This version of Fashionable Restaurant Administration (MRM) journal’s Analysis Roundup options the current and way forward for AI use in F&B, The Splintered Path to Buy, the Datassential 500 Awards, and the place cooks are incomes six figures.

A Dilemma of “Tremendous Dimension” Proportions

Amid rising meals costs and shifting shopper preferences, the restaurant business is going through a dilemma of “tremendous dimension” proportions.

Fast-service eating places keep a gentle buyer satisfaction rating of 79 (on a 100 level scale), whereas full-service eating places — regardless of slipping 2 p.c to 82 — stay one of many highest-rated industries within the Index, in response to the American Buyer Satisfaction Index (ACSI®) Restaurant and Meals Supply Research 2025. On the similar time, U.S. chain gross sales grew simply 3.1 p.c in 2024 — falling in need of the 4.1 p.c menu-price inflation price.

Eating places should now navigate a razor-thin margin between sustaining buyer loyalty and managing escalating prices. With households more and more treating eating out as a luxurious, each menu merchandise and repair interplay turns into a possible make-or-break second.

“Eating places cannot merely depend on their conventional playbooks anymore,” says Forrest Morgeson, Affiliate Professor of Advertising at Michigan State College and Director of Analysis Emeritus on the ACSI. “Smaller, in style manufacturers like Elevating Cane’s and Wingstop are proving that artistic advertising and marketing, digital engagement, and specializing in core strengths can problem even essentially the most established chains. The manufacturers that succeed would be the ones that adapt shortly to shifting tastes with out compromising consistency or expertise.”

Amongst sit-down venues, steaks nonetheless reign supreme.

Final yr’s co-leaders Texas Roadhouse (down 1 p.c) and LongHorn Steakhouse (down 2 p.c) finishfirst and second with ACSI scores of 84 and 83, respectively. Olive Backyard slides 2 p.c to 81.

Applebee’s inches nearer to the leaders, up 1 p.c to 80. Though the chain faces the identical visitors challenges as a lot of the business, prospects appear to recognize its “On a regular basis” worth platform. Crimson Robin climbs 3 p.c to 78 thanks largely to its deal with menu and meals.

In the meantime, Chili’s, which noticed common unit volumes enhance 16 p.c in 2024, experiences a 3 p.c satisfaction drop to 78. This decrease satisfaction was largely pushed by its carry-out efficiency throughout spring 2024, when it started focusing on McDonald’s with merchandise and messaging.

On the backside finish of the business, Buffalo Wild Wings sinks 4 p.c to 76, and Denny’s slips 1 p.c to 75.

Prospects can change into extra crucial of the standard of services when costs enhance. That is the case with the full-service restaurant buyer expertise, as buyer expertise benchmarks decline throughout the board. Nonetheless, the meals and repair metrics are fairly excessive. Accuracy of meals order leads the best way at 88, whereas beverage high quality and waitstaff efficiency each rating 86. The bottom rankings are associated to the digital expertise, which additionally reveals essentially the most deterioration. Web site satisfaction tumbles 6 p.c to 82, cell app high quality slides 6 p.c to 80, and cell app reliability plunges 8 p.c to 78.

Moreover, buyer satisfaction with full-service eating places varies considerably relying on the kind of buy expertise (dine in, perform, or supply). Prospects who dine in are by far essentially the most glad (regardless of the rating slipping 1 p.c to 83). Nevertheless, satisfaction falls 5 p.c to 79 for carry-out service and plummets 9 p.c to 74 for supply.

Chick-fil-A leads the business for the eleventh yr in a row with a gentle ACSI rating of 83. Nevertheless, the chain experiences its slowest progress in 20 years after U.S. gross sales solely develop 5.4 p.c in 2024, offering openings for in style manufacturers like Elevating Cane’s and Wingstop.

Amongst different rooster chains, KFC stumbles 5 p.c to 77 because it faces rivals who’re adapting to shifting preferences extra shortly. Popeyes (up 4 p.c to 75) appears to construct on positive factors by rolling out its “Straightforward to Run” initiative to standardize processes, enhance order accuracy, and cut back wait instances.

Different notable rating modifications embrace Panda Categorical (up 4 p.c to 80), which jumps right into a second-place tie with Starbucks (unchanged). The chain’s documented emphasis on coaching reveals in its robust efficiency on service high quality and worth. Little Caesars, up 3 p.c to 77, improves rankings for meals and repair high quality since introducing Loopy Puffs and continues its robust efficiency for worth.

5 Guys and Sonic each falter 4 p.c to scores of 75 and 73, respectively. Final-place McDonald’s dips 1 p.c to an ACSI rating of 70. The chain’s new efforts to hurry up R&D to drive quicker know-how and menu modifications could reverse this development.

