That is an extract from a current report “The Age of storage: Batteries primed for India’s energy markets” by EMBER.

Position of batteries in India’s energy market

Excessive value swings in wholesale electrical energy markets and rising issues round grid instability are opening up new markets for vitality storage. Batteries at the moment are a essential resolution to drive worth for each capital and customers. Battery participation in energy markets, with out long-term contracts, has usually been seen as a low-return enterprise riddled with unsure income streams. However India’s evolving electrical energy panorama has created an atmosphere the place battery vitality storage programs (BESS) can earn sturdy returns from energy exchanges, whereas providing essential system-level assist to the grid.

Batteries are more and more recognised because the multitool of the facility sector transition. A versatile resolution able to addressing numerous challenges emanating from a high-renewables grid, from storing low-cost renewable vitality to making sure real-time grid stability, batteries resolve a number of issues. But their large-scale deployment has, till not too long ago, been constrained by excessive upfront prices and unsure income streams.

As extra variable renewable vitality enters India’s electrical energy grid, coinciding with sharp declines in battery prices, new enterprise circumstances are rising for BESS. One significantly promising alternative is battery participation in India’s wholesale energy and ancillary companies market. Value volatility within the day-ahead market section of the facility exchanges is changing into the norm. Electrical energy costs at the moment are repeatedly crashing throughout photo voltaic hours and surging in the course of the evenings and nights. BESS should purchase electrical energy, cost when costs are low and promote when the charges surge. This distinctive means permits them to not solely generate income from the market inefficiency but additionally scale back the volatility over time. The report finds that this type of arbitrage alone is sufficient to get well the total lifecycle prices of BESS. Add ancillary (grid balancing) companies, and the situation improves additional. Batteries’ means to retailer vitality and ramp rapidly can basically reshape how grid balancing reserves have labored in India. With the regulatory groundwork in place and the economics making sense, BESS, even with out long-term energy buy agreements, seems poised to steadiness a renewables-heavy grid whereas delivering sturdy returns.

Market challenges

The power of BESS to cost throughout low-price surplus durations and discharge throughout high-price peaks makes it well-suited to handle value volatility. Nevertheless, the core precept stays: the income alternative of service provider BESS is proportional to the magnitude of the issue it addresses—on this case, the extent of value volatility.

The power of BESS to cost throughout low-price surplus durations and discharge throughout high-price peaks makes it well-suited to handle value volatility. Nevertheless, the core precept stays: the income alternative of service provider BESS is proportional to the magnitude of the issue it addresses—on this case, the extent of value volatility.

Value volatility within the day-ahead market section of the facility exchanges is changing into the norm. Electrical energy costs at the moment are repeatedly crashing throughout photo voltaic hours and surging in the course of the evenings and nights. In 2025, there have been a number of mid-day value crashes throughout market segments. Unexpectedly low demand resulting from unseasonal rains, mixed with surplus mid-day technology, significantly from photo voltaic, have been the important thing drivers of the crashes. On lots of the identical days, costs surged within the night, usually touching the market value cap.

In January 2025, the hole between the typical mid-day and late night costs rose from Rs 1.5 per kWh in 2019 to Rs 5.5 per kWh in 2025, a 24 per cent annual improve. In June 2025, this hole jumped from Rs 2.5 per kWh to Rs 7.5 per kWh, reflecting a 17 per cent rise. Since 2022, peak costs above Rs 9 per kWh have occurred round 6,500 occasions yearly, almost 18 per cent of all time blocks. In the meantime, ultra-low costs beneath Rs 1 per kWh are rising rapidly, from 375 situations in 2024 to 514 in simply the primary half of 2025. One factor is obvious: such market swings are not remoted occasions; they’re changing into a daily characteristic on India’s energy exchanges.

