What I am enthusiastic about: Essentially the most counterintuitive enterprise classes from 11 hours with Alex Hormozi…methods that really feel incorrect however unlock the subsequent degree of development.

Alex Hormozi is a small/medium enterprise strategist who has bought a number of corporations for 8-figure exits, manages Acquisition.com (a non-public fairness agency whose portfolio earns over $250M in annual income), and lately set the world file for non-fiction e book gross sales along with his $100M Cash Fashions launch.

I had stunningly gained a slot to the one-day stay affiliate workshop on the Acquisition.com HQ, one of many bonuses through the aforementioned e book launch. 100 of us have been invited to attend, and the highest 10 associates bought half-hour every of hearth chat time with Alex, plus dinner with him and his spouse, Leila, that night time. A killer bonus, credit score to the highest 10!

I wasn’t certain what to anticipate or who could be there.

Seems, Alex was primarily concerned for the entire day, delivering nonstop worth, which is typical for many of his group’s stay workshops. If something, my excessive regard for Hormozi elevated additional, and I already thought-about him to be one of many all-around finest entrepreneurs on the planet, and maybe the one most articulate relating to describing enterprise technique/techniques (relevant to land and actual property companies too).

This wasn’t a feel-good convention. No “ra-ra” stuff. Fairly the alternative; I got here away virtually sick to my abdomen contemplating the adjustments I wanted to make in my enterprise — development requires ache. That’s the value.

I’ve NEVER taken this many notes at a stay occasion. Being conscious of studying time and a spotlight span, I may’ve simply listed bullet factors of the entire key takeaways, so that you can nod your head, after which neglect 90% of them 10 minutes later. However my objective for these articles has been to assist change your enterprise (and life) for the higher, together with my very own.

That requires letting every chosen matter “breathe,” and I develop upon essentially the most essential factors under.

(In the event you’re , Alex’s group compiled key segments of this occasion on this video).

The Development Paradox: Why Your Methods Are Retaining You Caught

Alex hammered this level throughout a number of fireplace chats: The one option to develop past your present degree is to implement counterintuitive enterprise development methods.

Give it some thought: the intuitive methods are what you’re ALREADY doing. These are desk stakes.

Recall, each enterprise has three basic requirements: advertising, gross sales, and supply. In the event you test the field for each, you’ve a enterprise.

Let’s take staying financially solvent with no consideration… simpler mentioned than finished, after all. For a typical land flipping enterprise, advertising (mail, name, textual content, pay-per-click promoting, search engine marketing, or on-market listings), gross sales (closing acquisitions and tendencies), and supply (transferring title from one entity to a different, with potential value-add in between) is the baseline. Many viable companies have been constructed from this framework, and a number of other have develop into constant revenue engines.

Intuitively, relating to rising a land enterprise, most folk will give attention to advertising and/or gross sales constraints, as a result of they’re the best to know and measure.

To notice, advertising is a leads downside, gross sales is a conversion downside, and supply is a lifetime worth (LTV) downside. Bumping LTV is essentially the most surefire option to enhance an organization’s worth.

In land, sometimes, the LTV is the revenue earned from the sale of a property. Most land companies barely, if ever, give attention to LTV as a key efficiency indicator (KPI) due to the dearth of continuity throughout the trade. Your LTV is mostly relegated to a one-off sale, from a singular product that has its personal specific value level.

No upsells. No downsells. No continuity.

I can hear the arguments forming, so let me head them off:

- Sure, an upsell could possibly be thought-about value-add to land, like a septic or cell residence set up, although that’s usually nonetheless all dealt with as one buy, which I might take into account a core provide.

- Proprietor financing may qualify as continuity, although every parcel of land continues to be distinctive, with its personal value and set of phrases, and there’s an eventual finish to funds.

- Repeat patrons may bump common LTV, however most land companies will not be arrange this fashion (for instance, specializing in promoting to builders or builders in a specific space).

- Accounting-wise, it makes extra sense to calculate LTV on the level of disposition, however technically you may attribute the metric to acquisitions, so if in case you have a repeat vendor or have wholesalers or realtors birddog for you, LTV may get bumped. This isn’t typical for many land companies.

So, since most land companies will give attention to growing leads and/or conversions, development ultimately plateaus. After all, you possibly can construct a stable seven-figure, maybe eight-figure, enterprise this fashion. That is nothing to sneeze at.

