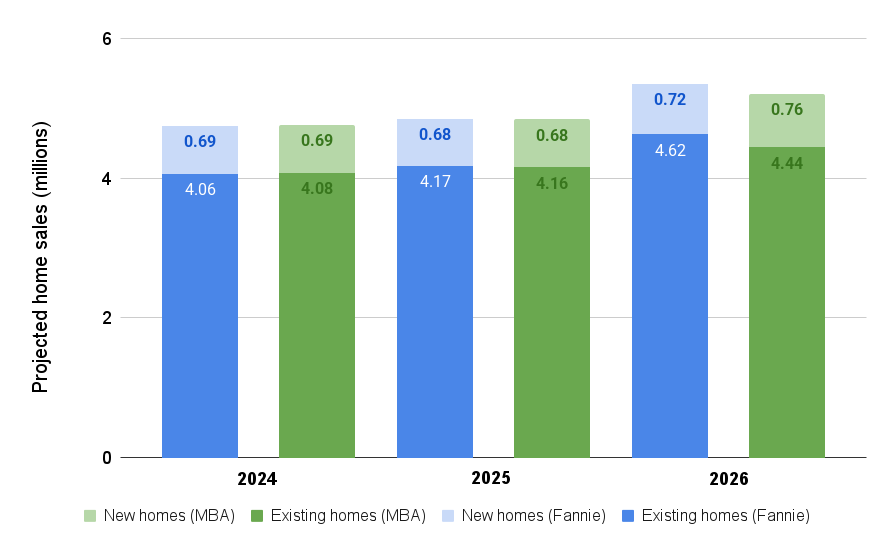

Forecasters at two mortgage business giants anticipate house gross sales to rebound subsequent 12 months as worth appreciation continues to decelerate and mortgage charges come down.

However the carefully watched forecasts from Fannie Mae and the Mortgage Bankers Affiliation differ markedly of their projections of how briskly house worth appreciation may cool and the way a lot room mortgage charges have to return down.

In a forecast launched Thursday, Fannie Mae’s Financial and Strategic Analysis (ESR) Group projected house gross sales will surge by 10 p.c subsequent 12 months, to five.35 million, as mortgage charges fall to six p.c by This fall.

TAKE THE INMAN INTEL SURVEY FOR JULY

The Mortgage Bankers Affiliation’s newest forecast, revealed on July 17, tasks a extra modest 7 p.c rebound in 2026 gross sales, to five.2 million.

House gross sales forecasts diverge

Supply: Fannie Mae and Mortgage Bankers Affiliation forecasts, July 2025.

Whereas Fannie Mae is forecasting gross sales of present properties will develop by 451,000 subsequent 12 months, to 4.62 million, the MBA forecasts present house gross sales will solely develop by 285,000, to 4.44 million.

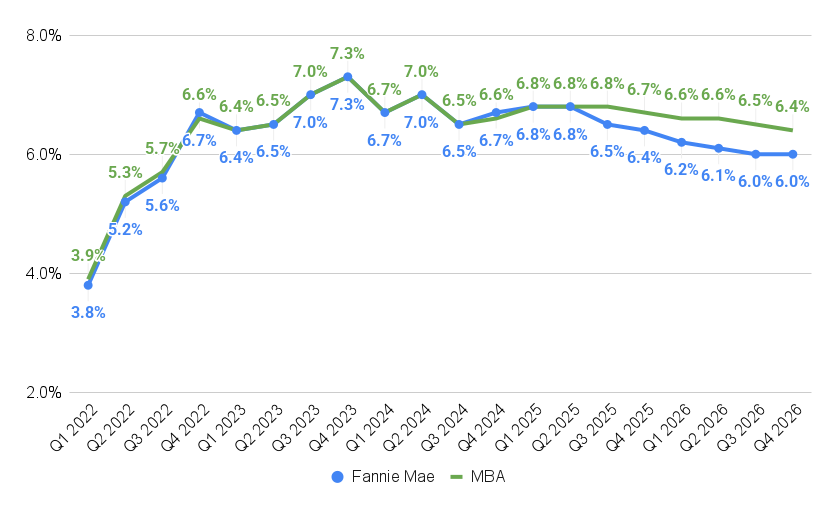

That’s due partially to Fannie Mae’s extra optimistic outlook for mortgage charges to return down.

How briskly will mortgage charges fall?

Supply: Fannie Mae and Mortgage Bankers Affiliation forecasts, July 2025.

Fannie Mae’s ESR Group thinks charges on 30-year fixed-rate mortgages may drop to six.4 p.c by the tip of the 12 months, and common 6 p.c through the second half of 2026.

The MBA’s extra cautious forecast is that mortgage charges will stay within the excessive sixes this 12 months, falling solely steadily to six.4 p.c by This fall 2026.

Which mortgage price forecast proves to be extra correct may have vital real-world impacts.

