The atrocious underwriting behind most subdivision offers throughout the land {industry} has been driving me nuts.

Offended? Wonderful, however for operators who need to enhance, maintain studying.

Having reviewed hundreds of “potential” subdivisions (and efficiently purchased and bought them), I believe fewer than 5%, in all probability even lower than 1%, of the land {industry} has a great deal with on land subdivision evaluation. The main target right here is on minor subdivisions, or majors which might be not being bought as paper heaps to a developer or builder.

This text goals to be as bare-bones as doable, since I need to reference these tips repeatedly, together with with my workforce.

A couple of fast definitions:

- Minor subdivisions sometimes contain splitting land into fewer heaps (sometimes 3-5), with restricted or no infrastructure required, and permit for a fast approval course of.

- Main subdivisions contain splitting land into extra complete heaps (varies broadly however doubtlessly into the tons of), usually with heavier infrastructure regulatory necessities.

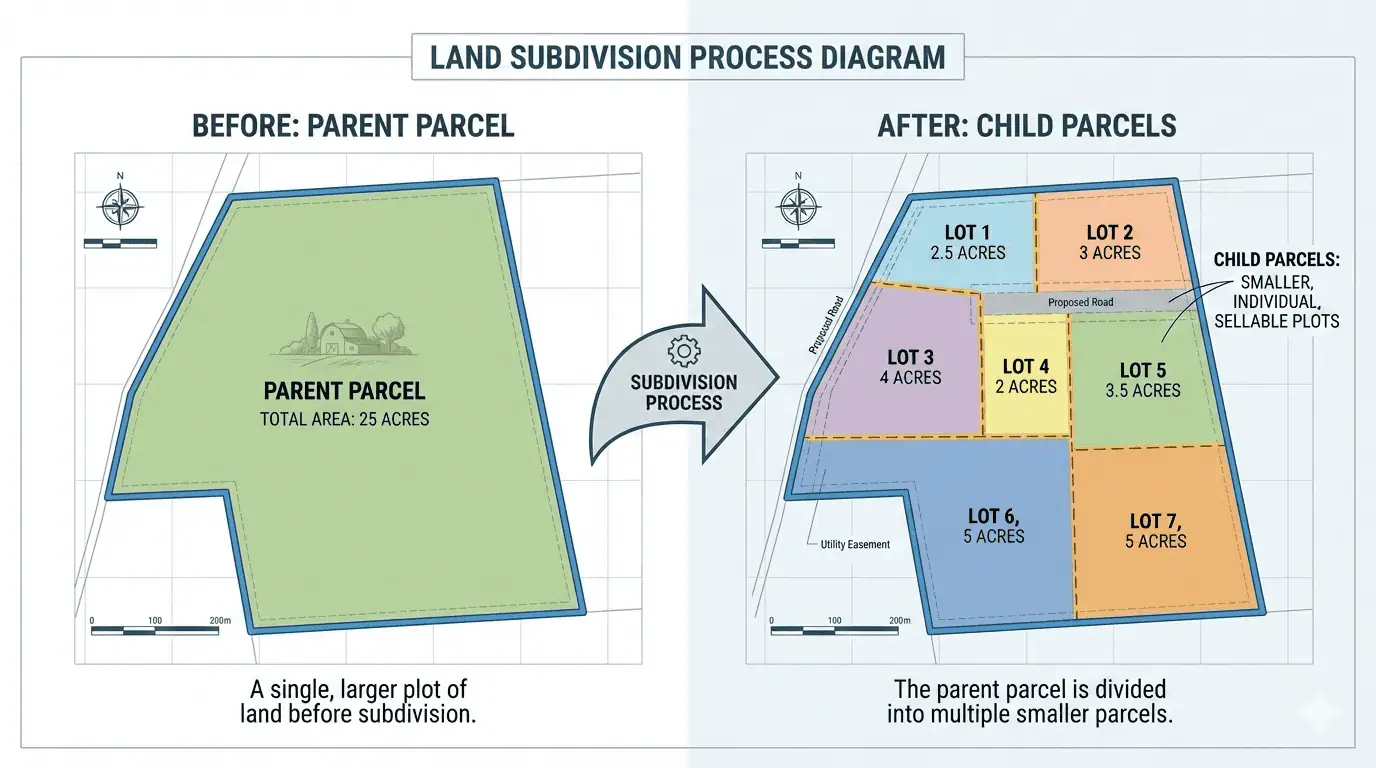

- Mother or father parcels are the unique topic property previous to a subdivision.

- Youngster parcels are the brand new heaps created from the dad or mum parcel after a subdivision.

RELATED: What Are Mother or father and Youngster Parcels?

Caveat: It is a STARTING level. These are desk stakes that apply ~99% of the time, wherever within the nation. However every bit of land can have its personal distinctive options, its personal market, and its personal set of laws. Regulate accordingly; subdivisions are complicated.

And should you solely take one factor away from this, always remember that the market doesn’t care about your VISION; it solely rewards the TRUTH.

