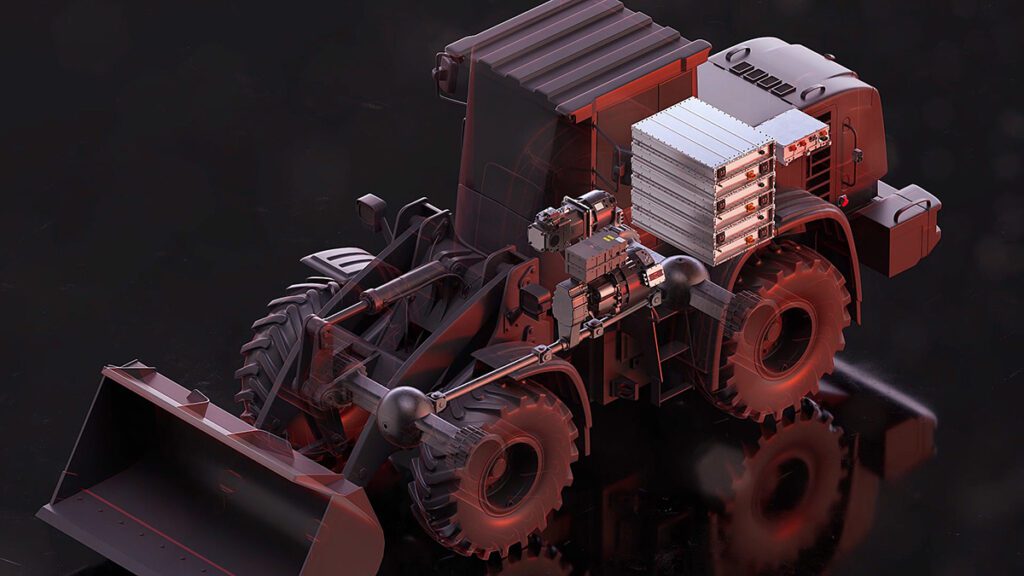

Electrification of off-highway autos isn’t new. What’s new is the mixture of battery economics, tighter city guidelines and a quickly evolving international provide chain—forces which are pushing OEMs to rethink machine structure, service technique and the realities of charging on a jobsite.

Danfoss Editron’s Eric Azeroual on off-highway electrification developments

Electrification is usually framed as the subsequent huge disruption for development, mining and agricultural tools. However within the off-highway area, “electrical” has been hiding in plain sight for many years. Have a look at ports and mines and you will see machines that already exploit electrical torque, effectivity and controllability, even when a diesel engine continues to be a part of the system. In warehouses, electrical forklifts and aerial work platforms have lengthy been mainstream.

So why does electrification really feel like a recent wave now?

Charged lately chatted with Eric Azeroual, Vice President at Danfoss Editron (the electrification arm of Danfoss Energy Options). He pointed to 2 accelerants: quickly enhancing battery economics and the rising stress of city-focused emissions requirements. As he described it, off-highway is “going by means of a really huge transformation,” transferring away from inside combustion engines and standard hydraulics towards electrical and electrified hydraulics.

The true inflection level: batteries received cheaper and cities received louder

Azeroual argues that off-highway didn’t out of the blue “uncover” electrification. Engineers and finish customers have lengthy understood the advantages of electrical machines: energy density, excessive torque at low pace, and the effectivity benefits that come from exact management.

The very first thing that has modified over the previous few years is the affordability of the vitality storage wanted to untether machines from the grid. Azeroual explains that the momentum of passenger-car electrification pushed battery value down from roughly $1,000 or $1,500 per kWh” to $100 or $150, making it possible to affect a a lot bigger slice of off-highway tools—particularly the “center market” between tiny low-power autos and enormous, grid-connected machines.

The second accelerant is regulation, particularly in cities. Emissions requirements for machines working in city areas are tightening, and OEMs are weighing whether or not to maintain investing in more and more complicated after-treatment techniques or to redirect that funding into electrical platforms and electrified work capabilities.