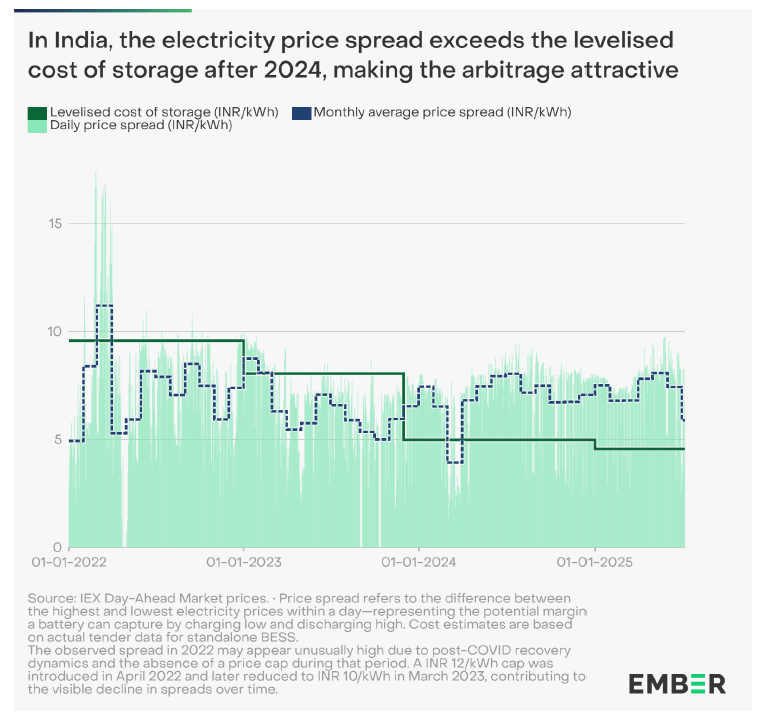

Massive fluctuations or volatility in costs can disrupt any market. The determine above reveals the every day hourly hole between the very best and lowest DAM costs throughout every 24-hour cycle, the typical unfold throughout every month and the LCOS. Frequent value crashes can severely affect the money flows of present service provider mills and discourage new capability from getting into the facility markets. In India, photo voltaic’s share in whole technology rose from 3.3 per cent in 2019 to 7.4 per cent in 2024, whereas the estimated common annual seize price on the IEX Day forward market (DAM) dropped from 93 per cent to 70 per cent in the identical interval. Clearly, falling seize charges have an effect on the profitability of service provider photo voltaic, which is primarily designed to function in energy exchanges.

Grid frequency can be a essential indicator of the well being of the facility system. As per the Indian Electrical energy Grid Code, the suitable frequency vary is 49.90 Hz to 50.05 Hz, with 50 Hz because the nationwide reference frequency. Deviations past acceptable limits can compromise reliability. On 26 Might 2025, each upward and downward spinning reserves have been insufficient. Downward reserves have been close to zero for 5 mid-day hours, whereas upward reserves have been zero for 3 hours late at evening. Such circumstances expose the grid to sudden outages, with restricted capability to revive steadiness rapidly. Such situations have turn into extra frequent and now symbolize systemic points.

Economics of service provider BESS

Service provider batteries are poised for enticing returns in India. Battery storage in India has moved from a promising expertise to a totally bankable grid asset. A big drop in battery prices and widening wholesale-price spreads imply a well-operated system can cowl its bills and nonetheless ship enticing earnings.

Over the previous decade, battery prices have declined considerably from round Rs 7.9 million per MWh in 2015 to Rs 1.7 million per MWh in 2025 (a median year-on-year decline of 14 per cent). In parallel, revenues from market participation have elevated fivefold, from Rs 0.5 million per MWh in 2015 to Rs 2.4 million per MWh in 2025. In 2024, estimated revenues surpassed prices for the primary time, marking a elementary shift within the enterprise case for Service provider BESS.

