Earlier articles by M. Ratkai, Professor of Hospitality Enterprise and ESG on the Hotelschool The Hague, have addressed the ever-changing panorama of company disclosures, together with the EU’s Company Social Accountability Directive (CSRD) and ongoing negotiations of the Omnibus proposal. To acquire efficient company reporting and governance practices, it’s important to have a powerful institutional, authorized, and regulatory framework. In 2023–2024, practically two-thirds of the nations revised their governance frameworks, and 73% of the analysed nations issued nationwide studies on corporations’ compliance. Most of those studies cowl all listed companies.

In 2024, round 44,000 corporations had been publicly listed throughout the globe, representing a complete market worth of EUR 100+trillion. Since 2022, their mixed market capitalisation has grown by 28%. Since 2005, nonetheless, over 35,000 corporations have exited public inventory exchanges worldwide.

The OECD research exhibits that sustainability-related disclosure is required by regulation or rules in 79% of jurisdictions, and 65% title a number of stakeholders (together with shareholders) as the first customers of sustainability disclosures. Moreover, 62% require transition planning. Relating to the reliability of sustainability-related info, 60% of the nations have established necessities for the peace of mind of such info (primarily restricted or affordable assurance), and a further 17% are contemplating it. Completely different approaches exist concerning the kinds of entities allowed to offer sustainability assurance, together with statutory auditors and different assurance service suppliers.

Do growing obligations and authorized accountability affect listed corporations’ behaviour? Aside from the plain, there may be one other noticeable pattern. In each the USA and Europe, delistings have outpaced new listings, leading to a web decline within the variety of listed corporations. Roughly 12,000 corporations delisted in Europe (about one-third of the entire) and 5,000 within the USA. Additionally, preliminary public providing exercise has weakened throughout most areas. The exception has been Asia (excluding China and Japan), the place web listings have continued to rise and remained constructive over 2022-24.

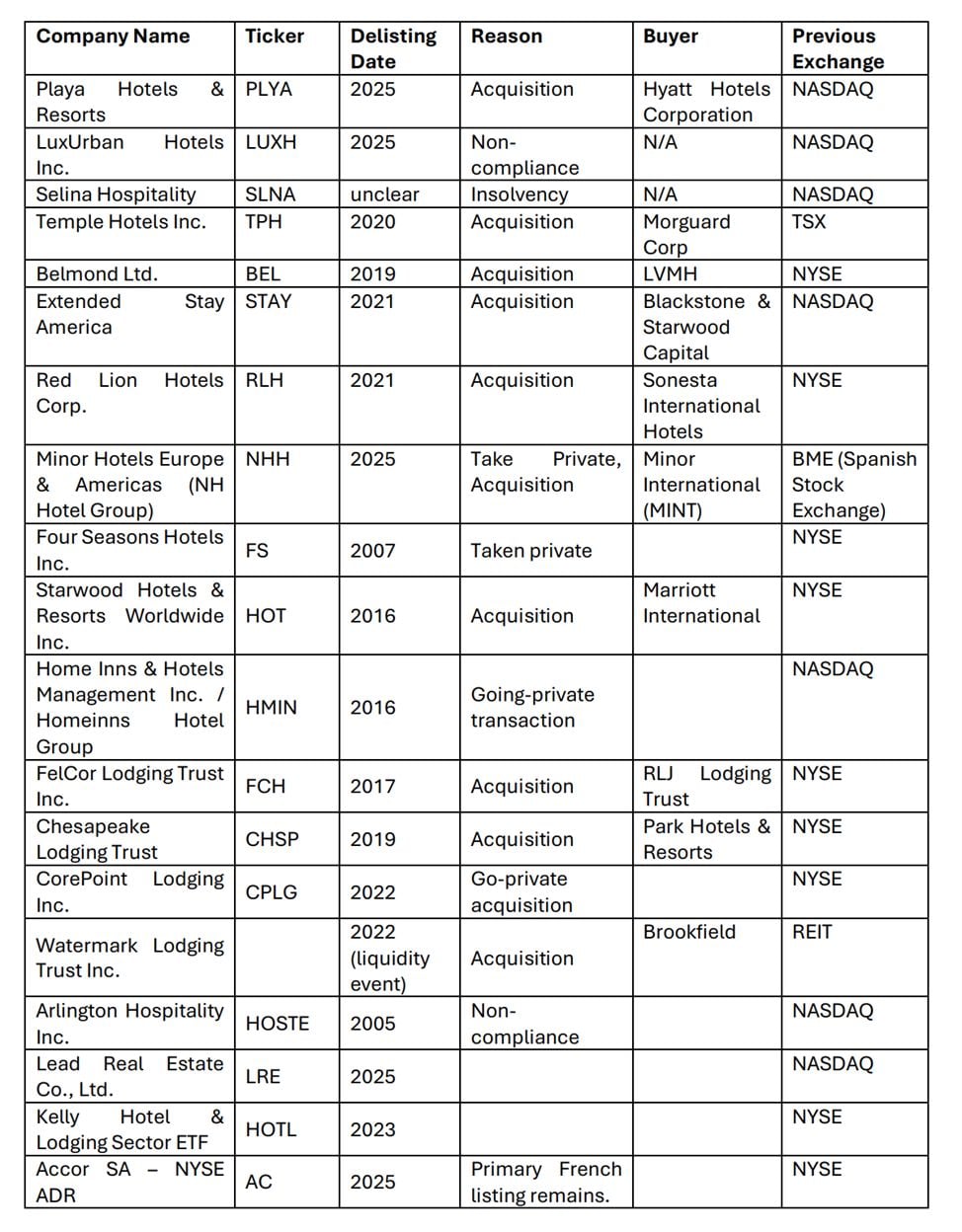

What insights has the Chair of Hospitality Enterprise and ESG at Hotelschool The Hague uncovered concerning the lodging and lodging sector? They discovered that many delistings came about in our sector as properly, see the checklist under from the previous years.

Word: The knowledge within the desk is supplied as is and should comprise inaccuracies. Customers are suggested to confirm vital particulars independently.

Conclusion

There are a couple of conclusions that may be drawn from the above: there have been many acquisitions, but additionally many non-compliance points. The query arises mechanically: whether or not the brand new possession construction is the one motive behind the delistings? Or perhaps, due to the growing expectations for transparency and accountability? Or perhaps we are able to witness a gradual market reorganisation? What do you assume? Do you may have an opinion?