This mix is especially consequential as a result of development dominates demand. Azeroual pegs wheel loaders and excavators as roughly 50% of the off-highway market, and he sees them as “poised to affect faster” for a really sensible cause: their responsibility cycles usually align with electrification higher than outsiders assume. Many of those machines don’t journey lengthy distances, and so they function in outlined areas, with intermittent work and idle time. And since many function inside cities, regulation and noise turn into fast drivers. He supplied a vivid instance: an excavator working in the course of Paris could should be electrical to satisfy emissions necessities within the close to future.

A two-speed voltage world: 48 V at one finish, excessive voltage in all places else

One of many clearest indicators that off-highway electrification is maturing is that the talk is shifting from whether or not to affect to methods to electrify. For Azeroual, voltage is changing into the defining design fork.

The primary wave is already right here: compact wheel loaders and mini excavators constructed round low-voltage (sometimes 48 V) architectures. They’re “low danger,” comparatively simple to cost, and keep away from the protection and integration complexity that comes with excessive voltage.

However he doesn’t count on a clean ladder that features a important medium-voltage class. As a substitute, he predicts a quick soar: both sub-60 V techniques (the 48 V class) or high-voltage techniques for many platforms past that—“two poles,” as he described it.

Two engineering drivers sit behind that soar:

- Charging fee and uptime. Greater voltage permits increased energy switch, which reduces cost time and protects tools uptime, a vital financial variable in off-highway.

- Energy and effectivity. When energy necessities push past about 150-200 kW, increased voltage turns into a sensible strategy to scale back present and resistive losses, enhancing system effectivity and reducing thermal burden.

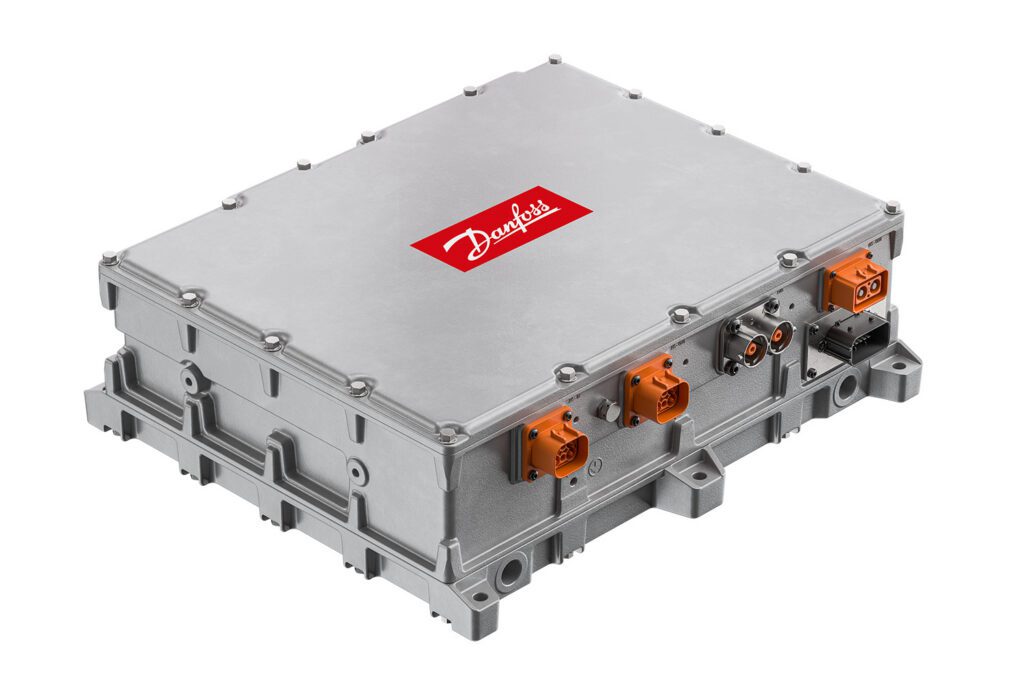

Danfoss Editron is creating low-voltage and high-voltage options as a result of these are the 2 segments through which OEMs are putting bets.