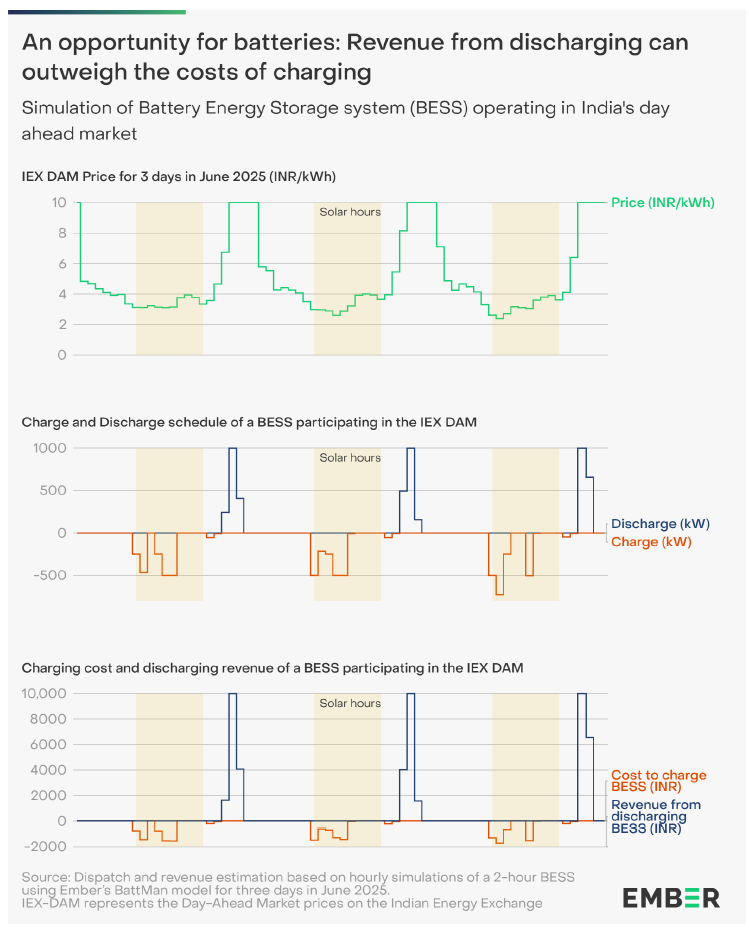

A system put in in 2025 can earn round Rs 2.7 million per MWh per yr from day-ahead market arbitrage, plus Rs 0.7 million per MWh per yr from ancillary companies, averaged over its lifetime. Arbitrage within the DAM contributes almost 80–85 per cent of whole earnings, whereas ancillary companies account for the remaining 15–20 per cent. Below optimistic assumptions, annual revenues attain Rs 3.3 million per MWh, pushing challenge inner price of returns (IRRs) to round 24 per cent. Even below conservative value spreads, returns stay sturdy at 21 per cent. Service provider BESS with 1–2 hour durations earn greater IRRs (15–22 per cent) than 4-hour programs (13–18 per cent) due to their means to take advantage of higher value arbitrage by means of quicker charge-discharge cycles. The chart beneath illustrates how a 2-hour battery can seize DAM value spreads over three days in June 2025, utilizing 2024 IEX-DAM costs. When value spreads within the DAM persistently surpass LCOS, it alerts that batteries can earn sufficient from pure arbitrage to get well their full lifecycle prices.

Totally different variables, each monetary and technical, can considerably have an effect on the returns of a BESS challenge. But the general uncertainty launched stays restricted, with IRR fluctuating by solely ±2 per cent. This means that BESS tasks can preserve enticing returns regardless of variability throughout value and technical parameters.

Conclusion

The sturdy enterprise case for service provider BESS presents the prospect for batteries to fulfil their long-held promise of being essential to assist a high-renewables grid. With rising value volatility and the rising want for fast-acting reserves, the case for battery storage is obvious. They ship essential system-level worth in two key areas:

- Lowering value volatility and enhancing liquidity in short-term markets.

- Enabling quick response for real-time grid balancing.

Not too long ago, India hit a milestone of fifty per cent non-fossil gasoline energy technology capability. The power of its electrical energy grid to maintain accommodating extra variable renewable vitality will rely upon whether or not builders, buyers and stakeholders are capable of speed up the daybreak of the age of battery storage.

Acces the report right here.