For many of grocery historical past, procuring adopted a straight line.

Clients walked the aisles, joined the queue, unloaded the cart, paid, and left.

For grocers, that very same line related service to the client. Inventory the cabinets. Employees the lanes. Ring the sale.

Early eCommerce didn’t break that line. It bent it. Customers weighed comfort towards price, selected in-store or on-line, pickup or supply, and paid both with time or with charges.

The trail was nonetheless singular. They picked one and adopted it by means of.

However in 2026, grocery procuring appears to be like much less like a queue and extra like scattered factors.

The identical family that retailers in individual at their close by grocer after work on Thursday will order supply from Walmart on Monday morning, ship paper towels from Amazon on Tuesday evening, then change to pickup at a grocery store midweek after a late assembly throws off their schedule.

None of this appears to be like orderly. None of it strikes in sequence. And none of it rewards methods constructed for a single, predictable path.

Customers transfer fluidly between achievement strategies, unfold spending throughout extra, smaller journeys, and take a look at new choices with out committing to anyone.

In a market like that, progress doesn’t come from pushing tougher on the outdated line. It comes from constructing new connections between moments by means of larger relevance.

This text outlines the 5 shopper shifts driving that change and identifies the one answer grocers want in 2026 to connect with clients with out eroding margin or counting on guesswork.

