On this episode, I’m joined as soon as once more by Vernon Henry, a land investor and former skilled landman with over 20 years of expertise in mineral rights.

In case you’ve ever purchased or offered land and puzzled, Do I personal the mineral rights, or may an vitality firm drill on my property? This episode is for you.

Vernon breaks down the complicated world of mineral rights into easy, actionable data. We cowl:

- What mineral rights truly are

- How they’re severed from floor rights

- Vertical and horizontal severance

- The right way to decide if you happen to personal the minerals

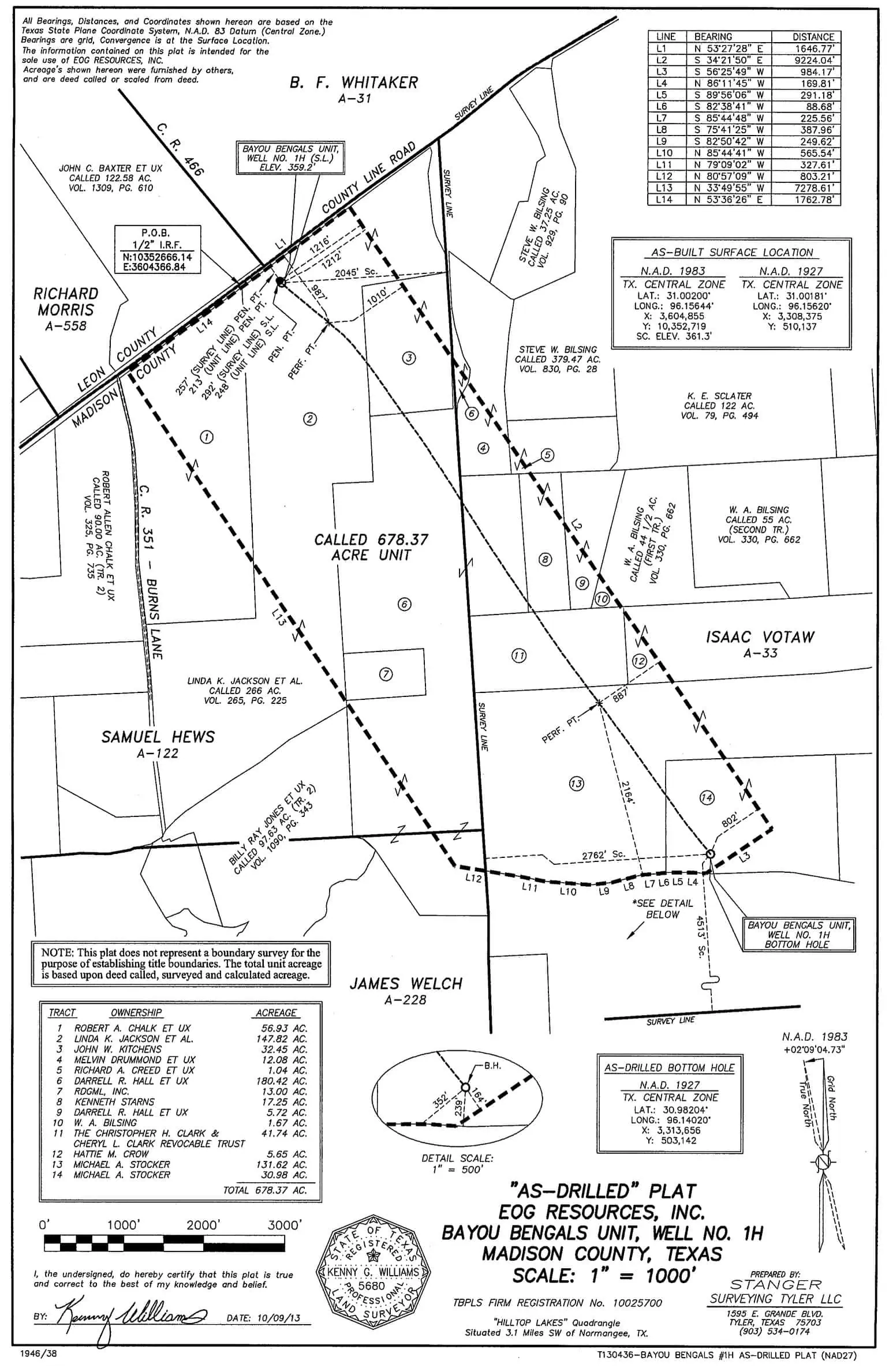

- How oil corporations pool models

- Why landowners obtain royalties

- The right way to worth mineral rights

- The place to promote or purchase mineral rights

- What to do in case your property sits above useful sources

This can be a must-listen for anybody in land investing, actual property, or mineral acquisition.

Hyperlinks and Assets

Key Takeaways

On this episode, you’ll:

- Learn the way mineral rights are separate from floor rights and should not switch together with your land deed, even when the title seems clear.

- Uncover that mineral rights homeowners have dominant authorized rights over floor homeowners and might entry their minerals by means of your property with compensation.

- Perceive that mineral rights require specialised title searches going again to unique authorities patents, which common title corporations do not carry out.

- Discover out about marketplaces like EnergyNet and U.S. Mineral Alternate for getting/promoting mineral rights, plus rent landmen for analysis.

- Notice that mineral rights can considerably enhance your land’s worth by means of lease bonuses and 20-25% royalty funds from manufacturing.

Mineral Rights Q&A: Possession and Title Fundamentals

Are mineral deeds a very separate doc from a traditional guarantee deed, or are the 2 ever mixed?