The client expertise for quick-service eating places is just like final yr. Each facet receives a rating of 81 or greater. Accuracy of meals order and high quality of cell app paved the way at 85, each down 1 p.c yr over yr. Cellular app reliability is 1 p.c decrease at 84, matching beverage high quality, workers courtesy and helpfulness, meals high quality, and web site satisfaction (the one metric to extend in 2025).

Chick-fil-A leads within the South and West, rivals Culver’s within the Midwest, whereas Starbucks has the products brewing within the Northeast

A lot of the reported quick-service restaurant manufacturers fall into considered one of 4 classes: burgers, rooster, pizza, and occasional/bakery-cafe.

Culver’s (78) leads burger chains (the most important class), adopted intently by Burger King (77). Chick-fil-A (83) leads the rooster class by a large margin. Papa Johns and Pizza Hut (each 79) share the pizza chain lead, simply forward of Domino’s (78). Starbucks (80) outperforms Panera Bread (79) and Dunkin’ (78) within the espresso/bakery-cafe chain class.

ACSI can be reporting its first-ever geographic outcomes by area. Chick-fil-A and Starbucks present broad enchantment throughout regional markets. Chick-fil-A leads outright within the South (84) and West (82). The chain faces stiff competitors within the Midwest, nonetheless, tying Culver’s for the highest spot at 82 apiece. Starbucks is a top-two performer in three of the 4 areas: first within the Northeast at 80, second within the South (tied with Pizza Hut at 82), and second within the West (81).

Regardless of bettering one p.c to an ACSI rating of 74, the meals supply business nonetheless lags properly behind full-service eating places and quick-service eating places.

Buyer satisfaction with the group of smaller meals supply providers drops 3 p.c to 77 but nonetheless outclasses the bigger manufacturers: Uber Eats (up 1 p.c to 75), DoorDash (unchanged at 73), and Grubhub (up 3 p.c to 73).

Satisfaction varies primarily based on the shopper’s cause for utilizing the service. These on the lookout for comfort (for instance, work schedule, spending time with household, or group occasions) are extra glad than these ordering resulting from want (e.g., well being, not having a car, lack of time, or not eager to drive). Prospects utilizing the service for household time or group occasions typically understand greater worth. Players report the bottom degree of satisfaction and higher frustration with the ordering course of.

Though costs are nonetheless the lowest-scoring a part of the meals supply expertise, scores have improved considerably, with equity of meals costs and equity of taxes and repair charges each up 3 p.c to 71. Cellular app and web site satisfaction enhance 1 p.c every to 83 and 82, respectively. But, whereas prospects could discover the benefit of ordering (80) to be acceptable, decrease scores for meals temperature (up 1 p.c to 74) and order accuracy and accuracy of quoted supply instances (each unchanged at 75) stay problematic.

The ACSI Restaurant and Meals Supply Research 2025 relies on 16,381 accomplished surveys. Prospects had been chosen at random and contacted through e mail between April 2024 and March 2025.

Restaurant AI Investments Warmth Up, However Adoption Nonetheless Seems to be on the Again Burner

Deloitte examines AI adoption In its new report, “How AI is Revolutionizing Eating places.” The survey signifies eating places leverage AI know-how to reinforce buyer experiences and enhance operations from the eating room to the kitchen and drive-thru, but dangers and challenges stay

Among the many key takeaways:

Eight in 10 (82 p.c) restaurant executives surveyed plan to extend investments in AI applied sciences within the subsequent fiscal yr, and hope to see advantages for improved buyer expertise (60 p.c), restaurant operations (36 p.c), and loyalty applications (31 p.c).

AI investments in buyer expertise are producing affect with 52 p.c of manufacturers and 84 p.c of operators surveyed presently seeing excessive buyer expertise affect.

Amongst these surveyed, figuring out the best use instances (48 p.c) and managing dangers (48 p.c) are the highest two components holding again restaurant leaders from deploying AI.

Throughout all manufacturers surveyed, lower than half of respondents say their organizations are prepared for AI adoption in relation to technique (43 p.c), know-how infrastructure (39 p.c), operations (34 p.c), threat and governance (28 p.c), and expertise (27 p.c).

Deloitte examines what’s driving worth, perceived challenges, and organizational readiness to scale AI successfully. The report reveals that AI funding and adoption differs throughout the business as organizations search to steadiness experimentation with operational focus, customer-facing innovation with back-of-house transformation, and excessive ambitions with organizational readiness.

AI Funding Focuses on the Buyer

AI has captured the curiosity and creativeness of many enterprise leaders worldwide, and restaurant executives are not any exception. Deloitte discovered respondents indicated plans for AI investments, together with hopes for what such investments may help them obtain.

When requested how they count on their group’s funding in AI applied sciences to alter within the subsequent fiscal yr, 82 p.c of respondents say their AI funding is prone to enhance whereas solely 2 p.c count on a lower.