See The Resolution In Motion

The 5 Shopper Shifts Set to Form Grocery in 2026

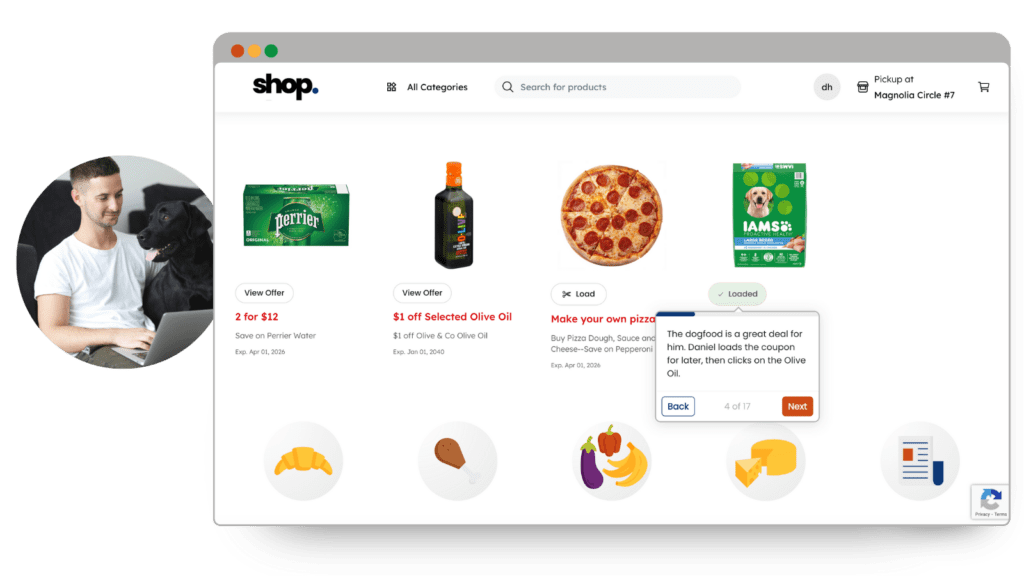

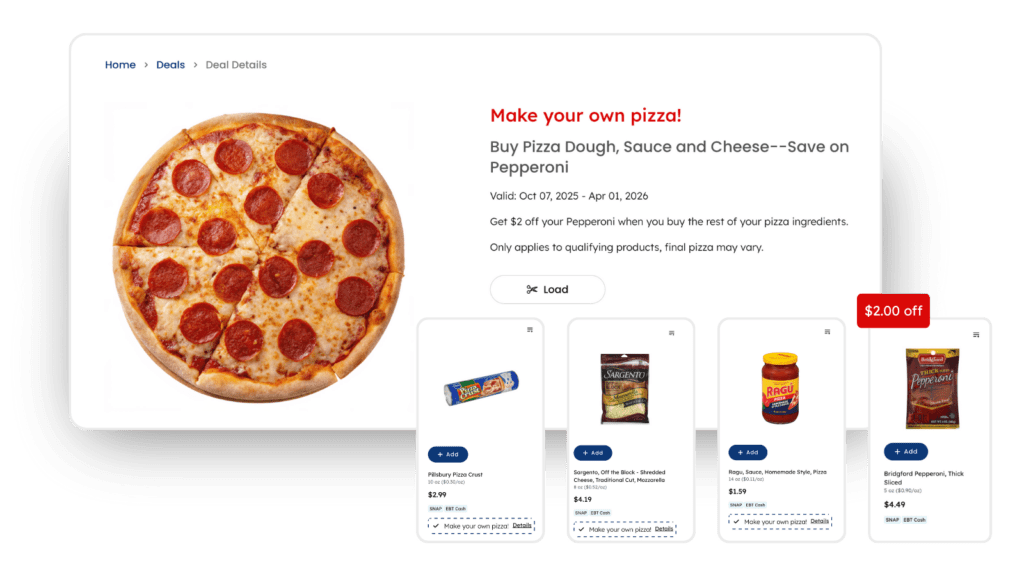

hat answer is a digital expertise platform designed for grocery procuring that not strikes in a straight line.

DXPro’s embedded buyer knowledge platform is sensible of habits scattered throughout journeys, channels, and achievement strategies, turning perception into clear alternatives for relevance.

Utilizing DXPro, retailers can load focused coupons, related product placement, and well timed nudges that clients truly discover and use.

The 5 shifts under present why that functionality issues, and the way grocery procuring in 2026 calls for relevance that works second by second.

1. Customers depend on on-line grocery as a default, not a backup

What’s altering

In 2026, on-line grocery is the place procuring begins, not the place it ends. Lists are constructed digitally, with achievement determined later based mostly on the second.

November 2025 proved how entrenched this habits has change into: a month anticipated to gradual below SNAP strain as an alternative delivered $12.3B in on-line gross sales (+29% YoY), with increased order frequency, bigger baskets throughout each technique, and almost half of buyers utilizing a number of achievement choices.

That’s not digital as a fallback. It’s digital because the default.

What grocers ought to do

Deal with on-line as the entrance door.

Use related provides and well timed prompts to carry buyers in, then reinforce that alternative instantly with experiences that really feel private, not generic.

What DXPro supplies

DXPro’s embedded buyer knowledge platform exposes buyer habits throughout journeys, channels, and achievement strategies, then triggers automated, focused provides on the moments that matter.

2. Customers change channels and achievement strategies based mostly on the second

What’s altering

In 2026, buyers don’t decide to a single achievement technique. They fluctuate based mostly on time, price, and circumstances.

Late 2025 confirmed how fluid this has change into. September supply and ship-to-home surged as pickup misplaced share, whereas November noticed pickup rebound alongside supply and ship-to-home progress. As we talked about within the earlier part, nearly half of all on-line grocery buyers used a number of achievement choices in November.

What grocers ought to do

Cease treating achievement strategies as separate audiences.

Acknowledge the identical shopper throughout pickup, supply, and ship-to-home, and modify provides and messaging for flexibility as their decisions shift.

What DXPro supplies

DXPro brings collectively buyer knowledge, digital engagement, and commerce capabilities so grocers can ship a seamless, personalised expertise throughout supply, pickup, ship-to-home, and in-store.

DXPro retains provides and worth unified throughout strategies, so relevance follows the patron, not the achievement sort.

3. Customers tempo their spending throughout extra frequent, deliberate journeys

What’s altering

In 2026, buyers aren’t pulling again from on-line grocery. They’re pacing their spending extra intentionally.

By the top of the 12 months, order frequency had elevated for 15 straight months. On the identical time, common order worth turned much less predictable—up and down throughout achievement strategies—signaling that buyers have been actively managing basket measurement by event.