Azeroual additionally sees an necessary “bridge” between automotive and off-highway: heavy-duty vehicles and industrial autos. In his view, developments there are serving to shut the hole between passenger-car high-voltage ecosystems and off-highway necessities. Danfoss is selectively concerned in on-highway electrification, he stated, primarily when the know-how may be carried again into off-highway merchandise.

Why modularity is just not non-compulsory in off-highway

In passenger vehicles, product technique is constructed round standardization: a small set of interfaces, high-volume platforms and minimal variation. In off-highway, that assumption fails shortly. OEMs face huge variation in machine structure, packaging area, work capabilities and buyer expectations, and volumes are sometimes low sufficient {that a} “one-size-fits-all” method can turn into a deal breaker.

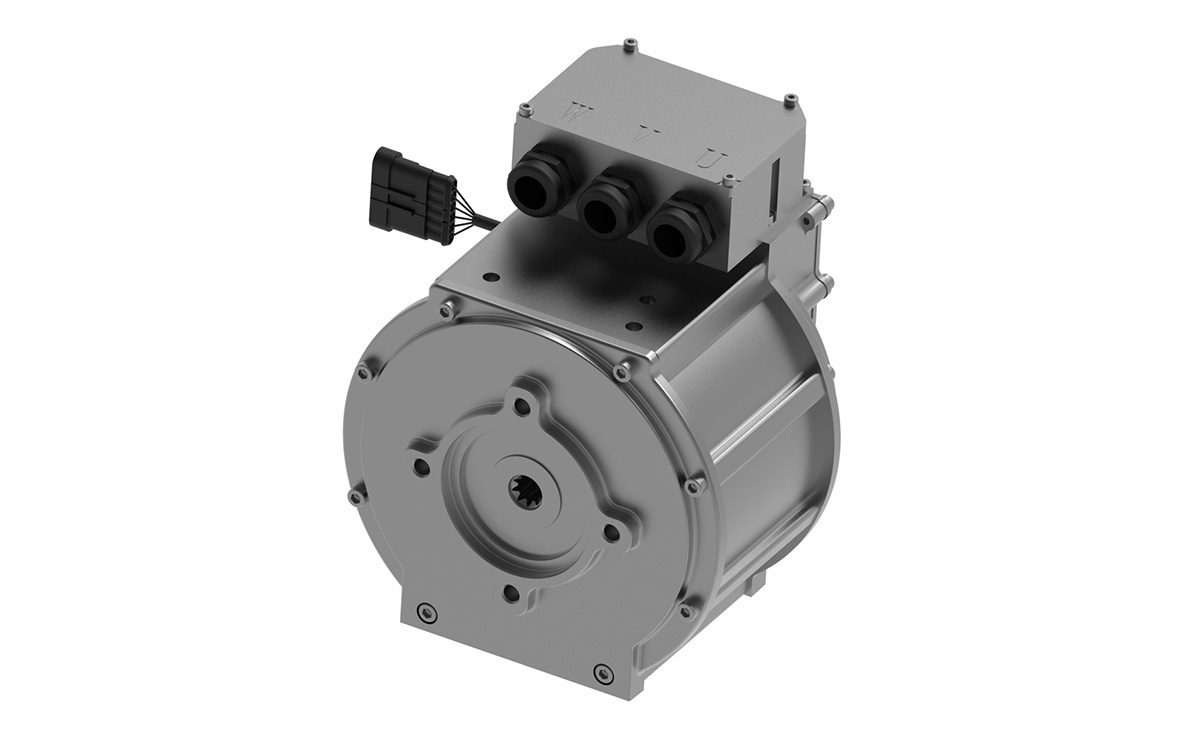

Azeroual presents drivetrain topology for example. An off-highway machine can simply require 5 motors and 5 totally different inverters, and every of these elements should mount, route and funky in a manner that matches a selected machine structure. Not like automotive, through which the interface may be standardized round a small set of packaging conventions, off-highway usually calls for totally different kind elements—“pancake” versus cylindrical—and totally different mounting realities.