=====

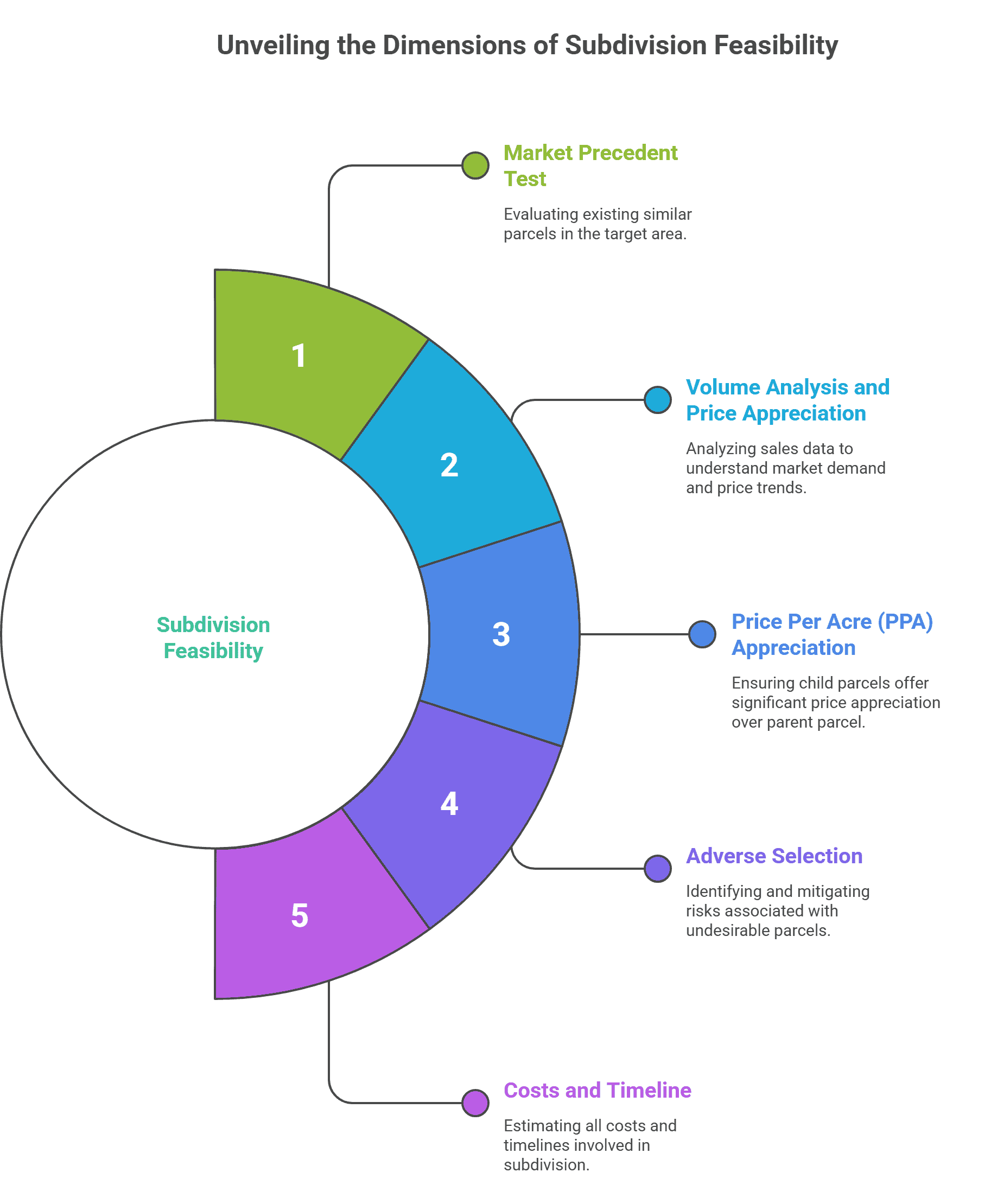

Step 1: The market precedent check

On the aerial map, are there already present parcels with related acreages (inside ~1-2 acres) as your proposed little one parcel plan inside a ~5-10 mile radius, with related traits, reminiscent of contour and avenue frontage?

- If “Sure”: That is a great signal. The market has confirmed it accepts that product.

- If “No”: You’re a first mover. That may be a huge purple flag until you will have affected person capital and an urge for food for prolonged maintain occasions, doubtlessly for years.

Understanding whether or not comparable subdivisions exist in your goal space is the inspiration of efficient parcel break up feasibility analysis. With out present market precedent, you’re basically experimenting with purchaser urge for food utilizing your personal capital.

Step 2: Quantity evaluation and worth appreciation

For step 2, verify the bought, pending, and lively listings inside a ~5-10 mile radius. The nearer, the higher. Some areas will justify prolonged search radii.

In case you are creating 2 little one parcels of comparable acreage, have at the very least 2x the kid parcels (in comparison with dad or mum parcel acreage) bought or pending previously 3-6 months, max 12, in that space. Bonus factors if the bought or pending comparables are from one other subdivide venture.