However a nine-figure, or a billion-dollar land flipping enterprise? I’ve by no means heard of 1, although forgive my ignorance if there’s. With a view to attain these heights, dramatically growing LTV is the one route.

Which inevitably, and counterintuitively, requires fewer prospects.

(As an apart, solely ~5% of United States non-public companies attain $1 million or extra of annual high line income. That’s already uncommon air if you’re at that mark. Then it’s about 1 in 250 above the $10 million mark, and about 1 in 3,000 above the $100 million income mark. I like the symmetry that with a view to develop 10X in measurement, it’s about 10X extra scarce within the stats. It’s all a numbers recreation; how large you get is immediately correlated with how good, and centered, you’re.)

How Elevating Our Minimal Deal Measurement From $10K to $50K Elevated Earnings

That is precisely what now we have been doing at Severe Land Capital over time.

We steadily raised our land investing minimal deal measurement from $10,000 to $20,000, and now to a $50,000 minimal. Each time we raised it, we priced out a bit of potential funding offers.

Psychologically, this was a tough capsule to swallow. We may nonetheless fund these $20,000 and $30,000 properties. The 2X margins usually exist at that degree, and we had finished very properly with them.

However here’s what modified: One ~$300,000 deal can ship the identical backend revenue as six or seven $50,000 offers (or ~30-50 desert sq. offers), usually requiring related due diligence effort per transaction.

The unconventional enterprise scaling tactic was deliberately lowering quantity to extend deal measurement (and LTV), though quantity felt like proof we have been “profitable.” And sure, this damage short-term as we adjusted operations. That’s the trade-off. Lengthy-term bets are required in enterprise, and usually the particular person with the longest time horizon wins. The most important operators in land — those doing tons of of hundreds of thousands or billions — work on fewer tasks with bigger test sizes.

So, we might slightly have the capability to tackle a higher variety of bigger tasks, even when it means sitting on liquidity till a greater alternative arises.

This trade adjustments by the yr, so we reserve the precise to alter our thoughts as new proof arises, however I’m laying my playing cards on the desk proper now.

There in all probability is a route for a land enterprise to do disgusting quantities of quantity to attain the identical measurement, however like Hormozi informed us on the stay occasion, whereas there are not any guidelines in enterprise, and loads of people have discovered success by following a route of lesser chance, why not play the chances and take the extra doubtless route? Enterprise is tough sufficient already.