Sixty p.c of respondents cited enhanced buyer expertise as one of many high three advantages they hope to realize by means of AI efforts, adopted by improved restaurant operations (36 p.c) and enhanced loyalty applications (31 p.c).

A smaller however good portion of these surveyed hope AI will strengthen their digital advertising and marketing efforts (26 p.c), optimize meals prep and waste administration (25 p.c), improve crew experiences (21 p.c), and assist them develop new merchandise and ideas (20 p.c).

Profit expectations differ by restaurant sort: For instance, respondents from informal eating eating places hope to realize a considerably higher profit in enhancing buyer expertise (60 p.c) in comparison with these within the fast service, quick informal and café segments (48 p.c).

Regionally, variations arose. When taking a look at AI’s potential to allow a extra optimistic buyer expertise, respondents within the U.S. and Europe are extra optimistic than their counterparts in Asia (62 p.c of U.S. and 59 p.c of European respondents famous it as a high three profit, in comparison with 42 p.c in Asia). In the meantime, respondents from Asia had been the one group to quote automation/augmentation of restaurant labor as their high three hoped-for advantages (25 p.c).

Adoption Is Anticipated to Are available in Waves

Many respondents have already built-in AI into their day-to-day actions in numerous capacities. It might not be shocking that buyer expertise is main the best way given AI’s prevalence throughout the buyer panorama, reminiscent of in-app or in-kiosk suggestion engines.

Each model and operators surveyed report that their AI investments are producing a excessive affect immediately in buyer expertise (52 p.c of manufacturers, 84 p.c of operators) and stock administration (35 p.c and 25 p.c), amongst different areas.

Sixty-three p.c of respondents report every day use of AI in aiding the shopper expertise, the most typical use case. One other 26 p.c say they’re engaged in buyer expertise pilots or different types of restricted implementation.

The second most-common use case is stock administration, 55 p.c of these surveyed cite utilizing AI in that course of every day; one other 25 p.c say they’re testing out such purposes.

Whereas buyer expertise and stock administration symbolize the primary wave of AI adoption, survey responses point out {that a} second wave of AI deployment is concentrated on boosting buyer loyalty and enhancing worker expertise. Implementation hovers close to 70 p.c for these two alternative areas (together with every day use and pilots) however report planning actions point out these numbers might quickly rise.

A 3rd wave contains leveraging AI in meals preparation and new product improvement. Each purposes are getting used or examined in these areas by half or much less of respondents immediately, however in addition they boast the best readings in relation to planning and improvement.

Based on respondents, one of many extra rising examples is using voice AI in drive-thrus to automate the order-taking course of.

Eating places Utilizing AI Nonetheless Have A number of Challenges to Overcome

Throughout the business spectrum, corporations which have adopted AI at some degree report a spread of challenges.

Managing threat round AI know-how and figuring out use instances tied for the highest concern for organizations (48 p.c), intently adopted by lack of expertise or technical abilities (45 p.c).

When contemplating the dangers associated to AI implementation, mental property points (20 p.c) and misuse of consumer/buyer information (16 p.c) had been cited most frequently by these surveyed.

What doesn’t fear surveyed restaurant leaders could also be simply as noteworthy: Corporations should not involved with lack of govt dedication (solely 20 p.c of respondents stated it is holding them again), selecting the best applied sciences (29 p.c), or by computing infrastructure or information (31 p.c). This means that restaurant executives have moved previous getting management buy-in for AI investments and are targeted on extra sensible issues reminiscent of selecting the correct purposes and discovering the folks to help them.

Total AI Readiness Stays within the Prep Stage

As their plans unfold for future AI deployments, some restaurant executives say their organizations could not have foundational components in place to scale.

Technique is the one space the place most respondents say their corporations are “extremely” ready, though nearly 40 p.c say they don’t really feel they’ve a robust technique in place.

Twenty-one p.c of respondents throughout all segments and geographies consider they’ve the danger and governance in place to shepherd AI investments to fruition. In the meantime, 29 p.c say their organizations are ready by way of know-how infrastructure, and 27 p.c say they’re ready by way of expertise.

Readiness for AI adoption varies between manufacturers and operators. Operators report being extra ready throughout technique and operations. Manufacturers, in the meantime, have the sting in know-how infrastructure readiness. Each teams have comparatively low ranges of confidence and readiness by way of expertise and threat and governance.

The Deloitte report relies on a survey of 375 international restaurant executives in 11 international locations fielded throughout This autumn 2024 (October – November 2024).

AI and Visitor Belief

SOCi’s 2025 Client Habits Index (CBI) sends a transparent warning to restaurant CMOs and digital advertising and marketing leaders. Discovery has modified, and conventional digital methods are not sufficient. Whereas 19 p.c of shoppers now use generative AI instruments like ChatGPT or Gemini to seek out companies, a staggering 95 p.c say AI is the least trusted supply in relation to making precise buy choices.

