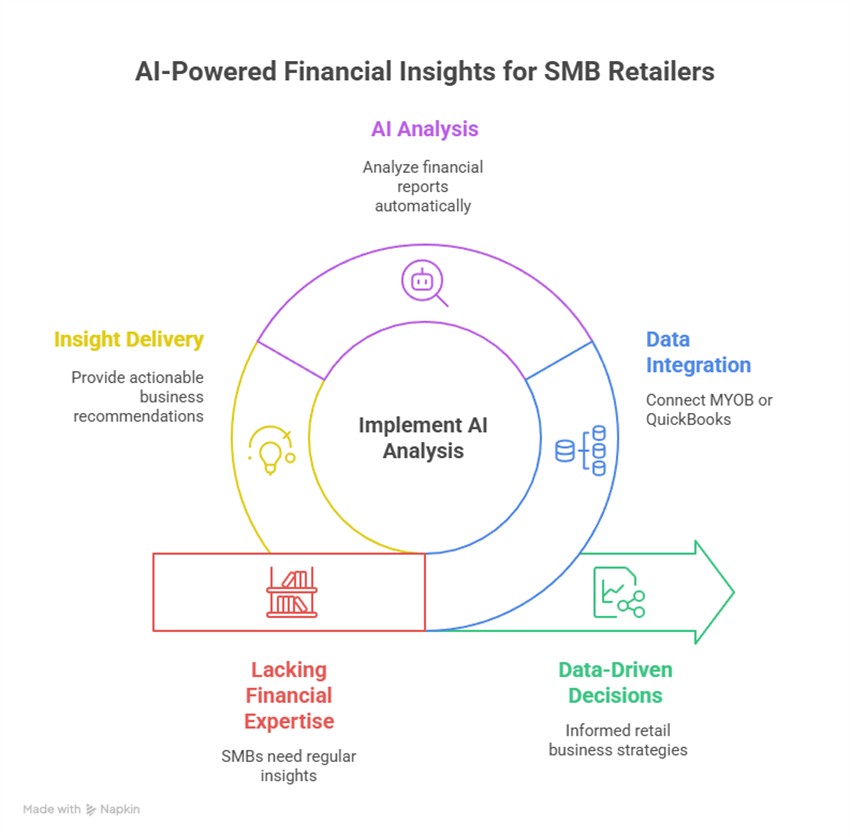

Many small and medium-sized retailers throughout Australia function with out the advantage of a devoted accountant. It’s an on a regular basis actuality, with most counting on periodic check-ins with exterior advisors relatively than having in-house monetary experience. In consequence, common strategic evaluation of monetary reviews can fall by the wayside, leaving enterprise homeowners at an obstacle when making well timed, data-driven selections. With the speedy development of AI monetary evaluation instruments, a urgent query has emerged: Can synthetic intelligence reliably analyse SMB monetary reviews and ship the sort of actionable enterprise insights that drive retail success?

It emerged in a latest assembly with a number of shoppers, a lot of whom look to us as leaders in AI expertise for retail in our market house. An enormous query arose: How good is AI at analysing monetary reviews for SMB retailers? The fact is that the majority small retailers in Australia do not have a everlasting accountant. Not like giant organisations with in-house finance groups, most SMBs solely meet up with their accountant every year, which places them at an obstacle concerning common, data-driven enterprise selections. Many would really like an accountant to evaluation their figures and provides some recommendation, however time and monetary concerns are actual.

To reply this query, we undertook a sensible experiment to mirror Australian retailers’ real-world challenges. The purpose was to find out whether or not in the present day’s main AI accounting instruments might step in the place common monetary evaluation is usually missing, particularly for companies utilizing platforms like MYOB or QuickBooks.

May AI ship the monetary perception wanted with out an accountant by drawing on real-world testing and present finest practices in retail monetary administration in SMB retailing?

Our Take a look at Methodology

Here is how we structured the take a look at to make sure it was truthful, sensible, and related to on a regular basis retail operations:

Studies Offered:

We used real-world reviews from MYOB or QuickBooks, which had errors and inconsistencies you’d anticipate from an SMB enterprise with out a skilled bookkeeper. So we used their knowledge, and we ran for 2 years.