Mineral deeds will be separate or included in a guaranty deed. Until particularly excluded, mineral rights will convey to the Grantee in a Common Guarantee Deed. In the event that they’re severed, a mineral deed (or reservation clause) is often used to convey (or retain) simply the subsurface rights.

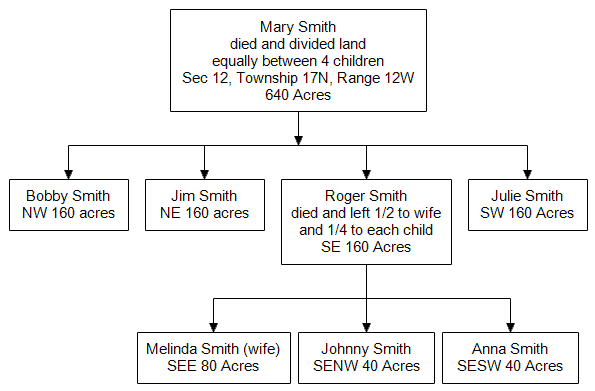

Over time, mineral rights could also be reserved throughout property transfers, so by the point a purchaser purchases a property at this time, the mineral rights might have been reserved a number of generations earlier. That is mirrored within the chain of title, which exhibits how possession of each the floor and minerals has modified over time. It’s normal to see floor and mineral estates break up a long time in the past.

In case you presently personal each the floor and the mineral rights, you may reserve your minerals when conveying the floor. To do that, you could embody a reservation clause within the deed on the time of sale. As soon as recorded, that reservation turns into a part of the official report and stays with you except you later switch or promote these mineral rights individually.

How far down into the earth do mineral rights go except specified in any other case?

Until in any other case restricted by contract or legislation, mineral rights prolong to the middle of the Earth. Nonetheless, they are often restricted by depth (e.g., “rights beneath 5,000 toes”).

In sensible phrases, oil and fuel improvement hardly ever goes deeper than 12,000 to fifteen,000 toes of complete vertical depth. Past this depth, the warmth and stress within the subsurface are so excessive that they degrade hydrocarbons and make drilling uneconomical or technically unfeasible. Most industrial oil and fuel reservoirs are positioned between 2,000 and 10,000 toes deep.

Moreover, as you go deeper, hydrocarbons endure thermal maturation. Oil turns into fuel underneath ample warmth and stress, which means that deeper zones are likely to include pure fuel fairly than oil. These geological and thermal limits outline the place mineral rights are prone to maintain worth primarily based on improvement potential.

