The Federal Housing Administration has socked away report ranges of money in its mortgage insurance coverage fund and will climate a housing crash with out a taxpayer bailout, the company mentioned in its Dec. 31 annual report to Congress.

However with delinquencies on FHA loans on the rise and extra homebuyers taking over budget-busting month-to-month mortgage funds, the Trump administration is eyeing tighter underwriting necessities for debtors with a number of danger elements.

The FHA has additionally streamlined the method for initiating foreclosures proceedings on householders who repeatedly fall behind on their funds.

The FHA Mutual Mortgage Insurance coverage (MMI) fund, which protects mortgage lenders when debtors default, grew by 9 % through the fiscal yr ending Sept. 30, to $189 billion, HUD reported.

However FHA’s “ongoing assist for American homebuyers requires sturdy oversight of the MMI Fund to guard taxpayers from pointless danger,” Housing Secretary Scott Turner mentioned in a foreword to the Dec. 31 report.

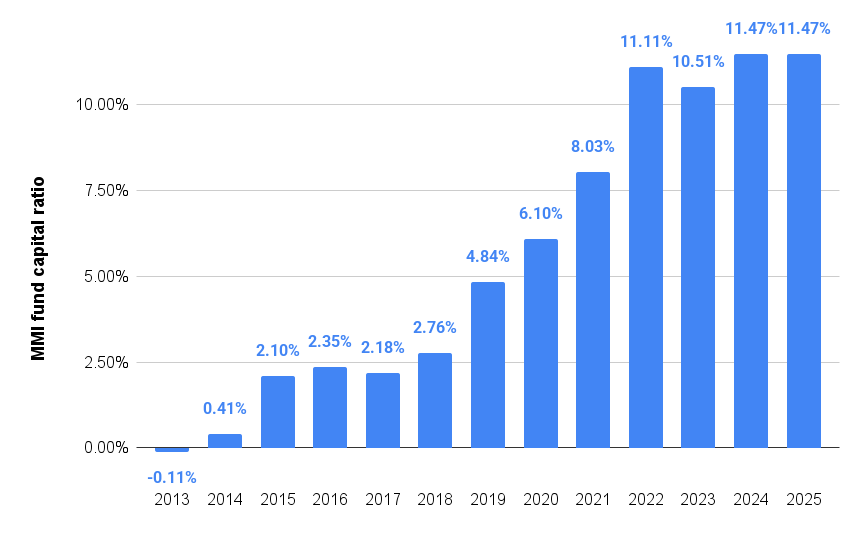

Insurance coverage fund capital ratio ties report excessive

Supply: FHA 2025 annual report to Congress.

The MMI fund’s capital ratio dropped beneath its 2 % statutory minimal from 2009 by 2014 following the subprime housing crash, requiring a $1.69 billion taxpayer bailout.

FHA premium hikes and enhancing housing market situations have since helped replenish the fund, which has sustained a report excessive 11.45 % capital ratio for 2 years in a row — greater than 5 occasions the statutory minimal.

The Mortgage Bankers Affiliation maintains that the FHA’s “sturdy capital reserves” may justify offering homebuyers some reduction by chopping FHA premiums, because the Biden administration did in 2023.

“Any such modifications ought to be calibrated responsibly and knowledgeable by a cautious analysis of this system and the financial elements behind the rising severe delinquency charge to make sure this system stays protected, sound, and sustainable,” MBA President Bob Broeksmit mentioned in a assertion.

The FHA’s stress exams present that if one other downturn of the magnitude of the Nice Recession got here alongside once more, the insurance coverage fund’s capital ratio would drop to 4.42 % — nonetheless greater than twice the minimal set by Congress.

However non-public mortgage insurers who compete with the FHA say that if the company’s insurance coverage fund needed to meet the identical requirements they’re topic to, it will be thought-about undercapitalized by $32 billion.

“FHA should stay well-capitalized in an effort to carry out its essential countercyclical operate in America’s housing market and allow entry to mortgage credit score for individuals who might not in any other case be capable to safe financing by the standard and portfolio mortgage markets which can be backed by non-public capital,” U.S. Mortgage Insurers, an affiliation representing non-public mortgage insurers, mentioned in a assertion.