Shoppers aren’t rejecting AI; they’re verifying it. As AI instruments more and more function a place to begin for native discovery, shoppers wish to platforms like TikTok and Instagram to validate that what AI suggests is correct, related, and human-backed. That is very true for Gen Z, the place 34 p.c use TikTok and 35 p.c use Instagram to find new manufacturers. The message is obvious: AI could begin the journey, however belief is earned by means of folks.

This isn’t a future drawback. That is immediately’s actuality. Shoppers now transfer fluidly between AI instruments, social media, and evaluation platforms to validate claims, examine model repute, and watch movies from actual prospects earlier than making choices. Treating these touchpoints as disconnected methods creates expensive blind spots. With Google more and more surfacing social content material in search outcomes, SOCi’s 2024 Native Visibility Index discovered that manufacturers that lack a social-first presence are leaving thousands and thousands in potential income untapped.

The trust-building doesn’t cease at discovery. Critiques are actually the ultimate checkpoint earlier than conversion. An awesome 91 p.c of shoppers depend on peer-generated content material to guage native companies. Amongst youthful audiences, 40 p.c choose video critiques, and 65 p.c say they’re extra probably to decide on a enterprise that actively responds to critiques. But 55 p.c are more and more skeptical of faux suggestions, highlighting that transparency and responsiveness are actually business-critical.

Importantly, critiques should not solely influential to shoppers but in addition a key sign for AI engines (Damian Rollison, Search Engine Land). Instruments like ChatGPT incorporate buyer critiques as a foundational enter in producing native suggestions. This underscores the twin position critiques now play in constructing shopper belief and shaping how companies seem in AI-powered discovery outcomes.

The CBI survey was performed between February 19 and February 24, 2025, and included 1,001 grownup U.S. respondents distributed evenly throughout gender, age, and geographic space.

The Splintered Path to Buy

The trail to buy has splintered, and Gen Z is within the driver’s seat. Based on SOCi’s 2025 Client Habits Index (CBI), youthful shoppers are constructing a brand new mannequin of native discovery for eating places that’s fueled by platform-hopping, peer validation, and real-time analysis.

The place earlier generations might need turned to a single search engine or mapping app, Gen Z navigates a mosaic of micro-decisions. Their journey might start on TikTok, proceed by means of Reddit threads or Yelp critiques, and culminate in a Google Maps search. The normal entrance door has been changed by a dozen digital entry factors, every one shaping how a model is perceived.

“Legacy retail advertising and marketing fashions weren’t constructed for immediately’s purchaser,” stated Monica Ho, CMO of SOCi. “Gen Z is redefining what discovery appears like; they don’t observe a path, they create one. Manufacturers that may’t meet them throughout platforms with authenticity and proof received’t earn their belief or their enterprise.”

This fragmented method to look and discovery comes with a reshuffling of belief. Whereas search engines like google and navigation instruments stay broadly revered throughout age teams, Gen Z is way extra prone to experiment with newer instruments like AI-driven platforms whereas additionally leaning into peer-powered content material. But regardless of this experimentation, they continue to be cautious: AI nonetheless lags behind in trustworthiness, whereas user-generated content material on platforms like Instagram, TikTok, and Reddit performs a bigger position in shaping choices.

Model loyalty can be on the decline. Based on the CBI, practically one-third of shoppers aged 18–24, and greater than a 3rd of these aged 25–34, report being much less loyal to retail manufacturers than they had been a yr in the past. For the youngest patrons, conventional model repute ranks simply ninth in significance when making a purchase order choice, trailing behind components like value, high quality, comfort, buyer critiques, and visible content material.

The CBI survey was performed between February 19 and February 24, 2025, and included 1,001 grownup U.S. respondents distributed evenly throughout gender, age, and geographic space.