Why would somebody carve out a sure depth of mineral rights?

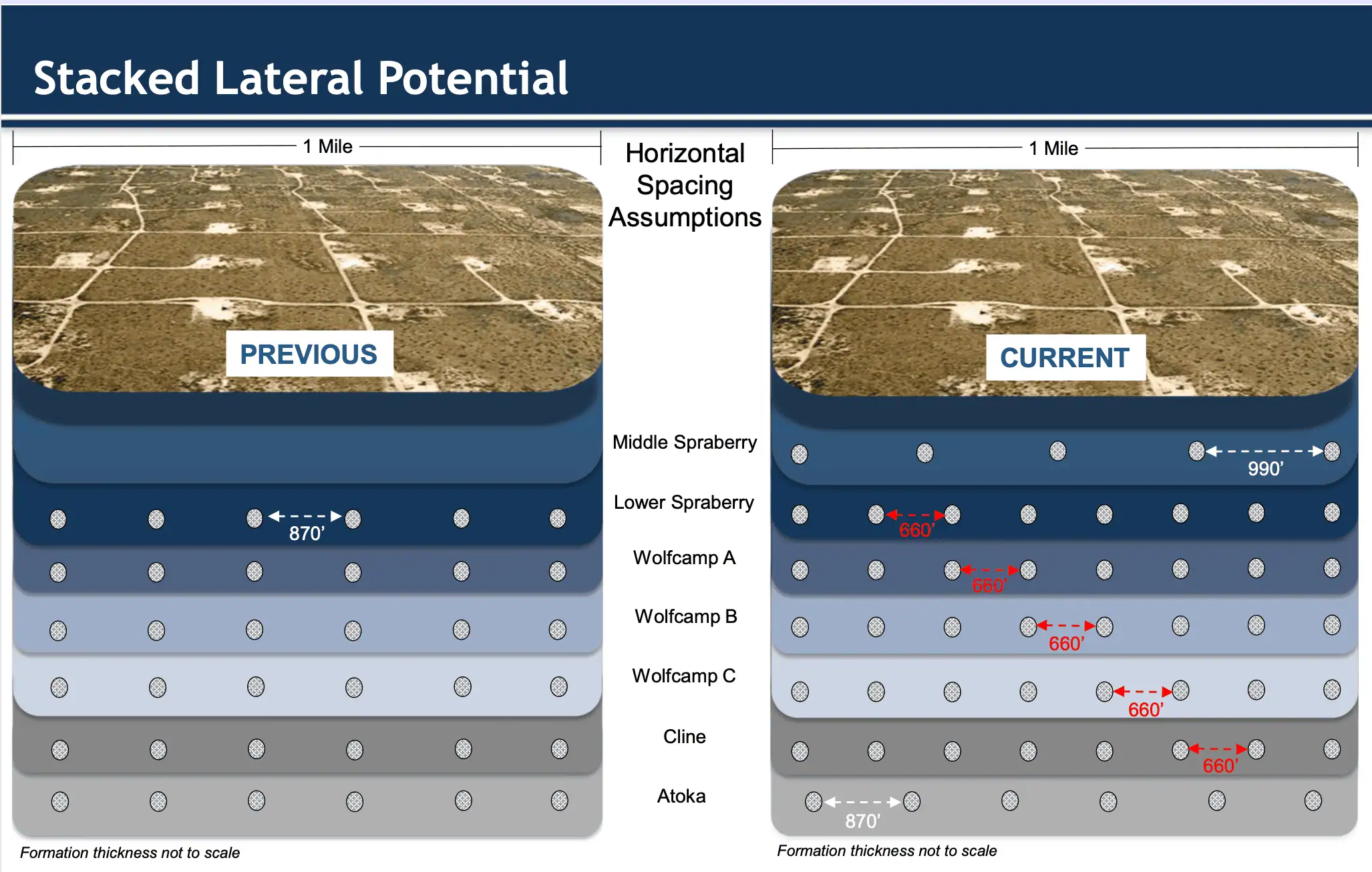

To maintain rights to particular formations (e.g., shallow fuel) whereas promoting deeper rights or to construction offers with a number of consumers/operators. It is usually completed to guard potential upside in stacked formations.