Modularity is just not purely mechanical. Off-highway machines are more and more sensor-rich—OEMs are demanding extra inputs and outputs, extra diagnostics and extra freedom to calibrate software program to match distinctive work cycles. Azeroual describes modularity as the power to change interfaces—shaft, spline, connectors—in addition to the software program itself, in order that finish customers can calibrate conduct to a selected utility.

That is the place Danfoss leans on its controls background. Azeroual highlighted Danfoss’s lengthy historical past with the PLUS+1 software program structure—about 20 years—as a framework that enables prospects to “decide and select constructing blocks” for his or her car structure.

The trade-off, he acknowledged, is value. Including choices and configurability can enhance half value. However in off-highway, flexibility is incessantly the worth of entry, particularly when prospects order ten models reasonably than ten thousand. Azeroual instructed that suppliers constructed round high-volume standardization usually battle right here, and {that a} lack of flexibility may even be perceived as “conceited” in what’s, regardless of the tools measurement, “a small world” of commercial equipment.

He supplied a concrete benchmark for a way far this variation can go: a single motor household could exist in “350 totally different variants,” pushed by mechanical interfaces, connector choices and associated configuration wants.

The enterprise physics: ROI sensitivity and market cycles

Off-highway is an engineering market, however it’s also a market ruled by easy economics. Azeroual says that finish customers are “very delicate to ROI,” and notes the traditionally incremental tempo of machine innovation: if the machine does the job, patrons prioritize reliability and hours-of-operation enhancements over radical redesigns.

Electrification is totally different as a result of it forces a step change throughout the machine: structure, elements, controls and repair. That creates alternative, but in addition hesitation when enterprise situations tighten. He described the market as a “mild change.” When cash is tight, innovation slows—when demand rises, urge for food returns.

Azeroual additionally referred to as out a cultural distinction that may shock engineers coming from automotive: in off-highway, prototypes can find yourself being offered. He contrasted this with passenger vehicles and industrial autos, the place prototypes are constructed for validation and by no means attain prospects. In off-highway, a prototype electrical machine could also be bought shortly, as a result of machines are sometimes custom-built and patrons are looking forward to workable options.

That dynamic can create whiplash. Some OEMs constructed electrified machines and struggled to promote them instantly, resulting in a “we did it for nothing” sentiment, which Azeroual described as short-sighted. He contrasted these reactions with OEMs that deal with electrification as a part of an extended technique—leveraging learnings from different mobility markets akin to marine and on-highway vehicles.

China’s gravitational pull on the electrification provide chain

Azeroual didn’t sugarcoat the position of China in electrification. He conceded that China dominates the electrification provide chain—batteries, motors, inverters—and instructed that international OEMs and suppliers should think about what meaning for value and iteration pace.

China’s strategic focus on the Bauma China commerce present in 2024, which was closely centered on electrification. Chinese language OEMs weren’t merely displaying ideas—hey had machines accessible for buy and deployment.

From an engineering standpoint, the extra uncomfortable level is value and iteration. Azeroual instructed that Chinese language suppliers are additional alongside in improvement cycles—he describes China as being within the midst of a “seventh evolution” of motor and inverter improvement, in contrast with “era three” elsewhere.

Azeroual’s interpretation is that Chinese language producers have iterated aggressively sufficient to know the “naked minimal” required to serve actual functions, reasonably than over-designing for edge circumstances.

A hidden differentiator: distribution, service and native engineering leverage

In off-highway, shopping for a element is inseparable from shopping for uptime. Machines function in harsh environments, below schedule stress, and downtime can erase any value financial savings shortly.

Azeroual framed Danfoss’s giant distribution community as a strategic benefit that enhances modular design. Distributors should not solely gross sales channels—they will additionally act as native integrators and resolution builders. He described seeing a distributor share an built-in resolution constructed from Danfoss elements—motor, pump and controls—and supply it on to prospects.

He additionally warned in regards to the limits of low-price entrants who lack service infrastructure. A element could also be cheap, however when the half breaks, the query turns into who can service it and the way shortly the machine can return to work—off-highway’s definition of actual worth.

Proper-sizing as value technique: what marine and continuous-duty markets educate

Azeroual supplied an engineer’s reply to the fee downside: be taught from harsh responsibility cycles the place the physics are unforgiving.