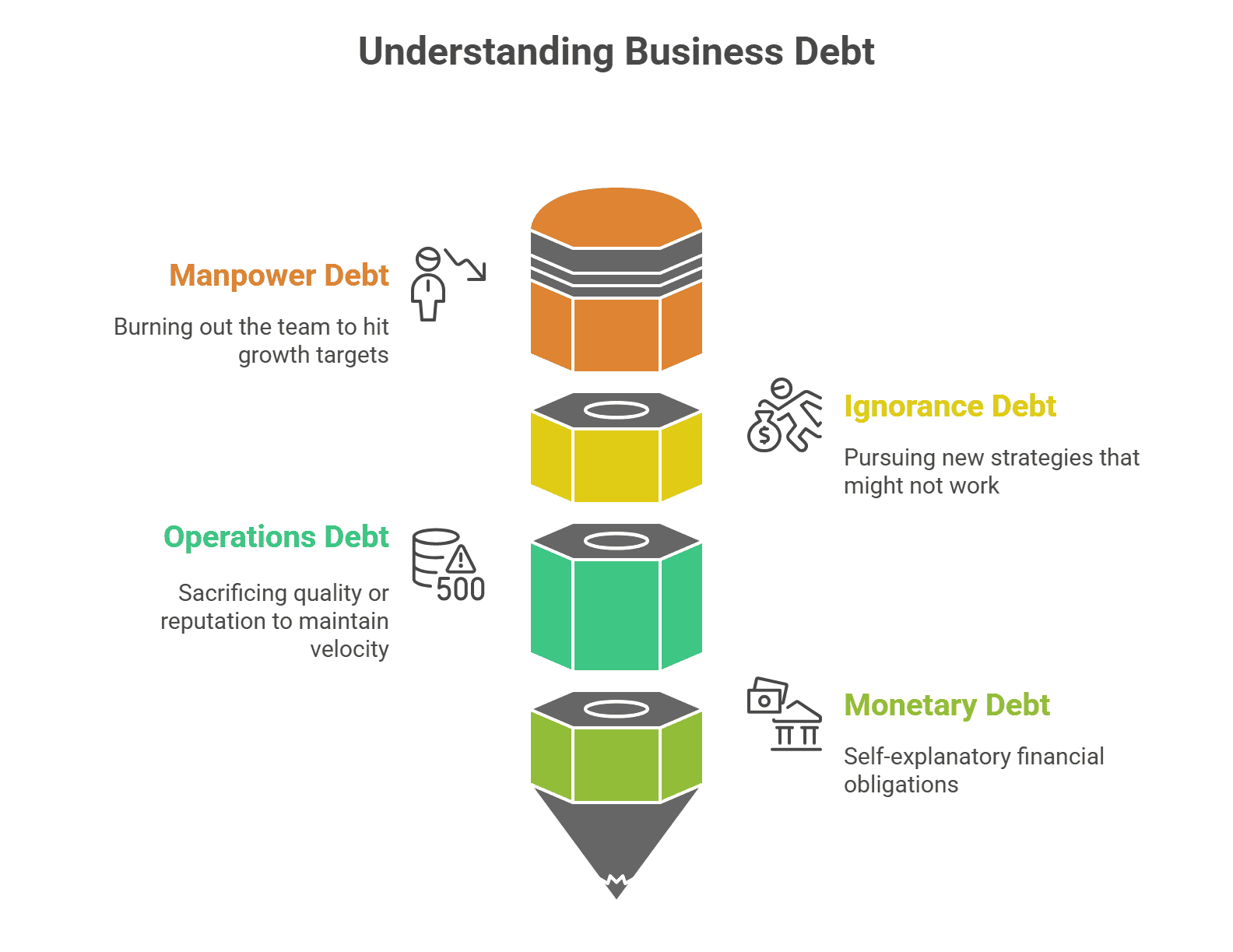

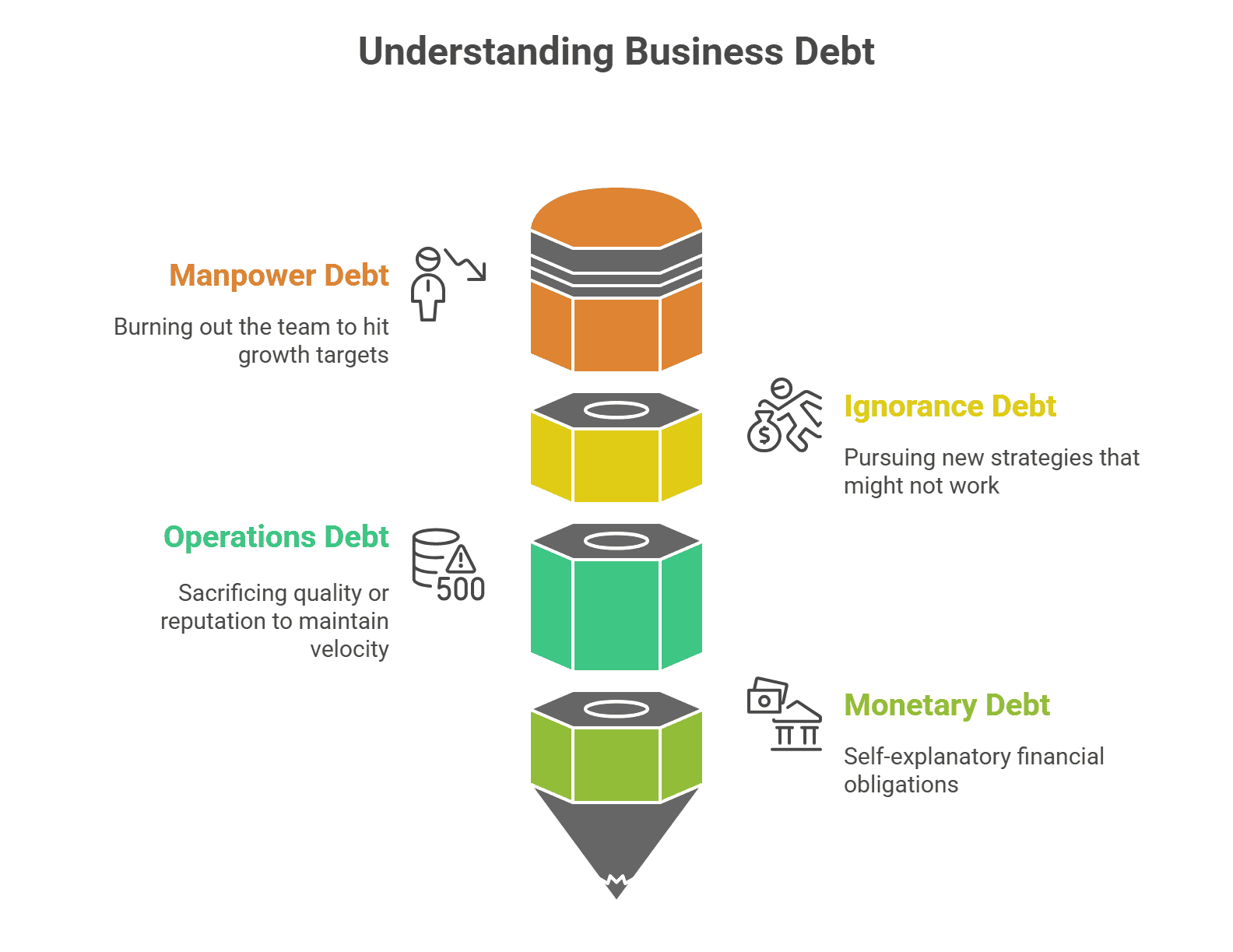

The 4 Kinds of Enterprise Debt You are Incurring Day by day (And Which One to Prioritize)

Here is one other fast lesson from the stay Alex Hormozi occasion: Each enterprise incurs debt each day.

You’re incurring debt on:

- Manpower – burning out your group to hit development targets

- Ignorance – pursuing new methods which may not work

- Operations – sacrificing high quality or repute to take care of velocity

- Financial – self-explanatory

Alex’s framework: At all times take out the debt in your enterprise that you would be able to pay again the quickest. For instance, burning the group laborious for six weeks to finish a significant AI buildout that creates leverage for years.

The error shouldn’t be acknowledging which debt you take on, and whether or not you possibly can really pay again earlier than it compounds right into a disaster.