For instance, within the Permian Basin, productive formations just like the Wolfcamp or Spraberry can vary between 6,000 and 10,000 toes in depth. A mineral proprietor might select to promote solely rights beneath 7,500 toes to a purchaser focusing on the Wolfcamp whereas retaining shallower rights the place one other operator would possibly ultimately drill.

These selections usually hinge on danger tolerance and money circulate wants. Some homeowners promote rights beneath a sure depth in change for a lump-sum fee, primarily buying and selling potential future royalties for assured cash now. Consumers—usually specialised mineral acquisition corporations—assume the chance {that a} sure formation will ultimately produce, hoping to revenue from future lease or royalty earnings. Others select to order sure depths as a result of they imagine these intervals will turn out to be economically viable sooner or later, notably as expertise or market costs evolve.

This type of depth-based severance is frequent in basins with stacked pays just like the Midland Basin, Delaware Basin, or the DJ Basin, the place a number of productive formations exist at various depths.

Do mineral title searches have to return to sovereignty?

Sure—in contrast to floor title (which regularly solely goes again 40 to 60 years), mineral title should be traced again to sovereignty—which means the unique land patent from the federal government. That is as a result of mineral rights will be break up, reserved, or partially conveyed at any level within the chain of title, and people early selections have an effect on possession all the best way to the current.

Why that is vital:

For instance in 1890, the federal authorities patents a 640-acre tract to John Smith. He owns 100% of the minerals. In 1910, John sells the floor however reserves 50% of the mineral rights. From that time on, each subsequent transaction of that tract will solely contain a portion of the mineral property—except somebody explicitly conveys or reunites the total curiosity (which is uncommon).

Now think about that in 1930, one of many mineral homeowners sells half of their 50% curiosity to a neighbor. That new curiosity begins its personal chain of title—separate from the unique. Then in 1950, that purchaser dies and leaves their minerals to a few kids. Then in 1975, a type of children sells their 1/6 curiosity to a distinct particular person, and so forth…

Every of those branching occasions creates a brand new “chain” of mineral possession. So a whole mineral title search has to:

- Establish each chain created by a severance or transaction

- Hint every chain individually, usually by means of a number of generations, gross sales, probates, and presents

- Reconcile all of the chains so as to add as much as a full 100% of the mineral property

In case you miss even one fractional curiosity from a long time in the past, it may possibly throw off possession at this time—and you might not even have the authorized proper to lease, promote, or acquire income on 100% of the minerals.

This is the reason mineral title work is usually completed by landmen, title attorneys, or abstractors who focus on vitality title. It requires a distinct stage of element than conventional actual property titles—and much more digging. You are not simply confirming possession—you are reconstructing the total puzzle over a long time and even centuries.

Are you able to specify sure minerals when conveying or reserving rights?

Sure—mineral rights are sometimes described as a “bundle of sticks,” which means they are often separated and transferred in some ways. You do not have to promote or reserve all the mineral rights underneath a property. As a substitute, you may carve out particular minerals or particular rights associated to these minerals.

You possibly can divide by kind of mineral:

When conveying or reserving rights, you may specify:

- Solely oil

- Solely fuel

- Oil and fuel, however not coal

- Arduous rock minerals like lithium, copper, or gold

- Aggregates like gravel or sand (if thought-about a mineral underneath state legislation)

One of these reservation is frequent in areas the place sure sources are being actively developed—for instance, somebody would possibly promote the floor and preserve the lithium rights as a result of a battery-grade lithium venture is transferring in close by.