He defined how Danfoss’s expertise in marine and oil-and-gas functions—markets through which motors can run repeatedly close to their limits—supplies information that informs product design for off-highway. In traction, peak energy could also be transient. In marine, “the height energy is the continual energy,” and the system runs “repeatedly on the edge.”

That stress testing can reveal that many merchandise are over-designed for off-highway functions.

For engineers, it is a crucial theme: electrification is not only about making an electrical machine work. It’s about making it work on the proper value, with the appropriate lifespan assumptions, and with supplies and efficiency aligned to precise responsibility cycles.

The bridge know-how: electrifying hydraulics earlier than electrifying all the things

Azeroual repeatedly returned to a practical adoption path. Off-highway is conservative. If one thing is “too new,” it will probably stall. He instructed that this conservatism is a part of why totally electrical machines haven’t but taken off broadly.

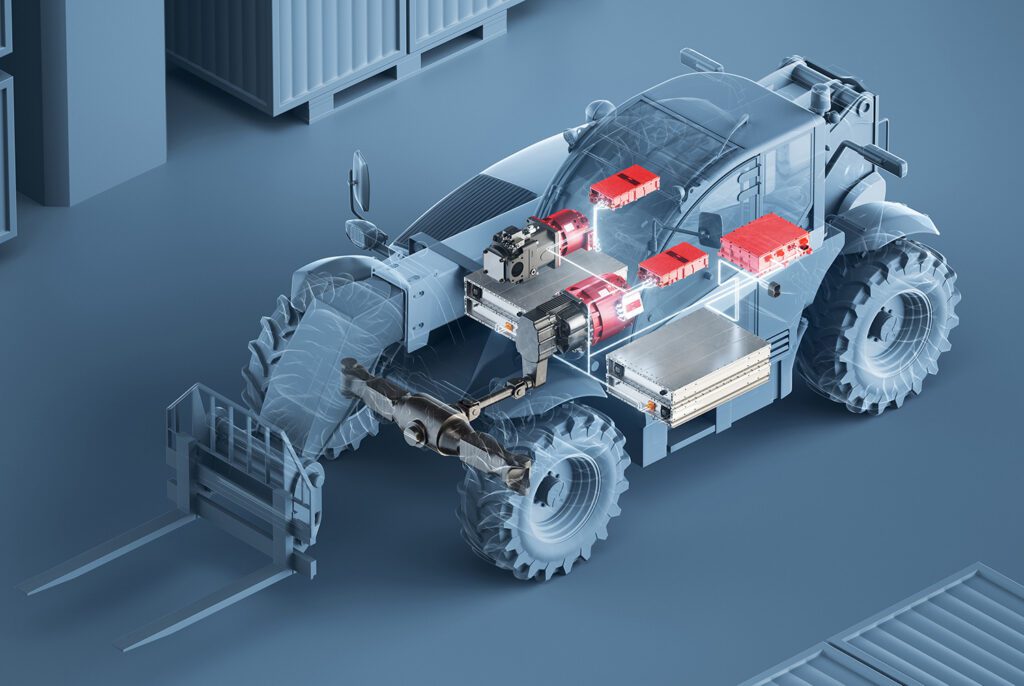

Danfoss’s near-term emphasis is electrifying hydraulics and enhancing hydraulic effectivity—primarily utilizing electrical management to cut back wasted vitality and to make work capabilities extra responsive. The underlying thought is to cease losing vitality “turning a pump,” and to manage stress and circulate in order that the system operates as effectively as potential.

He additionally instructed that electrification permits new element design decisions, akin to high-speed pumps higher matched to electrical motors—on the order of 8,000 to 10,000 RPM—together with the potential for decrease noise as soon as the combustion engine is faraway from the loop.

Azeroual highlighted one Danfoss instance as a “better of the very best” mixture: pairing a digital displacement pump (DDP) with an electrical motor. Digital displacement can modulate pump output to match demand, and electrical motors enable pace to be adjusted dynamically, increasing the working envelope and enhancing effectivity. He referred to as the mixture “a game-changer.”

