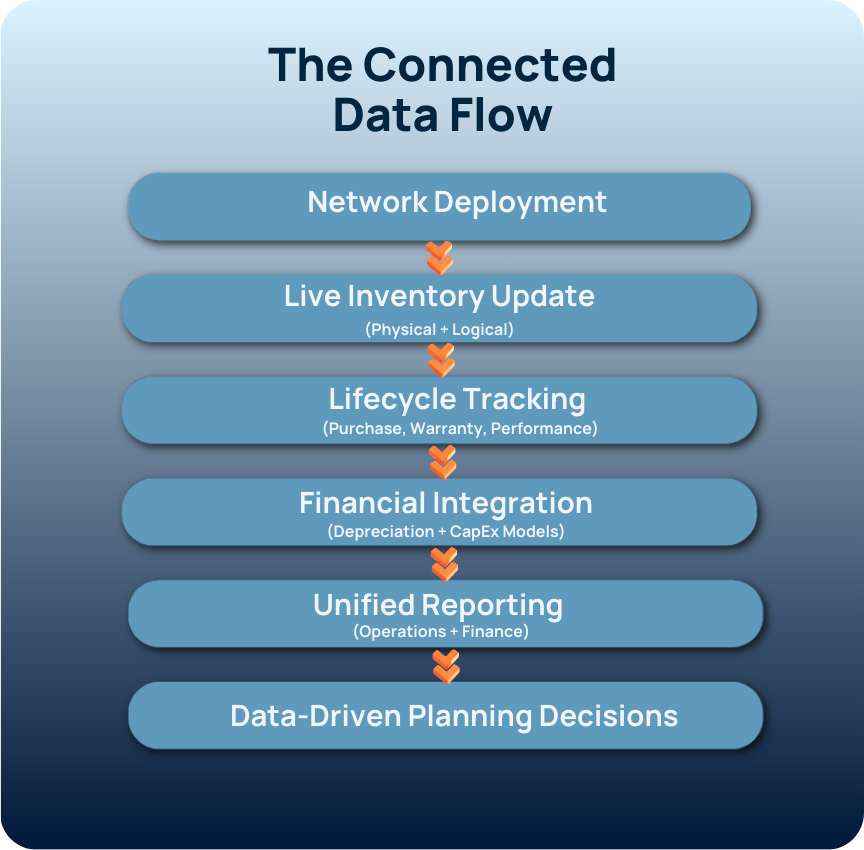

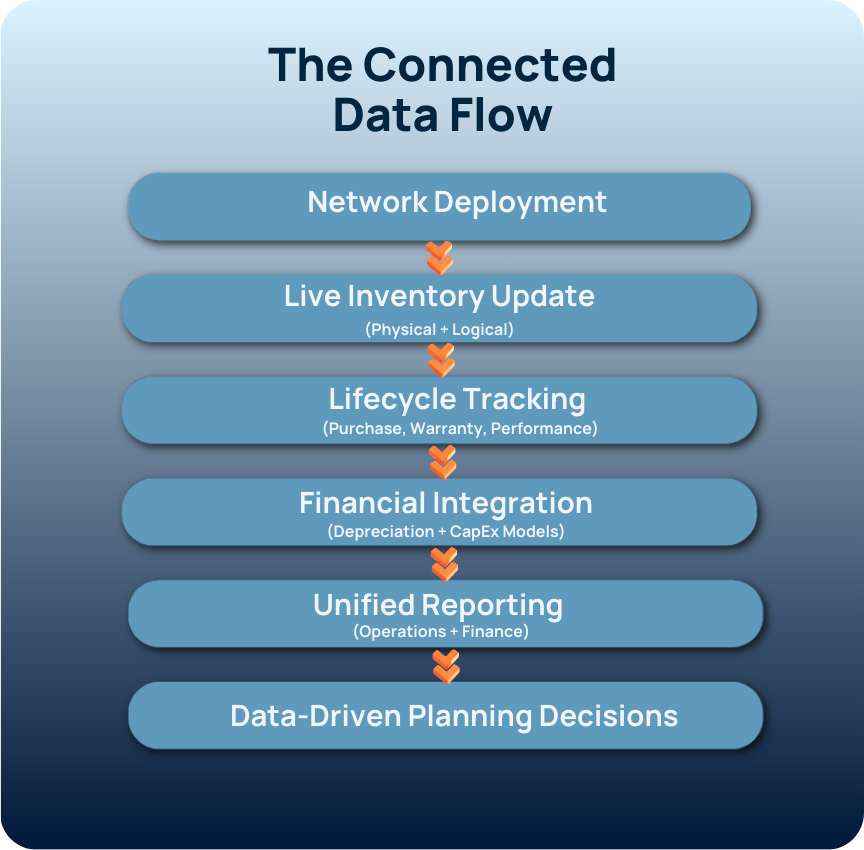

The Linked Information Circulation

Right here’s how operational and monetary knowledge stream collectively to create unified visibility. This exhibits the trail from community deployment by monetary reporting:

A sensible instance exhibits the affect. Telxius, managing over 94,000 km of submarine fiber throughout 93 PoPs in 23 nations, confronted the problem of sustaining unified visibility throughout bodily, logical, and digital layers. By implementing unified stock that related operational and monetary knowledge, they achieved end-to-end lineage from community interfaces by to billing information. This created traceability supporting each technical fault dealing with and monetary audit trails, whereas streamlining alignment between deployed infrastructure and monetary commitments.

Turning Information Silos Into Strategic Benefit

Most OSS platforms present operators what they’ve. The true worth comes from displaying what that stock means financially.

Stock accuracy ensures operators know precisely what’s deployed and the place. Lifecycle visibility exhibits when tools wants changing earlier than failures happen. Monetary integration reveals what property price, how they depreciate, and which investments ship the strongest returns.

Telecom operators already gather the info they want. The problem is that it lives in silos with operations in a single system and finance in one other. Platforms that break down these partitions rework property from line objects into strategic planning instruments.

In an business the place CapEx effectivity instantly impacts competitiveness, the operators who can join community actuality to monetary planning will make smarter investments, cut back waste, and ship higher returns. As a result of constructing networks isn’t sufficient anymore. Constructing ones that make monetary sense issues simply as a lot.

Platforms like VC4’s Service2Create (S2C) assist this shift by combining stay stock, lifecycle monitoring, and monetary integration right into a unified system. It’s designed particularly to bridge the operational and monetary divide, giving groups throughout the group entry to the identical related knowledge. The consequence: higher planning, clearer visibility, and CapEx choices grounded in community actuality moderately than guesswork.

References

- Dell’Oro Group – “Worldwide Telecom Capex Decline Report” (April 2025)

- Analysys Mason – “Community Capex Has Began a Lengthy Decline” (Could 2024)