Mark Zandi

“House gross sales, homebuilding, and even home costs are set to hunch except mortgage charges decline materially from their present close to 7 p.c quickly,” Moody’s Chief Economist Mark Zandi warned final week. “That, nevertheless, appears unlikely.”

With the Trump administration and the Federal Reserve locked in a battle of wills, it’s not straightforward to foretell the place mortgage charges will probably be just a few months from now — not to mention subsequent 12 months.

Federal Reserve policymakers have resisted the Trump administration’s calls to chop short-term rates of interest, saying they want time to evaluate whether or not insurance policies in areas together with tariffs, immigration, taxes and regulation will rekindle inflation.

The CME FedWatch Device, which tracks futures markets to foretell future Fed strikes, exhibits buyers on Thursday suppose there’s solely a 3 p.c probability the central financial institution will lower charges at its July 30 assembly, however a 62 p.c probability of a Sept. 17 price lower.

A Fed price lower wouldn’t essentially imply decrease mortgage charges, since charges on long-term investments like U.S. Treasurys and mortgage-backed securities are based mostly on investor demand.

The final time the Fed lower the short-term federal funds price — by a full proportion level over three months on the finish of final 12 months — mortgage charges elevated by an equal quantity as incoming financial information instructed inflation was on the rise once more.

The newest studying of the buyer worth index (CPI) confirmed annual inflation moved away from the Federal Reserve’s 2 p.c objective in June for the second month in a row as tariffs on imports started to be handed on to shoppers.

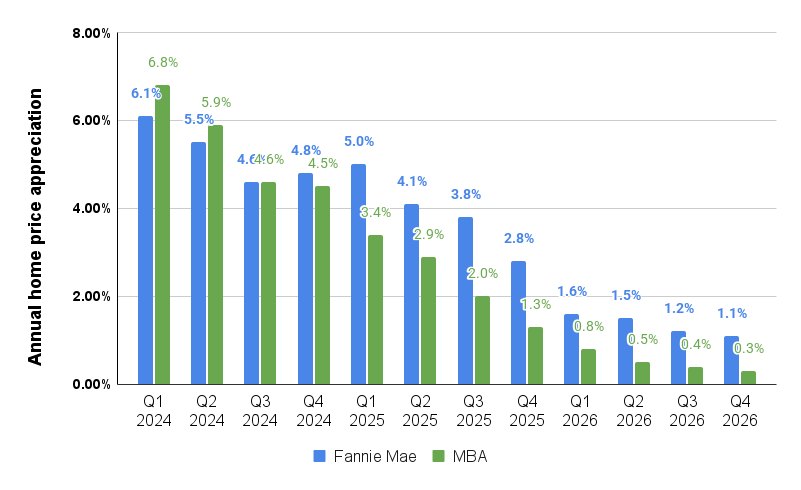

One other issue weighing on house gross sales has been affordability, with double-digit house worth appreciation through the pandemic pricing many would-be homebuyers out of the market.

Economists at Fannie Mae and Freddie Mac anticipate house worth appreciation to proceed to chill this 12 months and subsequent, however differ on how drastically.

House worth appreciation cooling

Supply: Fannie Mae and Mortgage Bankers Affiliation forecasts, July 2025.

The MBA’s July 17 forecast envisions house worth appreciation slipping to 1.3 p.c by the tip of this 12 months, and just about working out of steam by the tip of 2026, hitting 0.3 p.c in This fall.

Fannie Mae economists suppose the run-up in house costs will cool extra steadily, to 2.8 p.c by the tip of this 12 months and 1.1 p.c in This fall 2025.

These projections are based mostly on the Fannie Mae House Value Index, a nationwide, repeat-transaction house worth that measured Q2 annual house worth appreciation at 4.1 p.c.

The MBA appears to be like on the FHFA purchase-only Home Value Index, which confirmed house worth appreciation cooled to 3 p.c in April.

Redfin’s June House Value Index put annual house worth progress at 3.4 p.c, the bottom stage seen since 2023.

As nationwide house worth appreciation cools, many markets are already seeing worth declines.

The ICE House Value Index measured annual house worth progress slowing to 1.3 p.c in early June — and located house costs had been down by not less than a full proportion level from their peaks in 31 the 100 largest U.S. housing markets.

Markets experiencing the most important declines included Austin, Texas (-19.7 p.c), Cape Coral, Florida (-13.3 p.c), San Francisco (-8.9 p.c), Phoenix (-5.7 p.c), Boise Metropolis, Idaho (-5.2 p.c), Denver, Colorado (-3.6 p.c) and Dallas, Texas (-3.2 p.c), ICE Mortgage Know-how reported this month.

Get Inman’s Mortgage Temporary E-newsletter delivered proper to your inbox. A weekly roundup of all the most important information on the planet of mortgages and closings delivered each Wednesday. Click on right here to subscribe.

Electronic mail Matt Carter