The Institute for Provide Administration launched its month-to-month manufacturing Buying Managers Index (PMI) on Dec. 1, reflecting November U.S. industrial exercise, which reverted additional into contraction for a second straight month.

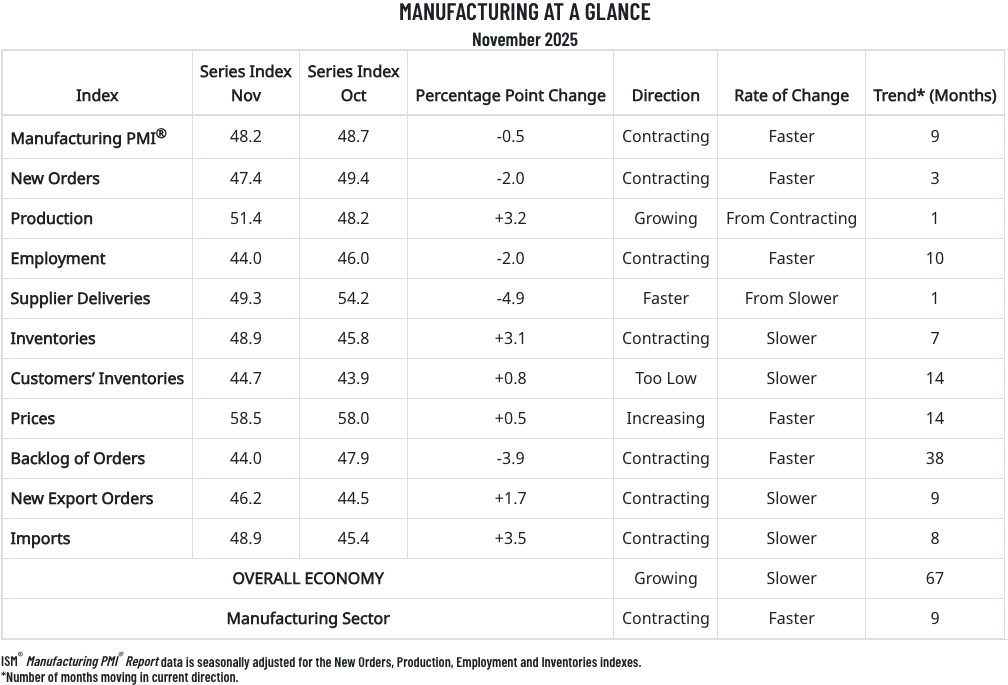

The PMI — thought to be a key of U.S. industrial well being — slid 0.5 share factors throughout November to a studying of 48.2%, following October’s 0.4-point decline. It marked the ninth straight month that the PMI was in contraction territory (something beneath 50.0%) after a short growth in January-February preceded by 27 straight months of contraction.

ISM PMI – the Final 12 Months

ISM’s November report confirmed that its largest demand indicator — New Orders — fell two factors in its third straight month of contraction, whereas the most important enter indicator — Manufacturing — improved 3.2 factors. The Costs index remained in growth with a 0.5-point achieve to 58.5%, whereas indexes for Backlog of Orders sunk 3.9 factors and Employment fell by two factors. In the meantime, the Provider Deliveries index indicated quicker supply efficiency and the inventories index moved up 3.1 factors. Indexes for New Export Orders and Imports each improved.

“In November, U.S. manufacturing exercise contracted at a quicker fee, with pullbacks in provider deliveries, new orders and employment resulting in the 0.5-percentage level lower of the Manufacturing PMI,” commented Susan Spence, MBA, Chair of the ISM Manufacturing Enterprise Survey Committee. “ Persevering with a latest pattern, a earlier month’s enchancment in a single index was evident in one other gauge. After new orders strengthened in August, manufacturing improved in September. An enchancment within the Backlog of Orders Index in October transferred to the Manufacturing Index, which expanded in November (as backlogs pulled again). Nonetheless, the New Orders and Employment indexes each dipped 2 share factors, underscoring the continued financial uncertainty.

The report famous that 58% of the U.S. manufacturing financial system’s GDP contracted in November — matching October’s determine — and the proportion of GDP in sturdy contraction (PMI of 45% or decrease) decreased barely at 39% vs. 41% in October.

Of the six largest manufacturing industries three — Laptop & Digital Merchandise; Meals, Beverage & Tobacco Merchandise; and Equipment — expanded in November. Miscellaneous Manufacturing was the fourth business to develop, whereas the 11 different industries all reported contraction.

November PMI Respondent Commentary

- “New order entries are inside the forecast. We have now elevated requests from clients to get their orders sooner. Transit time on imports appears to be longer.” (Equipment)

- “We’re beginning to institute extra everlasting modifications because of the tariff setting. This consists of discount of workers, new steering to shareholders, and growth of extra offshore manufacturing that may have in any other case been for U.S. export.” (Transportation Tools)

- “Tariffs and financial uncertainty proceed to weigh on demand for adhesives and sealants, that are primarily utilized in constructing building.” (Chemical Merchandise)

- “No main modifications at the moment, however going into 2026, we count on to see huge modifications with money circulate and worker head rely. The corporate has offered off an enormous a part of the enterprise that generated free money whereas providing voluntary severance packages to anybody.” (Petroleum & Coal Merchandise)

- “Enterprise circumstances stay mushy on account of larger prices from tariffs, the federal government shutdown, and elevated international uncertainty.” (Miscellaneous Manufacturing)

- “The unstable market has made pricing fluctuate in a really unstable approach; I’ve needed to scale back suppliers for uncooked supplies to take care of a greater direct price construction. Lowering my suppliers has lowered the supply of some gadgets and created longer lead occasions.” (Fabricated Steel Merchandise)

- “Enterprise continues to be a battle relating to long-term sourcing choices primarily based on tariffs and touchdown prices. Exterior (or worldwide) sourcing stays the lowest-cost resolution in comparison with U.S. manufacturing/manufacturing. The delta is smaller now, lowering margins.” (Laptop & Digital Merchandise)

- “The federal government shutdown has impacted our entry to agricultural knowledge, impacting agricultural markets and, consequently, choices we make. Optimism for a tariff exemption on palm oil percolated however hasn’t come to fruition at the moment.” (Meals, Beverage & Tobacco Merchandise)

- “Commerce confusion. At any given level, commerce with our worldwide companions is clouded and tough. Suppliers are discovering increasingly more errors when making an attempt to export to the U.S. — earlier than I even have the chance to import. Freight organizations are additionally having difficulties abroad, contending with altering rules and uncertainty. Situations are extra attempting than throughout the coronavirus pandemic by way of provide chain uncertainty.” (Electrical Tools, Home equipment & Elements)

- “Home and export enterprise have been lackluster. Our clients are taking immediate orders solely and nonetheless don’t have faith to construct stock, a lot much less make growth plans. Actually, most of any sort of ‘planning’ has been undermined by unpredictability attributable to inconsistent messaging from Washington. Synthetic intelligence is in its infancy levels, producing complicated and most frequently inaccurate data. This additionally causes apprehensive client shopping for patterns, contributing to the problem of forecasting demand.” (Wooden Merchandise)

Associated Posts

U.S. manufacturing exercise contracted for a fifth straight month in July, because the PMI fell…

Although nonetheless in contraction, it adopted a July decline, whereas respondents emphasised the uncertainty and…

September’s PMI rose barely to 49.1% however stayed in contraction territory as some producers report…