You can even divide by kind of proper:

Even inside a single mineral property, completely different rights will be break up up and owned by completely different events. These embody:

- Government rights – The proper to barter and signal leases with operators

- Bonus rights – The proper to obtain upfront lease funds

- Royalty rights – The proper to obtain a share of manufacturing income

- Leasing rights – The proper to lease minerals for exploration and improvement

- Proper of ingress/egress – The proper to entry the floor to develop minerals (usually tied to government rights)

For instance, one particular person would possibly personal the manager rights and get to barter leases, whereas one other particular person owns the royalty curiosity and will get the income.

It began unified—however hardly ever stays that approach.

Initially, one particular person (or household) doubtless owned 100% of the minerals and all related rights. However over time, by means of gross sales, inheritance, and offers with traders or builders, these rights are sometimes “sliced and diced” throughout a number of events.

That is why understanding what’s being conveyed or reserved—and what’s already been separated—is crucial earlier than shopping for or promoting mineral pursuits.

What does it imply to switch 20% of mineral rights?

On the floor, “20% of mineral rights” sounds easy—however in authorized phrases, it may possibly imply very various things relying on how the deed is worded and what the vendor truly owns.

The language issues—lots.

For instance you personal 20% of the mineral property underneath a property. Now:

- In case your deed says you are promoting “20% of the minerals,” that is 20% of the entire mineral property—and also you’re doubtless promoting the whole lot you personal.

- But when your deed says you are promoting “20% of my mineral rights,” then you definately’re solely conveying 20% of your 20%—or — or simply 4% of the whole mineral property.

That distinction might sound minor, however in oil and fuel legislation, that nuance is the whole lot. This is the reason title attorneys and landmen learn each deed word-for-word to see what was truly granted or reserved.

Why this will get sophisticated:

Mineral pursuits are sometimes fractional to start with, and homeowners might not all the time know precisely what they personal. That is why imprecise or inconsistent deed language can result in confusion—and lawsuits.

One well-known authorized doctrine that comes into play is the Duhig Rule (from Duhig v. Peavy-Moore Lumber Co., 1940). This case established a key precept in Texas (and adopted in lots of different jurisdictions):

If a deed conveys extra curiosity than the grantor truly owns, and it additionally makes an attempt to order an curiosity, the reservation fails to the extent crucial to satisfy the grant.

In plain English: if you happen to say you are promoting 1/2 of the minerals and reserving 1/2—however you solely personal 1/2 to start with—then you definately simply offered the total 1/2 and did not efficiently preserve something.

Different key factors in fractional mineral transfers:

- Single leases often cowl 100% of the mineral property, even when there are lots of fractional homeowners. The operator will then pay royalties in proportion to every particular person’s possession.

- Every mineral proprietor indicators individually (or is drive pooled in some states), however there is not any want for 10 completely different leases—only one lease that covers 100%, with royalties break up accordingly.

- Government rights and royalties may also be divided. You would possibly switch a part of your mineral curiosity however retain the proper to lease or obtain bonus funds.

Backside line:

By no means assume a share is straightforward. “20% of the minerals,” “20% of my minerals,” and “an undivided 1/5 mineral curiosity” might all result in completely different authorized outcomes. That is why cautious deed drafting—and studying prior deeds within the chain of title—is crucial.

If I purchase land however not the minerals, can somebody entry my property to drill? What rights does the mineral proprietor have over the floor?

Sure. In most states, the mineral property is dominant, which means the mineral proprietor (or their lessee) has the authorized proper to entry the floor to extract minerals — even with out the floor proprietor’s permission. This contains constructing roads, pads, tanks, and pipelines.

Operators are restricted to “cheap use” of the floor and should decrease pointless injury. In the event that they exceed that, they are often held chargeable for damages.

Floor Use Agreements (SUAs)

Although not all the time required, operators usually negotiate a Floor Use Settlement (SUA) with the floor proprietor. This outlines:

- The place drilling and roads can go

- Compensation for floor damages

- Restoration phrases after operations finish

If no SUA is signed, the operator can proceed however should pay damages, usually resolved by means of state legislation or litigation.

State-by-state variations:

- Texas: Mineral rights are dominant, however the Lodging Doctrine might shield sure floor makes use of.