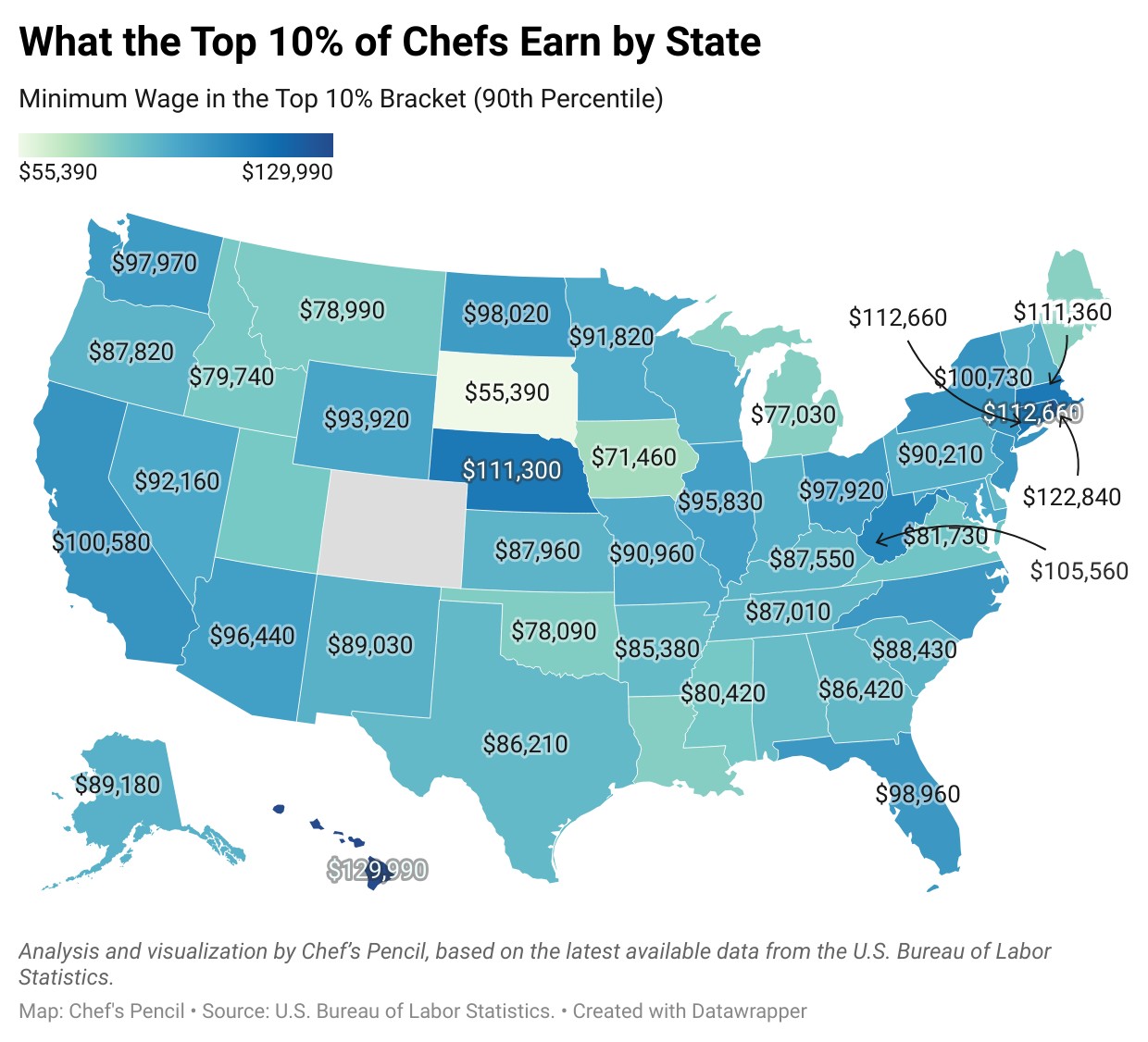

The place Cooks Are Incomes $100,000

New information from Chef’s Pencil reveals the place cooks are incomes $100,000+

What stands out:

For the primary time, now we have a transparent estimate: greater than 11,000 U.S. cooks are incomes six-figure salaries—providing a uncommon take a look at the true higher tier of chef compensation.

The metros with the best variety of six-figure-earning cooks embrace New York (1,651), Los Angeles (924), Boston (820), San Francisco (794), and Miami (692).

To highlight the place cooks earn essentially the most, we analyzed the highest 10 p.c of earners in every U.S. state and metro space—rating and mapping the highest places. Main the listing are Kahului–Wailuku, HI, the place top-tier cooks make over $134,990, and City Honolulu, with a mean of $124,880 among the many highest earners.

Datassential 500 Awards

Datassential introduced the winners of the Datassential 500 Awards, a first-of-its-kind recognition program spotlighting essentially the most dynamic manufacturers shaping the way forward for foodservice. The Datassential 500 blends proprietary information, predictive analytics, and actual shopper sentiment to highlight not solely America’s largest and most beloved manufacturers, but in addition the rising innovators making waves throughout the chain restaurant panorama.

America’s Favourite Chain: Chick-fil-A

The chain has the strongest shopper rankings throughout all main metrics, from meals high quality to worth and expertise.

America’s Quickest Rising Chain: Hangry Joe’s Sizzling Rooster & WIngs

The chain noticed essentially the most important unit proportion progress in 2024.

America’s Most Craved Chain: In-N-Out

The chain that earns high marks for craveable, constantly great-tasting meals.

America’s Most Distinctive Restaurant Menu: Crumbl

The chain rated by shoppers as having essentially the most unique and revolutionary menu choices.

The Folks’s Alternative Award: Portillo’s

The chain with the best variety of devoted prospects who constantly select this model out of loyalty and dedication, not only for comfort.

America’s Finest Restaurant Expertise: Texas Roadhouse

The chain that earns high rankings for excellent service, ambiance, and visitor expertise.

America’s Worth Chief: Little Caesars

The chain that earns high rankings or affordability and value-for-money notion.