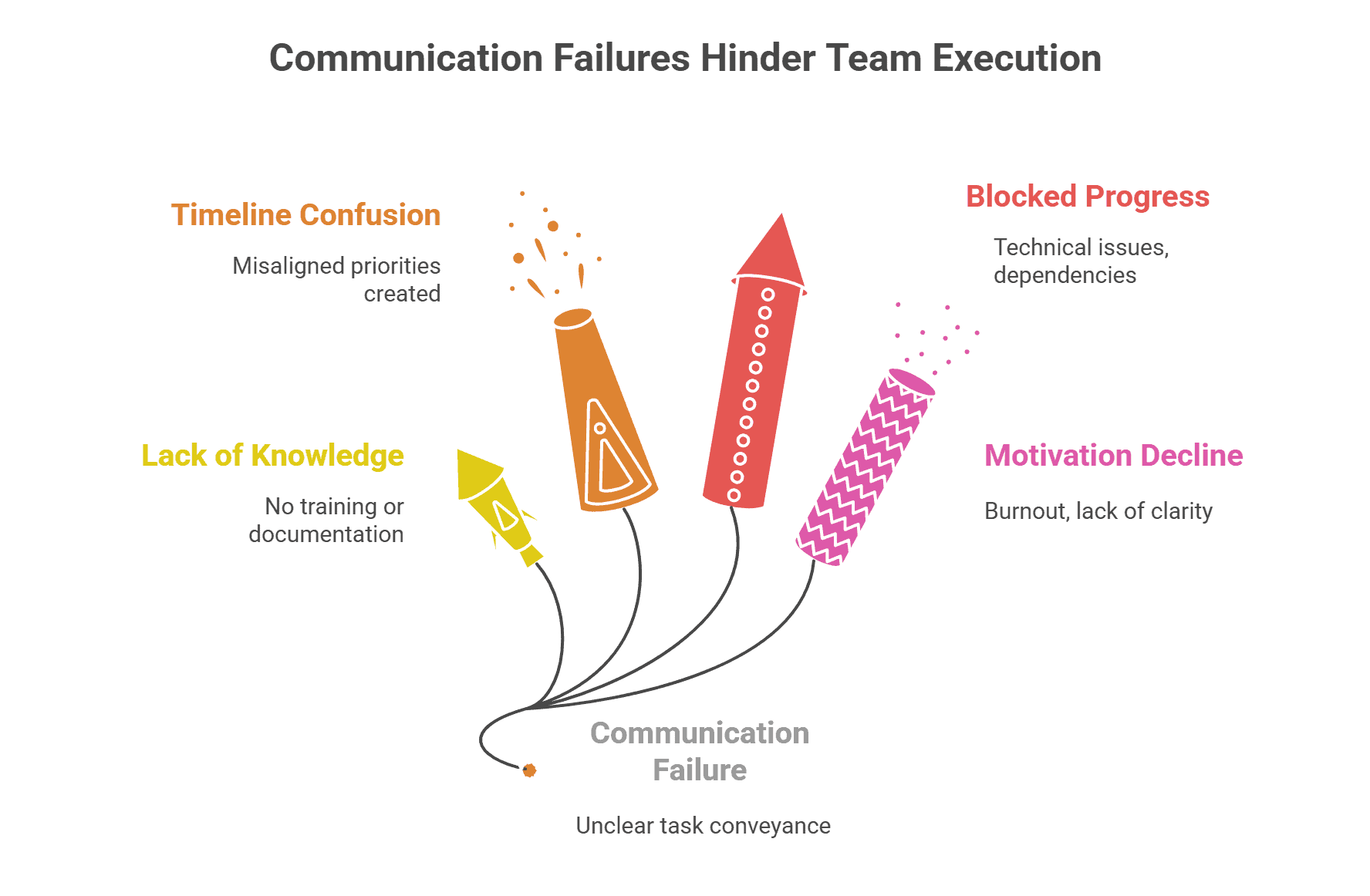

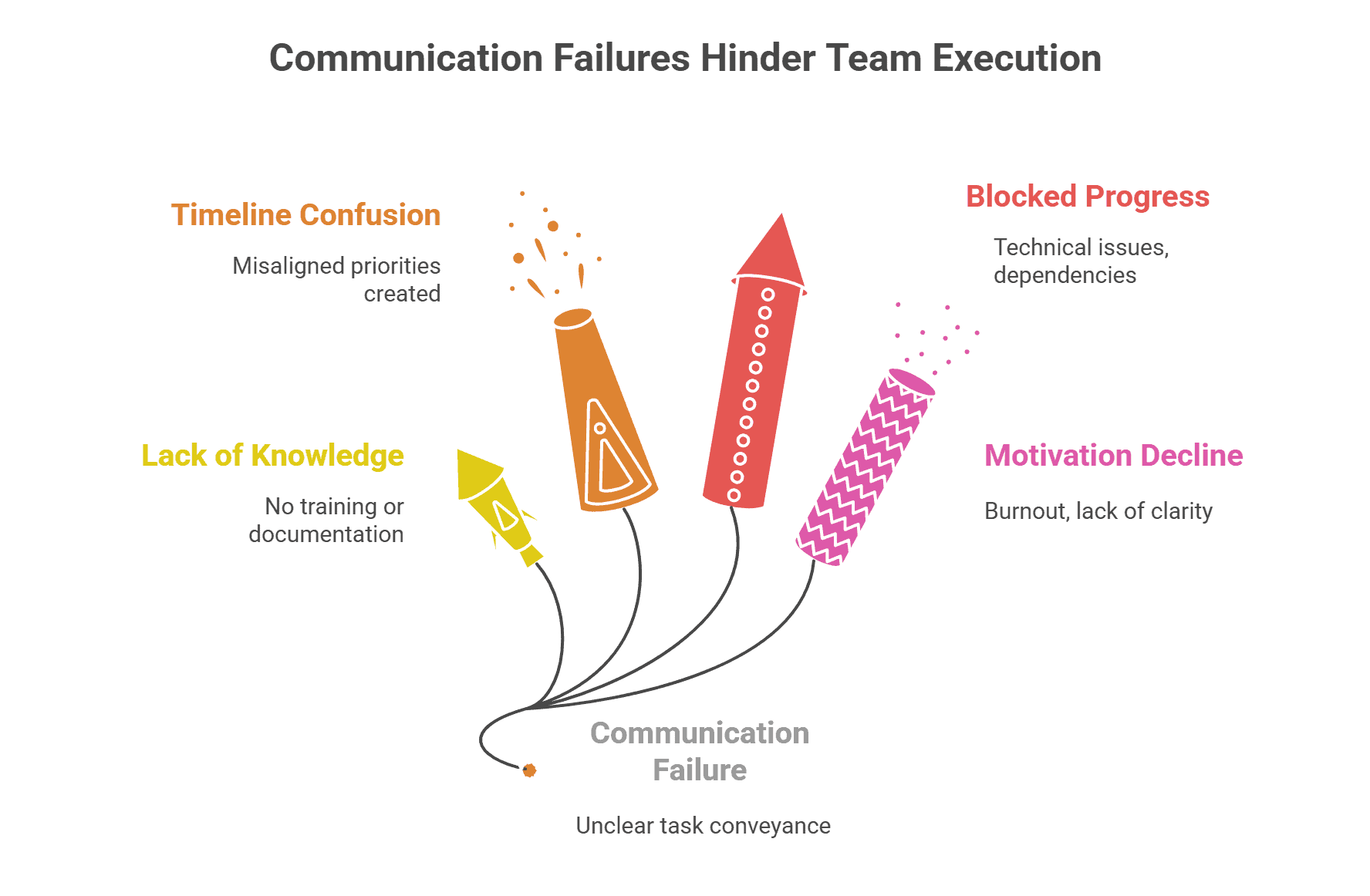

Why Your Workforce Is not Executing: The 5 Actual Constraints (And Find out how to Repair Them)

One other key lesson from Alex is to interrupt down the 5 actual causes staff don’t full work:

- They didn’t know you wished THAT finished. Communication failure; the duty was not clearly conveyed or bought misplaced in translation.

- They didn’t know HOW to do it. No coaching, no documentation, or no entry to the method.

- They didn’t know WHEN it was due. Timeline confusion creates misaligned priorities.

- They’re BLOCKED. Technical points, or dependencies on others.

- They don’t WANT to do it. Burnout, lack of readability on why it issues, or being overwhelmed by competing priorities.

Most execution issues stay in constraints 1-4. Repair these first earlier than assuming it’s a motivation concern. Most staff need to be of worth and contribute.

That is additionally the way you immediate AI successfully. The most effective AI prompting requires fixing all 5 of those constraints (together with motivating LLM fashions), which suggests the easiest way to speak with AI is additionally the easiest way to speak with people.

The Different Classes From Alex Hormozi Value Noting

- The ~$1-3 million income swamp. Most companies get caught right here as a result of they’ve confirmed they will function and homeowners have plateaued psychologically, however they haven’t solved for the subsequent constraint and can’t afford star expertise with out sacrificing many of the enterprise’s earnings. It is advisable focus 80% or extra of your time in your most important constraint and let different fires burn (and doubtlessly hand over main short-term earnings). What bought you to $1 million won’t get you to $10 million.