Revenue and Loss Assertion

Stability Sheet

Trial Stability

Then put them right into a single PDF

Our immediate

After refining our strategy by way of a number of iterations, we developed a complete immediate for the AI platforms.

==========================================================================================================

Firm Efficiency Evaluation Immediate

“I would like you to offer a complete enterprise efficiency evaluation for [Company Name] based mostly on their monetary statements for [Year 1] and [Year 2]. Your position is to assist the corporate perceive how they’re performing and what they need to give attention to going ahead.

DOCUMENTS PROVIDED IN PDF format:

- Revenue & Loss Assertion (2 years)

- Stability Sheet (2 years)

- Trial Stability (2 years)

Observe: These paperwork might comprise some errors or inconsistencies. Please flag any points you discover, however focus totally on offering worthwhile enterprise insights in regards to the firm’s efficiency and route.

YOUR ASSESSMENT SHOULD COVER:

Total Enterprise Well being

- How is the corporate performing financially?

- What are the important thing strengths and areas of concern?

- Is the enterprise trending in the proper route?

Key Efficiency Highlights

- Income progress and sustainability

- Profitability tendencies and margins

- Money circulate and liquidity place

- Operational effectivity enhancements or declines

Areas Requiring Consideration

- What challenges is the corporate dealing with?

- Which metrics or tendencies are regarding?

- What dangers ought to administration pay attention to?

Strategic Suggestions

- What ought to the corporate give attention to to enhance efficiency?

- What alternatives exist for progress or effectivity good points?

- What speedy actions ought to administration contemplate?

Future Outlook

- Based mostly on present tendencies, the place is the corporate headed?

- What ought to they monitor carefully sooner or later?

- What are the important thing success elements for continued progress?

DELIVERABLE: Write this as a enterprise efficiency report that decision-makers in an SMB retail store would discover worthwhile for strategic planning and decision-making. Deal with sensible insights that assist them perceive their enterprise higher and make knowledgeable selections in regards to the future.

In case you discover any errors within the monetary knowledge, please point out them, however do not let knowledge high quality points forestall you from offering significant enterprise insights.“

============================================================================================================================================

The take a look at

The Free AI Panorama

Like a lot on the planet, not all AI instruments are equal; some are higher than others, and every has account limitations. So we examined six in style instruments to the utmost the free model allowed.

Now, we all know that every one of them are good, however there’s all the time a case the place even the perfect six runners on the planet have one who is best, and that’s what we needed to search out out: the perfect free AI for retailers.

When working the report, we put the absolute best mannequin on the very best free stage.

Scoring the AI Efficiency

To objectively evaluate the AI-generated reviews, we carried out a 100-point scoring system based mostly on:

Total Enterprise Well being: Did the AI assess the corporate’s monetary place precisely?

Pattern Evaluation: How properly did it determine the route of the corporate?

Key Efficiency Insights: Did it break down income, profitability, money circulate, and operational effectivity?

Drawback and Threat Evaluation: May it pinpoint areas requiring consideration and spotlight potential dangers?

Actionable Suggestions: Had been the solutions sensible, related, and implementable?

Communication and Usability: Was the report straightforward to know and observe?

Error Dealing with: Did the AI flag knowledge inconsistencies and keep away from being misled by errors?

Scoring Pointers:

Now, we had a grading system that was

90–100: Distinctive Enterprise Perception

80–89 Sturdy Enterprise Evaluation

70–79 Sufficient Evaluation

60–69 Poor Enterprise Evaluation

Under 60 Fail

Detailed outcomes by AI

Claude

Rating: 88/100 — Sturdy Enterprise Evaluation

Total Enterprise Well being (23/25):

- Gave a transparent, correct abstract: highlighted a ten.2% income decline and a 30.4% internet revenue drop,

- Balanced strengths (recognized a robust stability sheet with issues on the corporate’s shrinking income

Pattern Evaluation (9/10):

- Nailed the year-over-year development, contextualising declines and highlighting the necessity for pressing motion.