America’s Restaurant Innovation Chief: Outback

The chain with the strongest-performing limited-time gives and menu releases throughout metrics like buy intent, uniqueness, draw and worth.

America’s Finest To-Go Chain: Wingstop

The chain that excels in off-premise expertise, from order to doorstep.

America’s Finest Burger Chain: Shake Shack

The burger model with the strongest progress, alongside robust shopper rankings for style and satisfaction.

America’s Finest Rooster Chain: Elevating Cane’s

The rooster model with the strongest progress, alongside stellar shopper rankings for style and satisfaction.

America’s Finest Espresso Chain: Dutch Bros

The espresso model with the strongest progress, alongside excessive shopper rankings for style and satisfaction.

America’s Finest in Beverage: HTeaO

The beverage-focused idea with the strongest progress and most unusual, thrilling drinks.

America’s Finest Wholesome Chain: CAVA

The chain that ranks excessive when shoppers crave wholesome, better-for-you, or plant-forward eating.

America’s International Taste Favourite: KPOT Korean BBQ & Sizzling Pot

The chain that ranks excessive when shoppers crave worldwide or globally-focused cuisines.

Loyalty Challenges

Circana, LLC launched new analysis revealing that restaurant loyalty members go to 20 distinctive restaurant chains in a yr, simply as many as nonmembers. Based mostly on an evaluation of longitudinal receipt information from 4 of the most important loyalty applications in america, this discovering challenges the belief that loyalty program enrollment interprets to model exclusivity.

Whereas loyalty members have interaction with a number of restaurant manufacturers, they proceed to symbolize a extremely helpful section for visitors progress. These shoppers are heavier customers of eating places general, making 22 p.c extra visits per yr than nonmembers. Whereas they don’t go to single manufacturers solely, they frequent manufacturers they’re enrolled in at twice the speed of nonmembers, allocating 8 p.c of their complete restaurant visits to that model, in comparison with simply 4 p.c amongst nonmembers.

The analysis additionally highlights the sustained momentum of loyalty program utilization. Loyalty visitors doubled from 2019 to 2024, and loyalty members now symbolize 39 p.c of complete restaurant visits. Loyalty visitors elevated by 5 p.c final yr alone, whilst general restaurant visitors declined by 2 p.c. At main quick-service restaurant (QSR) chains, loyalty members account for half, or extra, of complete visits.

The rise in loyalty visitors underscores the lasting significance of those applications for restaurant operators. Loyalty applications not solely assist seize a higher share of visits but in addition generate helpful insights into visitor habits and preferences. When paired with syndicated business and demographic information, eating places achieve the complete image, understanding how they evaluate to the broader market and what actually drives buyer decision-making.

As loyalty program adoption grows, manufacturers should proceed investing in multi-channel engagement methods that stretch past the app. The app isn’t the technique—it’s one touchpoint in a bigger expertise that ought to embrace tailor-made promotions, unique content material, and moments of enjoyment. The restaurant business thrives on experiences, and a loyalty program ought to replicate the identical sense of hospitality, connection, and delight that company really feel once they go to in individual.

What’s Fueling QSR and Quick Informal Visits?

HungerRush launched its newest information findings that present insights into what’s driving shoppers to quick informal and fast service eating places in 2025, in addition to how a lot of these eating places can higher meet the wants of diners. Total, the analysis discovered that 93 p.c of shoppers are visiting quick informal eating places month-to-month, however that doesn’t imply they aren’t with out ache factors. Key takeaways from the information embrace:

Lengthy waits, order errors, and generic offers are the highest causes diners don’t return

57 p.c of shoppers choose customized reductions primarily based on their order historical past

69 p.c count on real-time order updates, and 51 p.c would use extra tech if it meant quicker service

Whereas tech issues, 38 p.c nonetheless choose ordering from human workers, underscoring the necessity for a seamless mix of high-touch and high-tech

Views on Ideas

A brand new report from Instantaneous Monetary gives crucial perception into how the coverage might straight have an effect on the lives of frontline employees throughout the nation. The findings, primarily based on a nationwide survey of 571 employees who use the Instantaneous app to entry digital suggestions and earned wages, spotlight overwhelming help for the proposed laws—83 p.c of respondents stated they wish to see the coverage cross.

Key findings from the report embrace:

- 83 p.c of respondents help a No Tax on Ideas coverage. Simply 4 p.c opposed it, and 12 p.c stated they had been uncertain or detached. Help was robust throughout demographics and job sorts, reflecting a widespread want for tipped revenue to be handled as untaxed take-home pay.

- 70 p.c of employees are frightened about inflation and rising prices. Respondents cited financial anxiousness pushed by tariffs, greater grocery and gasoline costs, and unstable housing prices—making tip tax aid really feel particularly pressing.