Non-public mortgage insurers compete with FHA and VA mortgage applications to serve homebuyers who can’t make an enormous down fee. Fannie Mae and Freddie Mac require non-public mortgage insurance coverage when homebuyers put lower than 20 % down.

FHA premium cuts in 2015 and 2023 made FHA loans extra enticing than conforming mortgages with non-public mortgage insurance coverage for a lot of debtors placing down lower than 5 %, in response to an evaluation by the City Institute.

However debtors with FICO scores at or above 700 can typically get a greater deal by taking out a conforming mortgage backed by Fannie or Freddie with non-public mortgage insurance coverage, the evaluation discovered.

Within the fiscal yr ending Sept. 30, the FHA backed 876,502 mortgages totaling $275 billion, bringing the full variety of mortgages insured to greater than 8.1 million with $1.6 trillion in unpaid principal stability.

A 3.26 % improve in 2026 FHA mortgage limits permits FHA-approved lenders to finance single-family house purchases of as much as $541,287 in low-cost markets and as a lot as $1.249 million in high-cost markets like New York, San Francisco and Washington, D.C.

However delinquency charges on FHA loans are on the rise, with debtors greater than 5 occasions as more likely to be behind on their funds than these counting on typical loans backed by Fannie Mae and Freddie Mac (the government-sponsored entities, or “GSEs”).

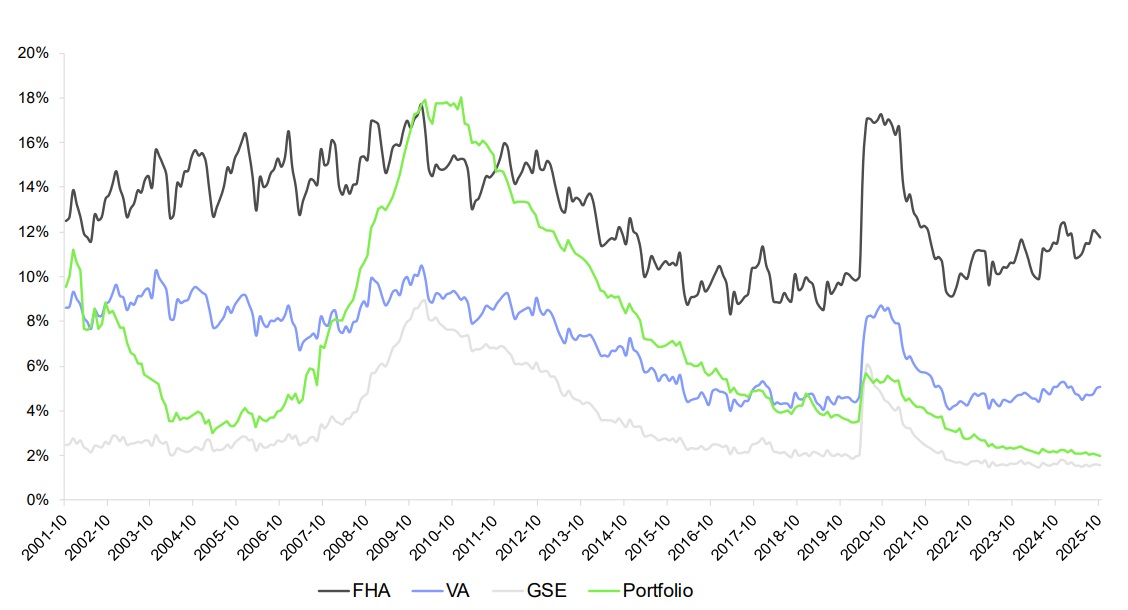

FHA delinquencies on the rise

Mortgage delinquency charges by mortgage kind. Supply: ICE Mortgage Monitor, December 2025.

Practically 12 % of FHA debtors have been behind on their funds in October, in contrast with the three.34 % common for all mortgage holders and fewer than 2 % for loans backed by Fannie and Freddie, in response to information tracked by ICE Mortgage Expertise.

As a result of they begin out with much less fairness of their properties, ICE information reveals FHA patrons are additionally extra more likely to find yourself underwater or in foreclosures when house costs fall.

