Shopper developments are altering at breakneck pace. One thing could be in a single minute and out the subsequent – even the much-celebrated Dubai chocolate, which dominated spring 2025, has had its day.

So what’s on the way in which up and what’s on the way in which out as we enter Autumn 2025?

Going Up: Purposeful F&B

Shopper demand for purposeful meals and drinks is off the charts. From confectionery to espresso, the purposeful development is massive and in cost.

A lot in order that the worldwide purposeful meals and beverage market has been valued at over $281bn (€242bn) and is forecast hit half a trillion by 2028, in keeping with stats specialists Statista.

“Performance has change into the default client expectation – not a differentiator,” says Alon Chen, CEO of meals analytics group Tastewise.

Such is the attain of this development that 57.3% of non-alcoholic drinks gross sales at the moment are pushed by health-related wants.

In the meantime the dairy class is getting a serious increase from the rising curiosity in purposeful merchandise, with gross sales of kefir and reside yoghurt climbing quick.

And social mentions of adaptogens like ashwagandha and turmeric are rising 15.2% year-on-year, displaying simply how engaged customers are with them and their potential.

Going Up: Snacking

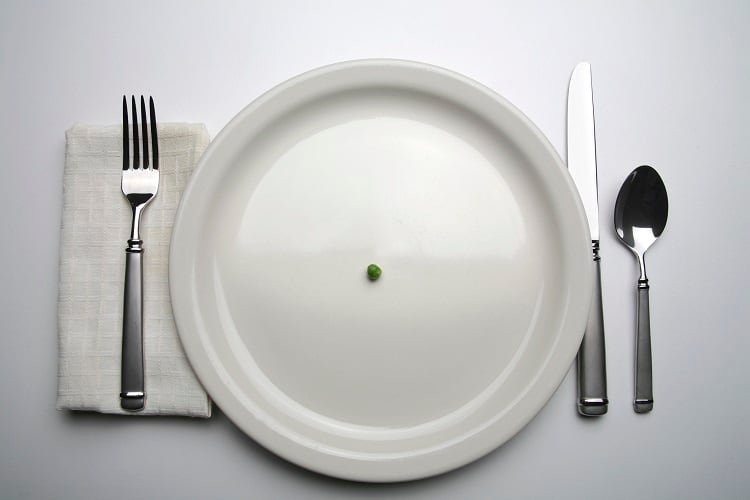

Snacking may be very a lot in, whereas important meals are on the way in which out.

Customers are more and more switching to the little-and-often method, in the case of mealtimes, pushing the snack meals market to a worldwide worth of $269.45bn in 2025 (Statista).

Common portion sizes for meals are lowering, whereas snack frequency has risen by 11.2% YoY. And gross sales of meal-replacement snacks, like protein bars and smoothies, are rising by 10.8% YoY (Tastewise).

Added to this, Tastewise is seeing breakfast skipping rising 7.1% YoY, whereas all-day snacking is rising by 6.6% YoY.

One of many causes for snacking’s success is definitely considered one of this 12 months’s megatrends – comfort.

Comfort as a consumption driver is rising 9.01% YoY, whereas satiety is climbing 6.5% YoY, highlighting the rising curiosity in nutrient-dense mini-meals over conventional sit-down meals.

And restaurant menu information helps this, displaying an 8.4% YoY common improve in menu appearances for snack gadgets.

Going Up: Thrilling flavours

Flavour is turning into a robust buy driver, even in health-led classes.

In response to Grand View Analysis, a key development is the rising demand for ethnic and regional flavours, pushed by globalisation, elevated journey, and a willingness to discover new tastes.

‘Intense flavour’ is driving client spending up by 53.4% YoY throughout baking, snacks, and condiments (Tastewise).

In the meantime social mentions of ‘zesty’ is up by 20.1% YoY, ‘fudgy’ by 13.4% YoY, and ‘wealthy’ by +9.6% YoY.

Going Down: Sustainability

Meals and beverage is working onerous to change to extra sustainable practices. From chopping meals waste to lowering CO2 emissions all through the provision chain, efforts are being made throughout the trade.