Then got here a forecast that can spark debate: Danfoss anticipates pure battery-electric machines to stay “lower than 5% by 2030,” whereas electrified, environment friendly hydraulics might rise into the 20-30% vary.

Whether or not or not these precise percentages show appropriate, the directional message is obvious: for a lot of machine courses, electrifying the work capabilities could ship ROI prior to full battery-electric conversion—and that may be a bridge to deeper electrification later.

Seeing is believing: demos, utility facilities and operator acceptance

Technical arguments alone hardly ever shift off-highway shopping for conduct. Operators, fleet homeowners and rental corporations want proof of efficiency below actual situations.

Azeroual described Danfoss’s Software Growth Facilities (ADCs) as a strategy to generate that proof. Danfoss takes in buyer autos (or selects platforms with excessive innovation potential), implements new architectures after which invitations prospects to check them. He cited ADCs in Ames, Iowa; Haiyan, China; and Nordborg, Denmark; the place Danfoss can quickly prototype and reveal options.

Demonstrations matter as a result of they reveal advantages that spec sheets hardly ever seize. One instance is jobsite communication: electrified machines may be quiet sufficient for a spotter to speak to an operator whereas the machine is digging, probably enhancing precision and teamwork. Azeroual agreed that these “different issues that we didn’t count on” can shift perceptions shortly.However he additionally emphasised the counterweight: electrified machines are nonetheless dearer. Adoption relies on fixing charging and uptime in a manner that matches the methods through which tools is definitely deployed.

Charging is a bottleneck—and it gained’t appear like freeway quick charging

Charging is the place off-highway diverges most sharply from passenger vehicles. At the same time as on-highway electrification is constructing an in depth DC quick charging community, off-highway tools usually can not use it. “You’re not going to deliver an excavator on the aspect of the freeway” to cost, Azeroual stated.

As a substitute, the query is what energy exists on a jobsite—and the way a machine can use it with out slowing the work.

Azeroual pointed to a sensible Danfoss product improvement: an onboard AC charging resolution, the ED3 (Editron three-in-one). His framing is pragmatic: most development websites have already got entry to AC energy, whereas DC energy is “very uncommon” on-site and solely potential by means of new giant energy banks. By enabling significant AC charging—he cited 44 kW for example—machines can recharge in a single day or throughout breaks with out requiring a devoted DC infrastructure build-out.

He additionally instructed that equipment-rental economics might turn into a key enabler. As a result of machines are sometimes rented, a rental firm might match battery measurement and charging technique to the job: the identical platform with a bigger battery for a distant web site, or a smaller-battery model when in a single day charging is accessible. That form of modularity, he argued, might assist “break the boundaries of entry.”

What this implies for engineers designing the subsequent era of machines

Azeroual’s perspective makes one factor clear: off-highway electrification is just not a single know-how development. It’s a techniques transition formed by economics, coverage and a quickly evolving international ecosystem.

For engineers, a number of sensible implications stand out:

- Structure selections are converging. Anticipate a break up between low-voltage compact machines and high-voltage mainstream platforms, pushed by charging energy, effectivity and the 150-200 kW-plus actuality of many work cycles.

- Modularity is an engineering requirement. Mechanical interfaces, packaging, I/O and software program calibration flexibility should not “good to have” in off-highway; they’re central to profitable packages throughout various machines and low-to-medium volumes.

- E-hydraulics is more likely to be a significant near-term lever. Electrifying and optimizing hydraulic work capabilities can ship effectivity, noise and controllability positive factors with out requiring each machine to turn into totally battery-electric in a single day.

- Charging should match the jobsite. Onboard AC charging, right-sized batteries and fleet/rental planning could matter greater than replicating the passenger-car DC quick charging playbook.

Off-highway is not going to electrify evenly. Some segments—compact city machines and responsibility cycles with predictable charging—will transfer shortly. Others—long-duration area work, distant jobsites and exceptionally harsh responsibility cycles—will take longer. However the path is more and more clear: electrification, in a single kind or one other, is changing into a normal design constraint, not a aspect mission.