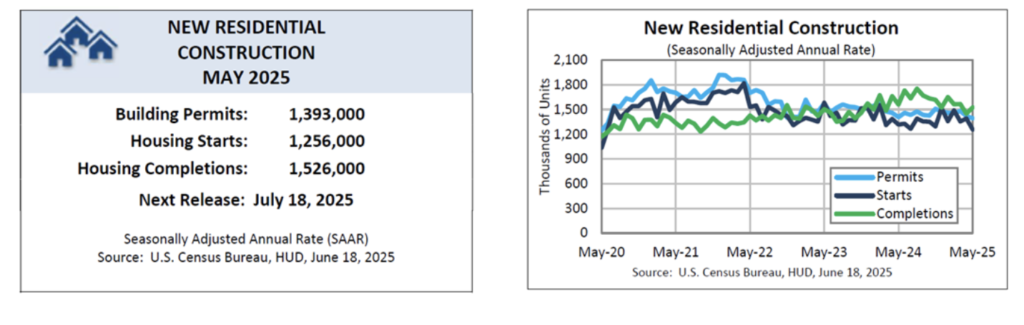

New residential building made progress in completions however largely fell brief on begins and permits, in line with new knowledge launched Wednesday by the US Census Bureau and HUD.

Larger. Higher. Bolder. Inman Join is heading to San Diego. Be part of hundreds of actual property execs, join with the Inman Neighborhood and acquire insights from a whole bunch of main minds shaping the business. When you’re able to develop your small business and put money into your self, that is the place it’s essential be. Go BIG in San Diego!

New residential building confirmed blended alerts in Might, providing glimmers of progress in completions however largely falling brief on begins and permits.

In accordance with new knowledge launched Wednesday by the U.S. Census Bureau and the Division of Housing and City Improvement (HUD), the broader image reveals stagnation quite than restoration.

Privately owned housing begins dropped 9.8 % from April to a seasonally adjusted price of 1,256,000. That determine can also be 4.6 % under the Might 2024 price of 1,316,000, marking the weakest tempo since 2020.

Odeta Kushi | First American Deputy Chief Economist

“Housing begins plummeted 10 % in Might to their lowest degree since 2020, falling in need of consensus expectations,” First American Deputy Chief Economist Odeta Kushi mentioned in an announcement. “The month-over-month pull again was primarily as a result of a decline within the risky multi-family groundbreaking, whereas a decline in single-family constructing permits factors to a weaker development shifting ahead.”

Single-family begins edged up simply 0.4 % to 924,000 models, whereas multifamily building took a deeper hit, falling to 316,000 models — down from 371,000 in April.

In accordance with Kushi, the information comes amid rising pessimism amongst homebuilders, as is mirrored within the newest Nationwide Affiliation of Residence Builders (NAHB) Housing Market Index (HMI).

“The steep drop will not be totally stunning contemplating that builder sentiment in June reached one among its lowest ranges in 13 years, the one exceptions being April 2020 and December 2022,” Kushi defined. “This rising builder pessimism was widespread throughout all HMI elements. Optimism about single-family gross sales for the subsequent six months dropped by two factors, and present gross sales circumstances additionally fell by two factors, marking the bottom degree since June 2012. Potential purchaser visitors decreased from 23 to 21.”

Supply: U.S. Census Bureau and the Division of Housing and City Improvement (HUD)

Whereas completions offered a modest vibrant spot, growing 5.4 % from April to a price of 1,526,000, they had been nonetheless 2.2 % under ranges from the earlier 12 months. Single-family completions rose to 1,027,000, an 8.1 % acquire month over month, however multifamily completions dipped once more, reaching 487,000 models in Might from 503,000 models in April.

On the forward-looking aspect, constructing permits — an indicator of future building — painted a dimmer image. Privately-owned permits fell 2 % from April to a price of 1,393,000. This determine can also be down 1 % from Might 2024. Single-family permits dropped 2.7 %, whereas multifamily permits had been comparatively flat at 444,000.

In accordance with Kushi, this knowledge stands in stark distinction to what was seen in new-home gross sales early this spring.

“The weak building knowledge contrasts sharply with sturdy new-home gross sales in April, which made up the best share of complete gross sales since 2005,” Kushi famous.”

“Contemplate that new-home gross sales would possibly provide a greater deal for patrons than present properties. Traditionally, new properties are priced at a premium relative to present properties, however that hole has flipped. In April, the median worth of a brand new residence ($407,200) was really decrease than the median worth of an present residence ($414,000), partly as a result of worth cuts and builders setting up smaller, inexpensive properties,” she added.

These worth changes are additionally exhibiting up in builder technique.

“The most recent HMI survey knowledge bears this out, revealing that 37 % of builders reported chopping costs in June, the best share since NAHB started monitoring this determine month-to-month in 2022,” Kushi mentioned. “Moreover, the usage of gross sales incentives elevated to 62 % in June, up one share level from Might.”

Nonetheless, a combos of challenges proceed to carry again building exercise, particularly within the single-family sector.

“Builders face larger financing prices, tariff uncertainty, softer demand from elevated charges, elevated competitors from rising existing-home stock in key markets like Texas and Florida, and better inventories of their very own,” Kushi mentioned. “This combine is weighing on builder sentiment and more likely to gradual single-family building.”

E-mail Richelle Hammiel