For many years, India’s function within the world spirits dialog was outlined by quantity somewhat than worth; an industrial powerhouse producing for mass consumption, not often invited to the highest desk of luxurious drinks. That narrative is now being dismantled.

Immediately, India is rising not simply as one of many fastest-growing spirits market, however as one in all its most fun new premium origins. Throughout the nation, internationally awarded whiskies, terroir-led rums and ultra-premium vodkas are competing on high quality, provenance and status.

Main this shift is a brand new technology of producers who’ve stopped asking whether or not Indian spirits belong on the world stage and have began constructing manufacturers that assume they do.

On the forefront is Piccadilly Agro Industries, a enterprise reworking India from a supply of bulk alcohol right into a producer of worldwide credible luxurious liquids.

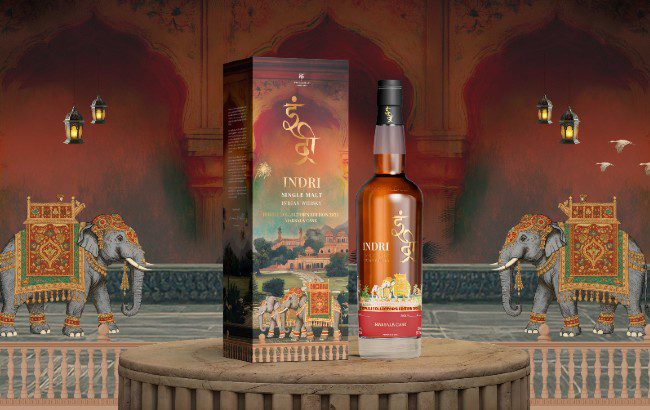

Piccadilly represents one thing uncommon: an innovation-led Indian producer, crafting premium spirits with world luxurious requirements. Its portfolio contains award-winning single malt Indri, of which the Founder’s Reserve 11 Years Previous and the Diwali Collector’s Version 2025 – Marsala Cask lately took Gold at The Luxurious Spirits Masters 2025 blind tasting.

Moreover, Picadilly produces pure cane juice, aged rum Camikara and the lately launched Indian natural craft vodka Cashmir.

Why India is unimaginable to disregard

India is not an ’rising’ market in idea. With actual GDP progress forecast to exceed 7% within the subsequent 12 months, in response to pib.gov information, the nation is producing hundreds of thousands of recent prosperous customers yearly. And so they’re not shopping for entry-level bottles: they’re buying and selling up.

Within the first half of 2025 alone, India’s beverage alcohol market grew by greater than 7%, Occasions of India reported, reaching greater than 440 million nine-litre instances and making it the fastest-growing main drinks market globally. Inside that, whisky stays dominant, with volumes exceeding 130m nine-litre instances in the identical interval – up by one other 7% 12 months on 12 months. Extra importantly, the premium-and-above segments are rising sooner than the remainder of the market, rising by round 8% in each quantity and worth, The Financial Occasions reported.

Premiumisation in India is not a development; it’s a structural shift. A youthful, prosperous, globally-aware client base is demanding high quality, provenance and authenticity – mirroring the event of markets like Japan, Taiwan and Eire as they reinvented their very own spirits credentials.

Piccadilly’s evolution: India’s rising luxurious spirits home

Piccadilly’s origins lie in large-scale manufacturing. Primarily based in Indri, Haryana, the corporate constructed formidable infrastructure throughout ethanol, grain processing, sugar, distillation and bottling. However somewhat than treating scale as a ceiling, Piccadilly turned it right into a launchpad.

As India’s home market matured, the corporate made a strategic pivot from provider to model creator. What adopted was an export-ready portfolio with objective, designed for worldwide credibility. Indri Single Malt turned India’s most talked-about whisky model virtually in a single day, whist Camikara rejected molasses totally and as an alternative crafted rum from contemporary cane juice (a course of extra related to agricole distilleries within the Caribbean). Then earlier this 12 months got here Cashmir Vodka – one of the globally bold Indian spirits launches to this point.

Cashmir isn’t chasing vodka’s lowest widespread denominator. It’s distilled from 2,000-year-old rediscovered, natural heritage wheat (Sona Moti), refined via a number of purification phases and blended with glacial water, then bottled with out components. It’s a illustration of the terroir that may be discovered on the Himalayan foothills, and brings a brand new luxurious take to the vodka class.

Indian Spirits Overseas: From Curiosity to Class

India’s popularity is shifting past its borders too. In 2024, exports of Indian alcoholic drinks reached US$375 million, up from US$325m in 2022, that’s a progress charge of over 15% in simply two years. Single malts, gins and area of interest spirits at the moment are touchdown in specialist retailers, premium bars and world competitions – and never as novelties.

Indian whisky particularly is now recognised by worldwide judges, collectors and consumers. What was as soon as “surprising” is more and more profitable medals, gaining listings and driving consideration at commerce festivals.

Piccadilly’s portfolio is constructed for that second. Its infrastructure can help scale; its manufacturers are designed for tradition. It’s a uncommon mixture and one which world distributors more and more worth as whisky demand grows and conventional areas pressure below stock shortages.

Piccadilly’s rise isn’t taking place in isolation. It mirrors a broader repositioning of India itself.

Simply as Japan rewrote whisky’s hierarchy and Taiwan shocked the trade with Kavalan, India is now getting into the spirits discourse not as the most cost effective possibility, however as probably the most fascinating new one. India is indisputably revamping its identification as a producer of high-quality spirits, worthy of world acclaim.

Piccadilly’s success has created a ripple impact far past the corporate itself, reshaping how India is assessed inside the world drinks panorama.

From Indri to Camikara and Cashir, luxurious drinks have discovered their subsequent frontier — and it isn’t wanting west.

Associated information

Which whisky is the most well-liked in India’s bars?

Paul John: ‘very encouraging 12 months’ for Indian single malts

India Bartender Present publicizes 2026 sequel