- Greater than 80 p.c use their earned wages and tricks to cowl important wants. These embrace lease, utilities, groceries, and transportation. Removed from being further revenue, on-demand wages and suggestions are core to assembly day-to-day monetary obligations. With 65 p.c of People residing paycheck to paycheck, this could come as no shock.

- 70 p.c stated they might be financially unstable with out entry to wages and suggestions earlier than payday. This underscores the crucial position of earned wage entry (EWA) in serving to employees handle money circulation and keep away from overdraft charges, late payments, or high-interest debt.

- The median reported weekly take-home pay is $400. Whereas averages ranged broadly—from under $300 to over $1,000—the overwhelming majority of respondents described their revenue as inconsistent or unpredictable, with variability tied to hours, shifts, or supply quantity.

The survey additionally discovered that whereas 63 p.c choose direct deposit, a significant variety of employees favor money, checks, or paycards, underscoring the necessity for fee flexibility for individuals who could also be underbanked. The important thing takeaway: employees worth alternative, and insurance policies or payroll methods ought to replicate that. Based on a 2024 report from Instantaneous, 86 p.c of staff need same-day pay.

Instantaneous Monetary performed the survey from Might 29 to June 3, 2025, gathering responses from a various set of hourly employees utilizing the Instantaneous app. Individuals got here primarily from the meals service, hospitality, and retail industries, and included servers, bartenders, supply drivers, stylists, cashiers, and help workers. The median age of respondents was 41.

Summer season Eating Dos and Don’ts Report

Resy is serving up new insights into how People are eating out this season – and what’s formally off the menu.

Introducing its first-ever Summer season Eating Dos and Don’ts Report, Resy’s new survey of seven,500 frequent diners, reveals the newest developments, etiquette icks, and what’s shaping summer time eating habits. From fashionably late mates to telephone fake pas, right here’s what trending (and what’s not) on the desk this summer time:

● Largest etiquette offender? The buddy who’s all the time late. Practically two in 5 adults say they’ve one buddy who by no means reveals up on time. Greater than half of diners admit to setting faux reservation instances, padding them by 15 to twenty minutes, simply to maintain their group punctual. For Gen Z and millennials, a 15- to 20- minutes buffer is the norm.

● Completely different cities, completely different clocks: New Yorkers and Miamians are extra relaxed about lateness, with practically 25 p.c saying quarter-hour late is “high quality.” In distinction, diners in Atlanta, Chicago, LA and DC consider “10 minutes is pushing it.”

● Telephones on the desk? Gen Z says no. 40 p.c of Gen Z says it’s utterly unacceptable to be in your telephone throughout dinner. In truth, 61 p.c of Gen Z and millennials agree that telephone use is essentially the most awkward dinner habits, beating out being tremendous late or over-ordering on an even-split invoice. Different Gen Z etiquette icks embrace rudeness to workers (76 p.c) and loud speaking (53 p.c).

● No pay in your birthday? Half of all adults agree: if it’s your birthday, you shouldn’t have to separate the invoice. 44 p.c of Gen Z say mates ought to cowl the birthday visitor’s meal.

● Fashionably late is out, however style itself is in! Half of Gen Z diners coordinate outfits earlier than going out and 57 p.c examine a restaurant’s aesthetic on social media earlier than selecting a glance.

Fourth of July at Eating places

As we gear up for the July 4 weekend, Toast shares information about how People have fun the vacation at eating places. Neglect simply fireworks – we’re seeing clear shifts in what folks eat, drink, and once they dine out.

Toast information uncovered some shocking, consumer-driven developments, displaying shifting preferences and eating behaviors on a serious vacation, that hints at what we will count on extra of this yr, e.g. a heavy lean into conventional American consolation meals and in style, easy-to-drink drinks. In 2024:

🌭Sizzling Canines Topped King: Sizzling canine gross sales soared by an enormous 75 p.c, cementing their standing as the vacation’s final consolation meals. BBQ gross sales additionally jumped 31 p.c.

🥤Onerous Seltzers Sparkle: Regardless of general restaurant gross sales being down, arduous seltzers had been the undisputed beverage star, with gross sales up by a whopping 40 p.c! Tequila additionally noticed a lightweight four-percent carry, hinting at new summer time drink developments.

😎The Get together Begins Early (and Lingers): Whereas general restaurant gross sales had been down 21 p.c in comparison with a typical Thursday, we noticed early morning bar gross sales soar 158 p.c at midnight, a transparent signal of celebrations extending from the evening earlier than. Lunch hours additionally noticed a notable carry, significantly at 2 pm (+9 p.c) and three pm (+19 p.c).

🦞Regional Eating Divides: New England hotspots like Rhode Island (+52 p.c transactions) and Maine (+20 p.c) noticed important will increase, whereas the Midwest, notably Nebraska (-62 p.c), largely opted for home-based celebrations.