“Sustainability isn’t a banner declare, it’s more and more embedded in ingredient decisions,” says Tastewise’s Chen.

However whereas trade goes greener, customers are displaying indicators of disillusionment.

A current survey by EIT Meals Shopper Observatory confirmed fears that client curiosity in sustainability is weakening. In truth, outcomes confirmed that simply 9% or Europeans prioritise sustainability of their lives.

Moreover, the variety of customers who think about sustainability, when making buying decisions, has declined from 51% to 46%, since 2020.

“In recent times, now we have seen a drop within the variety of customers who’re taking sustainability under consideration when selecting their diets,” says Klaus Grunert, professor at Denmark’s Aarhus College and director of EIT Meals Shopper Observatory.

And there are a number of causes for this. The primary being value, with 31% of these surveyed saying price range is the principle barrier to procuring sustainably.

In response to analysis, carried out by Dutch consulting firm Kearny, the costs of sustainable merchandise are on common 75-80% increased than non-sustainable merchandise.

One other main challenge going through customers, and it’s one which comes up repeatedly in relation to the meals and beverage trade, is confusion.

“Whereas sustainability stays necessary, customers are sometimes uncertain about what sustainable consuming really means,” explains Grunert.

Lastly, the phenomenon generally known as ‘disaster fatigue’ is having a detrimental affect on client attitudes in direction of sustainability.

For years, customers have been bombarded with detrimental messaging about the way forward for the planet and, as the issue grows, so too does the continual detrimental chatter. That is having the other impact to what environmentalists would hope, significantly amongst youthful customers.

“Disaster fatigue is sporting customers out,” says Aditi Kohli, senior vp APAC at market analysis specialists GWI. “Gen Z have gotten extra inward going through, specializing in themselves and their rapid circles. Their curiosity in environmental points and present affairs is ticking downwards. It’s not as a result of they don’t care, however relatively it’s a case of psychological bandwidth and prioritisation being a necessity.”

However, although customers will not be engaged with the topic of sustainability, its basic to the way forward for meals and beverage, that it stays a precedence.

Going Down: Alcohol consumption

Alcohol has been a stalwart of the beverage trade for hundreds of years. From wines and spirits to beers and cocktails, gross sales have been sturdy and customers loyal.

However, consumption has been falling steadily because the mid-2000s, and the development can not be ignored. Alcohol, it appears, has very a lot fallen from favour.

Although a results of a number of societal modifications, the shift away from alcohol can largely be attributed to the rise of the well being and wellness development.

“The world as we all know it has change into much more obsessive about well being, particularly since 2020,” says Freya Twigden, founding father of kombucha model Fix8 Kombucha and Fibe Prebiotic Soda.

What’s extra, types of leisure have modified dramatically. Pubs and golf equipment have been changed by gyms and health occasions, with #health, #fitspo, #fitfam and #fitgoals now dominating social media.

Value can be a serious affect within the decline of alcohol consumption.

In response to Eurostat, a division of the European Fee, the price of alcohol has risen by greater than 95% since 2000.

Going Down: Restrictive diets

Restrictive diets, such because the ketogenic food regimen (keto), have dominated meals and beverage for many years. However current figures from Tastewise present curiosity on this excessive method to weight-loss is waning, as different strategies achieve traction.

In truth, curiosity within the keto food regimen has dropped 4.6% YoY.

This decline, says Emily Vencat of protein model YouBar, shouldn’t be essentially on account of a scarcity of effectiveness however relatively issue in sustaining such a restrictive consuming sample over the long run.

“Because the keto development declines, many people are searching for extra balanced and sustainable approaches to vitamin,” says Vencat.

Diets that target a wholefoods together with fruits, greens, wholegrains, and lean proteins, are more and more gaining recognition. These approaches provide higher flexibility and are simpler to take care of, making them extra interesting to a broader viewers.

As client priorities proceed to shift, the meals and beverage trade should keep agile, able to embrace rising developments like performance, snacking, and daring flavours, whereas rethinking methods round sustainability, alcohol, and restrictive diets.

The winners can be those that hear carefully, innovate shortly, and ship what at present’s customers really crave.