What grocers ought to do

Reply to modifications in cadence, not simply modifications in spend.

Determine when buyers shift towards smaller, extra frequent baskets and nudge them towards bigger spends with focused worth as an alternative of broad reductions.

What DXPro supplies

DXPro detects modifications in journey frequency and basket measurement. These clients are positioned into audiences and served automated engagement packages designed to stabilize and develop worth over time.

See how you need to use DXPro to focus on high-frequency buyers with related coupons that encourage repeat journeys with out eroding margin.

4. Customers outline comfort by pace, not proximity

What’s altering

In 2026, comfort is not set by how shut the shop is. It’s all about by how briskly and the way predictably an order arrives or can be picked up.

Supply and ship-to-home positive factors on the finish of 2025 tracked intently with Walmart’s sub-three-hour supply push and Amazon Contemporary’s same-day ship-to-home growth, resetting expectations for pace with out apparent trade-offs.

What grocers ought to do

Making an attempt to match pace with bigger retailers is just going to empty margins. As a substitute, compete on perceived comfort.

Which means anticipating the place charges, lead instances, or uncertainty will break the expertise and use focused worth to maintain buyers shifting ahead.

What DXPro supplies

DXPro connects achievement habits and checkout indicators to focused provides that scale back friction for the time being it issues.

See how DXPro can be utilized to floor the best coupon or incentive when pace or price turns into the deciding issue.

5. Customers reply when experiences acknowledge them

What’s altering

In 2026, trial is simple. Dedication is earned.

All through 2025, knowledge confirmed progress pushed by the return of lapsing and rare buyers, whereas “tremendous customers” (these procuring 4 or extra instances in three months) delivered disproportionate worth by means of increased spend and stronger repeat intent.

What grocers ought to do

Flip lapsing and rare buyers into “tremendous customers.”

Focus much less on buyer acquisition and extra on buyer retention by bringing stalled buyers again into the fold.

Use well timed, related, and confirmed engagement to show return visits into routine habits.

What DXPro supplies

One of many strongest capabilities of DXPro is its means to determine high-potential segments inside returning, lapsing, and threshold buyers, and automate provides confirmed to maneuver them towards increased worth.

See how straightforward it’s to make use of DXPro to present focused coupons and provides that flip recognition into loyalty and repeat spend.

What Altering Buyer Habits Means For You

Collectively, these shifts make one factor clear: Straight-line options not work.

Broad reductions, weekly circulars, and generic loyalty packages assume buyers transfer collectively and concentrate on the identical time. In a market outlined by fragmented journeys and situational selections, these instruments miss extra moments than they attain.

The biggest retailers already know this.

Walmart and Amazon aren’t simply competing on value or pace. They’re elevating expectations round relevance, consistency, and immediacy throughout each interplay.

Making an attempt to match them on pace erodes margin. Making an attempt to match them on value results in a race you can’t win.

DXPro provides a special path. It helps regional grocers meet trendy expectations for relevance by recognizing buyers throughout moments, channels, and achievement strategies with out getting into a value or pace battle.

That’s learn how to compete in 2026.

How Grocers Can Make 2026 Their Most Profitable Yr But

Grocers don’t want an even bigger promotion calendar. You want a platform that turns buyer habits into motion, shortly, constantly, and profitably.

DXPro is constructed to do this by unifying buyer knowledge, engagement, commerce, and achievement into one system that produces shopper-visible relevance in each interplay.

You’ve seen how straightforward it may be to answer buyer habits shifts. The following steps are simple:

1. Totally discover the coupons and provides expertise so you’ll be able to see focusing on in motion.

2. Discuss to us about making use of the identical method to your personal segments, your personal margin constraints, your personal operational realities.

3. Begin making relevance the default throughout offers, login, and cart, as a result of that’s the place 2026 procuring selections will get made.

In 2026, buyers are rewarding the retailers that acknowledge the second they’re in and assist them end the job. Be that grocer in your clients.