Creating 3 little one parcels? You want 3x the bought or pending comparable quantity in comparison with the dad or mum parcel acreage.

If little one parcels are distributed throughout a number of acreages, reminiscent of three 5-acre parcels and two 20-acre parcels, modify the multiples of bought or pending comparables for every acreage band.

The lively market is successfully the inverse. Should you see a bunch of lively little one parcels (significantly if they’re grouped collectively as a part of one other subdivide venture and have related traits), be extra cautious about introducing extra stock, until you may considerably undercut the market. The longer the collective days on market (DOM) of the lively listings, the extra cautious it’s essential be.

Ask your self:

- Are all of them nearer to an interstate or metropolis limits? Account for the place little one parcels are shifting. In case your venture is way more rural, your venture could blow up in your face.

- Are little one parcels shifting considerably sooner (e.g., 2x as quick) than dad or mum parcel acreage? Whereas unusual, that may offset decrease bought or pending quantity, however be additional conservative if making a choice from this standpoint.

Step 3: Value-per-acre (PPA) appreciation have to be actual

For step 3 within the subdivision evaluation course of, as a rule of thumb for little one parcels above ~2-3 acres, PPA ought to present at the very least 1.5x appreciation over dad or mum parcel pricing. For little one parcels beneath that acreage threshold, the uncooked worth ought to be at the very least a 1.5x premium, since PPA falls aside.

To be crystal clear: If my dad or mum parcel acreage of fifty acres trades at $10K PPA, then my single break up pair of 25-acre little one parcels ought to commerce at $15K PPA minimal. Something much less and also you don’t have sufficient of a threat premium accounting for subdivision timeline and value, potential antagonistic choice, and DOM.

The extra little one parcels you’re bringing to market (significantly if they’re about the identical acreage), the upper the PPA appreciation ought to be.

The mechanics of the deal could make a key distinction right here. In case you are shopping for a dad or mum parcel outright, you want a better PPA appreciation. In case you are partnering with the vendor and your capital outlay is much less, a smaller margin could also be acceptable. That is a wholly completely different dialogue, nevertheless it’s value mentioning right here.

Step 4: Account for antagonistic choice

Are all of your little one parcels comparatively uniform in bodily traits, or will a number of parcels be considerably roughly fascinating than the others?

In case you are creating 3 parcels and one wants important grading to account for a nasty contour and can be impacted by wetlands, whereas the others are flat and clear, you can not common the pricing. The inferior parcels will drag down your blended return and doubtlessly lengthen your complete DOM dramatically. Mannequin every little one parcel individually with conservative assumptions on the weakest choices.

RELATED: Find out how to Determine (and Keep away from) Wetlands

Bear in mind, if you’re introducing a parcel that’s within the backside 25% from a attribute perspective throughout the whole lot that has been bought and is on market, then it is best to suppose twice before you purchase it.

Step 5: Know your true all-in prices and timeline

For the ultimate step, assuming you will have handed the above 4 hurdles, what’s the precise, complete price to subdivide? Embody submitting charges, surveys, engineering, authorized, and carrying prices throughout approval.

What’s the approval course of? Are there hearings? Planning fee critiques? Environmental assessments?

Most operators underestimate each price AND timeline or have achieved zero analysis into both. If doing horizontal growth work (e.g., clearing and driveways), add a minimal 25% price buffer to gentle quotes to be protected… and triple the quoted timeline.

Thorough subdivision price evaluation requires accounting for each gentle and onerous expense, plus the chance price of capital throughout prolonged approval intervals. The distinction between projected and precise bills usually determines whether or not your deal generates revenue or loss.

The Backside Line

As a rule, after rigorously making use of the above steps, the market will let you realize if you’re higher off making an attempt to promote the dad or mum parcel versus making an attempt a subdivide.

Even when the information signifies a subdivision is an efficient play, the market could shock you (because it so usually does), the place the one severe consumers need the whole acreage. So having optionality is right, the place you may at the very least break even promoting the dad or mum parcel acreage, web of all value-add and shutting prices.

Virtually no one who sends us subdivision offers has labored via even ONE of the above steps. I notice the steps above aren’t so simple as I meant. In the end, there may be a lot nuance in land that it’s onerous to boil issues right down to hard-and-fast guidelines. So it’s important to get the reps in to start out seeing issues as clearly as my workforce and I do.

Subdividing works… whenever you comply with the rules. In any other case, the market will beat you into the bottom. Powerful.

Whether or not you’re contemplating partnering with us or evaluating a subdivision by yourself, run via this guidelines first.

Should you can not reply every part confidently with knowledge, the subdivide in all probability is not going to work.

=====

Want funding for a properly-structured subdivision (or any land deal)? Work with probably the most data-driven land-funding workforce, with an industry-leading 41% working margin. $50K minimal buy worth, ~2x conservative gross margin. We shut 100% of offers we decide to.

Get Your Property Analyzed Immediately

Initially revealed at https://seriousland.capital on November 24, 2025.