- The SPCL content material framework. Content material both primarily entertains or educates. The most effective performing instructional content material must show Standing, Energy, Credibility, and Likeness. Energy (giving instructions that produce constructive outcomes in your viewers) issues most, which is why my content material focuses relentlessly on tactical worth you possibly can implement in your life and enterprise. Seth would not graciously permit me to visitor put up on REtipster if it have been in any other case, proper?

- Concentrate on inside deliveries over exterior metrics. Cease obsessing over hitting $2 million or $5 million (or $10 million or $1 billion) income targets. As an alternative: “Can I make 100 chilly calls each day this month?” or “Can I assessment 10 on-market offers right this moment?” The inputs you management result in outputs you can’t power.

=====

Many of the above objects come again to at least one uncomfortable fact: Development requires doing issues that really feel incorrect within the short-term.

Each time I decide up a weight on the gymnasium, my mind instantly calls for that I put it down. Each time. And I’ve been coaching for 20+ years. Development by no means comes straightforward. Get uncomfortable, and maximize intent.

The operators who break by means of are those keen to implement counterintuitive development methods whereas their opponents keep snug with what’s working “properly sufficient” — till it does not.

=====

Searching for funding from operators who’ve carried out these frameworks at scale? Severe Land Capital’s 41% working margins didn’t come from remaining complacent in right this moment’s difficult market, they got here from counterintuitive strategic selections like elevating our minimal buy value to $50,000. Land investing expertise most popular, however not required. 100% shut price on dedicated offers.

Get Your Property Analyzed Immediately

Initially revealed at seriousland.capital on November 10, 2025.