Key Efficiency Insights (27/30):

- Broke down income by section

- Famous labour income decline (-15%)

- Analysed gross margins, that are up, and internet margin, which was down

- Flagged money and stock points

Drawback & Threat Evaluation (18/20):

- Prioritised dangers: liquidity constraints, stock overstock, and unhealthy money owed

- May have expanded on market/aggressive dangers.

Strategic Suggestions (17/20):

- Sensible recommendation: weekly money circulate monitoring, stock optimisation, service diversification.

- It instructed digital transformation and market enlargement, however it ought to have gone deeper right into a long-term technique.

Communication & Usability (3/5):

- Properly-structured, logical, however dense—might be extra concise for busy homeowners.

Error Dealing with:

- +3 bonus for flagging knowledge high quality points with out dropping focus.

Abstract:

Claude delivered a extremely detailed, data-driven report with actionable recommendation, solely let down by its size and barely dense type.

Rating: 85/100 — Sturdy Enterprise Evaluation

Total Enterprise Well being (22/25):

- Clear on declining well being

- Balanced positives (profitability) with issues (liquidity, stock).

Pattern Evaluation (9/10):

- Sturdy in historic context, much less predictive about future tendencies.

Key Efficiency Insights (26/30):

- Detailed on income declines and margin shifts.

- Flagged stock days (752 days in FY24) are a big concern.

- Some working capital ratios have been missed as a consequence of knowledge presentation.

Drawback & Threat Evaluation (17/20):

- Recognized key dangers: income drop, stock build-up, and unhealthy money owed.

- May have ranked dangers extra sharply.

Strategic Suggestions (16/20):

- Sensible requires stock discount and credit score management.

- Some suggestions (like state of affairs planning) have been much less actionable.

Communication & Usability (4/5):

- Clear, structured, and accessible.

Error Dealing with:

- +3 bonus for dealing with knowledge inconsistencies with out dropping the thread.

Abstract:

Google’s report was well-organised, with sturdy sensible suggestions and a stable construction, although its strategic imaginative and prescient might have been extra forward-looking and detailed.

Grok

Rating: 82/100 — Sturdy Enterprise Evaluation

Total Enterprise Well being (21/25):

- Correct on decline (income -10.2%, internet revenue -30.4%), however much less particular in some areas.

Pattern Evaluation (9/10):

- The downward development was accurately recognized, however the future outlook was generic.

Key Efficiency Insights (25/30):

- Lined income and margin declines, however not as deep on drivers.

- Famous liquidity and stock points, however lacked a lot details about working capital, one thing important in SMB retailing.

Drawback & Threat Evaluation (16/20):

- Flagged income and liquidity dangers, however prioritisation was obscure.

Strategic Suggestions (16/20):

- Sensible recommendation on money circulate and stock, however lacked specificity.

Communication & Usability (4/5):

- Properly-structured and clear.

Error Dealing with:

- +2 bonus for addressing knowledge high quality with out overemphasis.

Abstract:

Grok produced a stable, readable report with cheap suggestions, although it lacked the element and strategic sharpness seen in others.

DeepSeek

Rating: 80/100 — Sturdy Enterprise Evaluation

Total Enterprise Well being (20/25):

- Clear on decline (income -10.2%, internet revenue -30.4%), famous fairness progress (+10.9%).

Pattern Evaluation (8/10):

- A downward development was recognized, however the future outlook was common.

Key Efficiency Insights (24/30):

- Evaluated income decline, stable on margins, however much less on particular drivers and operational ratios.

Drawback & Threat Evaluation (16/20):

- Flagged income and liquidity dangers, however did not rank them by impression.

Strategic Suggestions (16/20):

- Sensible however broad solutions.

Communication & Usability (4/5):

- Properly-organised and clear.

Error Dealing with:

- +2 bonus for noting knowledge inconsistencies with out overemphasis.

Abstract:

DeepSeek gave a agency overview and cheap suggestions however lacked specificity and depth.

5. Qwen

Rating: 75/100 — Sufficient Evaluation

Total Enterprise Well being (18/25):

- Offered a fundamental overview however made a big knowledge error by misstating one division’s progress.