Tightened eligibility for mortgage mods

To scale back its publicity to future claims, the FHA in April introduced that it was tightening eligibility necessities for applications which can be designed to assist struggling debtors.

The new guidelines, which took impact on Oct. 1, require severely delinquent debtors to efficiently full a trial fee plan earlier than being granted extra beneficiant “everlasting” options like a mortgage modification.

Debtors who’ve been granted a “everlasting house retention choice” within the final two years are not eligible to obtain one other one, up from the earlier restrict of 18 months.

In its annual report, the FHA mentioned it needs to keep away from “the cycle of churning redefaults and interventions” that improve losses.

“Whereas early COVID-19 loss mitigation interventions have been comparatively profitable, FHA is at present approaching a 60 % redefault charge, which is unsustainable and a detriment to the MMI Fund,” the company reported.

Earlier than the pandemic, solely 2 % of FHA debtors had been granted two or extra house retention choices up to now 5 years. By September 2025, that determine had risen to 40 %.

Going ahead, debtors who redefault inside 24 months of receiving a loss mitigation house retention choice “will now be ineligible for added house retention choices and can proceed extra rapidly by loss mitigation, disposition, or foreclosures if needed,” the report mentioned. “These loans are anticipated to succeed in termination sooner. In consequence, FHA forecasts a short-term improve in default and declare charges.”

In the long term, nonetheless, FHA mentioned it expects to save lots of $1 billion by resolving “serial redefault circumstances.”

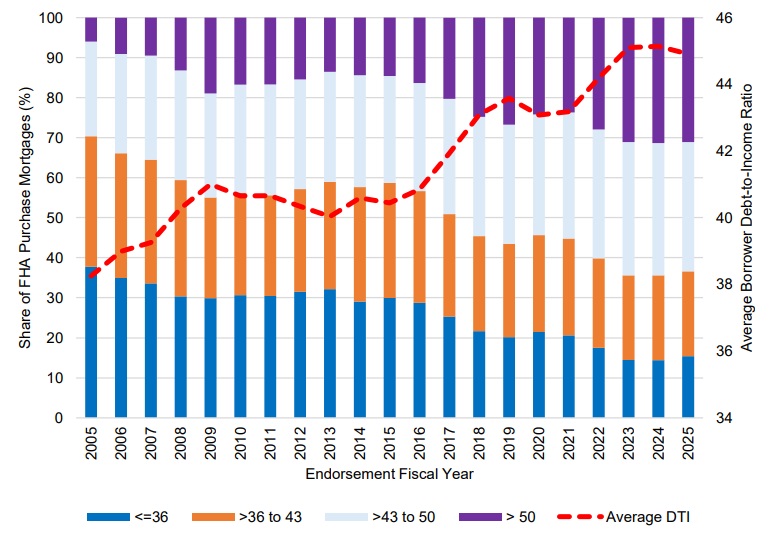

Casting a cautious eye on ‘danger layered loans’

Along with “restoring frequent sense safeguards for loss mitigation,” the FHA says it’s “working to treatment an rising development in danger layered loans” made to debtors with a number of danger elements — low credit score scores and excessive loan-to-value (LTV) and debt-to-income (DTI) ratios.

Such “danger layered loans” expertise early fee defaults at almost 3 times the speed of different loans, and a loss charge that’s 2.5 occasions increased, the company discovered.

Common credit score scores on FHA loans have been rising over the previous 4 years, hitting a 10-year excessive of 679 final yr. Mortgage-to-value ratios on buy loans have averaged between 95 % and 96 % for greater than a decade.

However due to rising house costs and mortgage charges, FHA borrower debt-to-income ratios have climbed from lower than 40 % through the 2005-2006 housing bubble to over 45 % over the past three years.

Rising borrower debt-to-income ratios

The FHA says the proportion of loans with all three danger layers is now over 3 times bigger than 12 years in the past, rising from 2.6 % in 2013 to eight.4 % in 2025.

Loans with all three danger layers “have an elevated value to the MMI Fund and subsequently warrant further scrutiny and monitoring,” the report mentioned.

Get Inman’s Mortgage Temporary E-newsletter delivered proper to your inbox. A weekly roundup of all the largest information on the planet of mortgages and closings delivered each Wednesday. Click on right here to subscribe.

E-mail Matt Carter