- North Dakota and Oklahoma: Require statutory floor injury funds if no SUA is in place.

- Colorado: Requires pre-drilling session and formal floor use planning.

Lengthy-Time period Affect

Operators should restore the land after drilling ends, however that might be a long time away. Wells usually keep energetic for 30–50 years. The floor proprietor can not prohibit entry, however can search damages or negotiate protections upfront.

What occurs if a dissolved LLC reserved mineral rights?

The mineral rights do not disappear — they’re nonetheless owned by the dissolved LLC or its successors. Possession would not mechanically revert to the floor proprietor except state legislation gives for abandonment, which is uncommon and often requires formal discover and statutory procedures.

When an LLC dissolves, its belongings — together with mineral rights — turn out to be a part of the wind-down course of. These belongings are usually distributed to:

- The members of the LLC (like shareholders in a company), or

- Collectors, if money owed are owed.

Nonetheless, if the dissolution wasn’t dealt with correctly or no switch was recorded within the county clerk’s information, the minerals should still present as owned by the defunct entity in title.

The right way to discover out who owns the curiosity now:

- Search the Secretary of State’s information – Most states preserve LLC filings and listing the registered agent and members. Begin right here to establish the folks or corporations behind the dissolved entity.

- Examine dissolution filings – If the LLC was correctly dissolved, there could also be documentation exhibiting who acquired the belongings.

- Overview probate or courtroom information – In some instances, belongings switch by means of probate or authorized motion if the LLC’s members are deceased or inactive.

- Quiet title motion – If nobody steps ahead and the chain of title is unresolved, a floor proprietor (or purchaser) might have to file a quiet title go well with to scrub up possession—particularly if the mineral rights are inflicting points with a sale or lease.

Does zoning (residential vs. industrial) have an effect on mineral proper issues?

Zoning would not change mineral possession or dominance—the mineral property remains to be legally dominant whether or not the floor is zoned residential, industrial, or rural. Nonetheless, zoning does affect how and the place improvement happens.

In residential areas, mineral improvement faces extra regulatory scrutiny, stricter allowing, and better pushback from householders. Nonetheless, if the minerals weren’t beforehand reserved, the mineral proprietor (or lessee) retains the proper to develop.

A very good instance is the Barnett Shale in Fort Price, Texas, the place Landmen went door-to-door signing leases in neighborhoods. In consequence, there are producing wells all through suburban areas—usually positioned on small pads tucked between properties, church buildings, and colleges.

Industrial tracts face related points. If an organization or investor owns the minerals underneath a shopping mall, workplace park, or warehouse, they nonetheless retain the proper to entry these minerals—even when it is inconvenient for the floor proprietor.

The underside line is, zoning impacts how simply mineral improvement can happen, but it surely would not override the mineral proprietor’s authorized rights.

Can mineral rights be bought again after severance?

Sure—however provided that the present mineral proprietor agrees to promote. Mineral rights are actual property and comply with a separate chain of title from the floor. So, if you happen to personal the floor and wish to “purchase again” the minerals, you will have to run title to establish who owns them, then contact these events to barter.

As a result of mineral pursuits are sometimes fractionalized, you’ll have to take care of a number of homeowners, execute buy agreements, conduct due diligence, and shut like some other actual property transaction.

Earlier than shopping for, it’s vital to evaluate the worth of future manufacturing primarily based on location, geology, and market traits—or have a purchaser already lined up so you may arbitrage the unfold between what you pay and what they’re prepared to pay.

The place do floor rights finish and mineral rights start?

There is not any common depth the place floor rights cease and mineral rights start—the division is authorized, not geological, and it depends upon how rights have been initially conveyed or severed within the chain of title.

Here is the way it usually breaks down:

- Water rights (together with groundwater) often belong to the floor proprietor, however legal guidelines fluctuate by state. In lots of instances, landowners can drill wells and use water beneath their property—topic to native regulation.