Procuring Behaviors Are Shifting

A brand new GS1 US shopper survey discovered that 33 p.c of U.S. adults count on to pay extra for meals this summer time in comparison with final summer time resulting from inflation and practically half (47 p.c) count on to pay the identical, suggesting 80 p.c report feeling no aid from excessive grocery costs.

With rising meals prices and summer time gatherings nearing, U.S. shoppers are paying nearer consideration to meals labels and looking for smarter methods to buy. The survey additionally confirmed that greater than three-quarters (76 p.c) of shoppers need extra data resulting from greater meals prices, with 71 p.c saying that they’re studying labels extra intently and sometimes. Moreover, 66 p.c stated they might scan a QR code on meals packaging to entry data reminiscent of freshness, substances and shelf life.

“Procuring behaviors are shifting, and shoppers are scrutinizing merchandise and labels greater than ever on the level of buy to make sure they align with their preferences and budgets,” stated Bob Carpenter, president and CEO of GS1 US. “Shoppers need extra transparency, and our digital world can present real-time entry to the knowledge they search. QR codes powered by GS1 are rising on product packaging to assist buyers retrieve more-trusted real-time product particulars through a smartphone scan—supporting smarter, extra assured choices on the shelf.”

By industrywide collaboration facilitated by GS1 US, manufacturers globally are starting their transition from the UPCs which have powered value lookup for greater than 50 years to new superior QR codes powered by GS1 that hyperlink a bodily product to digital data — whereas nonetheless going “beep” at checkout. These smarter barcodes can supply buyers entry to detailed data straight from the model, together with origin, substances, artificial dye disclosures, dietary content material, allergens, storage suggestions and extra. Retailers have set a goal date to just accept QR codes at checkout by 2027, though many can be prepared sooner – a GS1 US initiative labeled Dawn 2027.

Carpenter added, “Whereas the impetus for the transition to QR codes powered by GS1 is to help shopper data wants, business can be envisioning many different advantages. This contains streamlining crowded packaging labels, serving to facilitate recalled gadgets, automating reductions on demand and stopping expiring merchandise from being offered. The makes use of instances for QR codes on packaging are huge and proceed to evolve.”

Client Perceptions on Foodservice Packaging

The Foodservice Packaging Institute launched its third Client Perceptions on Foodservice Packaging Report to realize continued perception into the overall shopper’s use and notion of single-use foodservice packaging. To find these shopper perceptions and supply suggestions to its members, FPI commissioned a third-party to conduct an in depth survey. This survey targeted on the frequency with which individuals use single-use packaging and their perceptions and habits selections associated to foodservice packaging. Specific consideration was given to the post-pandemic panorama amidst growing business scrutiny.

“The highlight targeted on single-use foodservice packaging has not waned over the previous few years, and the business faces extra challenges than ever,” stated Natha Dempsey, president of FPI. “We needed to raised perceive shopper perceptions round these packaging merchandise and evaluate them to our earlier surveys performed in 2019 and 2021. With the continued evolution of foodservice packaging and the business, we felt the timing was proper to dig into shopper beliefs.”

Within the 2025 survey, contributors had been requested questions on their notion of potential advantages, issues or attributes of single-use foodservice packaging gadgets. In each the U.S. and Canada, the clear and sanitary nature of single-use foodservice packaging gadgets, adopted intently by the comfort of with the ability to take meals on the go, was in keeping with the 2 most vital advantages in 2021. The flexibility to see the meals contained in the packaging stays the least vital efficiency attribute.

Reaffirming outcomes from FPI’s earlier surveys, respondents in each international locations stated being leak- or spill-proof and stopping oil or grease from soaking by means of and marking garments, automotive seats, and so forth., stay a very powerful attributes of single-use foodservice packaging, adopted intently by safety from tampering.

Outcomes additionally confirmed that 56 p.c of adults within the U.S. and 62 p.c of adults in Canada use single-use foodservice packaging at the very least as soon as every week. This represents a slight lower from 2021 outcomes for U.S. and a slight enhance for Canadian respondents. Inside U.S. respondents, survey leads to 2025 and former surveys present that these with the best revenue stay the most definitely to make use of single-use foodservice packaging daily, and better schooling appeared to correlate with greater use.

Individuals had been requested questions on how incessantly they use single-use foodservice packaging; their beliefs in regards to the significance of efficiency attributes in single-use foodservice packaging; advantages and issues they’ve about single-use foodservice packaging and their reusable counterparts; their habits selections associated to foodservice packaging; environmental points; and, new in 2021, the affect of the COVID-19 pandemic. Every query was analyzed on the lookout for important variations in responses throughout demographic teams and frequency of utilizing single-use foodservice packaging, and from the 2019 survey.

The ultimate report contains enter from 800 respondents in america and Canada, balanced throughout revenue, schooling degree, gender and area. This pattern offers a statistically consultant view of the beliefs of those populations with a 95 p.c confidence price with a plus/minus 5 p.c margin of error.