Pattern Evaluation (8/10):

- A downward development was famous, however the evaluation was surface-level.

Key Efficiency Insights (22/30):

- Missed key income drivers and superficial operational evaluation.

Drawback & Threat Evaluation (15/20):

- Recognized points however lacked nuance.

Strategic Suggestions (15/20):

- Sensible, however generic and never modern.

Communication & Usability (5/5):

Error Dealing with:

- -5 penalty for knowledge misinterpretation.

Abstract:

Qwen’s report was straightforward to learn however was undermined by errors and a scarcity of depth.

6. ChatGPT

Rating: 78/100 — Sufficient Evaluation

Total Enterprise Well being (19/25):

- Summarised the decline, however used rounded numbers, which prompted it to lack precision.

Pattern Evaluation (8/10):

- A downward development was famous, however the evaluation was basic.

Key Efficiency Insights (23/30):

- Affordable on income and margins, however lacked element and section evaluation.

Drawback & Threat Evaluation (16/20):

- Flagged liquidity and stock dangers however did not assess the impression.

Strategic Suggestions (16/20):

Communication & Usability (4/5):

- Clear however barely verbose.

Error Dealing with:

Abstract:

ChatGPT produced a fundamental, readable report with cheap suggestions however lacked the depth and precision wanted.

What This Means for SMB Retailers

The findings are encouraging. AI monetary evaluation instruments have reached a stage that may genuinely help SMB retailers in understanding their enterprise efficiency. Even when introduced with imperfect knowledge, the perfect AI platforms can determine vital dangers and alternatives and provide worthwhile insights.

The highest performers, Claude and Google, delivered sturdy, actionable enterprise evaluation. These platforms recognized crucial dangers, resembling declining income and tightening money circulate, and provided sensible suggestions that retailers might implement instantly.

Claude’s report was the perfect. It offered clear summaries and highlighted each strengths and issues. Its suggestions centered on weekly money circulate monitoring, stock optimisation, and repair diversification.

Google’s evaluation was well-structured and accessible. It balanced a clear-eyed view of enterprise well being with sensible requires stock discount and tighter credit score management. Whereas its strategic outlook might be extra forward-looking, it dealt with inconsistencies within the knowledge with confidence.

The others have been enough, they usually all might do the job.

As somebody with deep expertise in retail and POS programs, I imagine these developments are a real alternative for SMB retailers. AI instruments don’t substitute for skilled recommendation; we did discover that not one AI produced what we might name an distinctive report; nevertheless, they considerably help these missing common entry to accountants. The capability to conduct thorough monetary analyses in minutes, utilising knowledge exported instantly from accounting software program can revolutionises strategic planning and day by day operations.

This AI-driven monetary evaluation empowers retailers to determine rising tendencies earlier than they escalate into crucial points, assist make knowledgeable selections concerning pricing, stock, and provider administration, determine areas for bettering operational effectivity and to focus on essentially the most important metrics: money circulate, revenue margins, and inventory turnover.

My Skilled Suggestion

I strongly advocate that each SMB retailer in Australia conduct a critical monetary evaluation not less than as soon as 1 / 4 utilizing these AI instruments. Here is how you are able to do it:

- Export your financials (P&L, Stability Sheet, Trial Stability) out of your accounting software program.

- Feed them right into a top-rated AI; I counsel Claude or Google with the immediate above.

- Evaluate the AI’s report for tendencies, dangers, and proposals.

- Act on the insights

- Repeat this evaluation not less than quarterly. Common critiques can allow you to adapt shortly to altering enterprise situations.

In case you need assistance setting this up, attain out for a chat. If there’s sufficient curiosity, I’ll do a webinar.

Written by:

Bernard Zimmermann is the founding director at POS Options, a number one point-of-sale system firm with 45 years of trade expertise. He consults to numerous organisations, from small companies to giant retailers and authorities establishments. Bernard is captivated with serving to firms optimise their operations by way of modern POS expertise and enabling seamless buyer experiences by way of efficient software program options.