- Gravel, sand, caliche, and limestone are sometimes thought-about a part of the floor property—particularly in the event that they’re close to the floor and generally used for on-site development or improvement. Nonetheless, they are often handled as minerals in some states or underneath particular contracts.

- Oil, fuel, coal, and arduous rock minerals (like gold, copper, lithium) are practically all the time a part of the mineral property and are severed from the floor when mineral rights are conveyed or reserved.

So how are you aware the place the road is? It comes all the way down to:

- The deed language. Some deeds particularly listing which sources are being reserved or conveyed—and that is one of the best place to start out.

- State legislation and precedent. Courts in numerous states interpret issues like limestone or sand in another way. In Texas, for instance, limestone is usually thought-about a part of the floor property, whereas oil and fuel are unquestionably a part of the mineral property.

- Financial use. In authorized disputes, courts typically contemplate whether or not the fabric is being utilized in a approach that resembles mineral manufacturing. For instance, if an organization is commercially mining gravel and promoting it off-site, a courtroom might deal with it as a mineral curiosity—even when it is shallow.

When minerals are severed:

If the mineral property has been severed from the floor, the mineral proprietor might declare possession of any useful resource legally thought-about a “mineral” underneath state legislation — even when it is near the floor. However many shallow supplies (like sand and gravel) nonetheless “go together with” the floor except expressly included within the mineral deed.

Are wind/photo voltaic rights handled like mineral rights?

No—wind and photo voltaic rights are a part of the floor property, not the mineral property. However they will battle with mineral improvement.

In locations like West Texas, the place each oil manufacturing and photo voltaic improvement are frequent, floor use should be coordinated. Because the mineral property is dominant, a floor proprietor can not block entry to the minerals—even when a photo voltaic array is put in.

To keep away from battle, photo voltaic builders usually search floor use waivers from mineral homeowners or lessees. This waiver provides up the proper to make use of the floor for oil and fuel operations. It is usually negotiated with compensation, particularly if the minerals are leased and held by manufacturing.

Mineral Rights Q&A: Fracking, Geology, and Drilling

How does fracking work, and the way does that complicate mineral rights?

Fracking, or hydraulic fracturing, includes injecting high-pressure fluid into underground rock formations to create cracks and launch trapped oil or fuel. It’s a key expertise in unlocking unconventional reservoirs—formations that have been historically too tight or impermeable to supply from economically.

Traditionally, oil and fuel improvement relied on standard reservoirs, the place hydrocarbons migrated from a supply rock into porous sandstone or limestone formations. These have been usually produced utilizing vertical wells. Nonetheless, with developments in drilling expertise, operators now drill horizontally into the supply rock itself—usually shale—which holds huge quantities of hydrocarbons however has extraordinarily low permeability.

Horizontal drilling permits a single wellbore to entry hundreds of toes of pay zone, and when mixed with fracking, it dramatically will increase manufacturing from these unconventional performs.

This shift complicates mineral rights as a result of horizontal wells usually cross a number of tracts, making it important to have clear pooling agreements. A properly pad on a neighboring tract would possibly legally extract hydrocarbons from underneath your property—if you happen to’re inside the unit and correctly leased. That is why clear unitization, lease boundaries, and division of curiosity calculations are crucial in horizontal improvement.

Is it ever not a speculative play to purchase mineral rights?

Sure—when shopping for producing minerals with present money circulate or acreage permitted for imminent drilling. Shopping for confirmed producing reserves is extra funding than hypothesis.

Reserve classifications assist outline this distinction. Essentially the most dependable class is PDP (Proved Developed Producing), which refers to wells which are actively producing hydrocarbons. These reserves carry the least danger, as engineers can mannequin remaining volumes utilizing historic manufacturing knowledge and decline curves.

Different classes embody:

- PDNP (Proved Developed Non-Producing): Reserves behind pipe or in shut-in wells which have already been drilled however aren’t but producing.

- PUD (Proved Undeveloped): Areas the place reserves are recognized to exist and will be recovered with current expertise, however a properly nonetheless must be drilled. These carry extra danger and delay.

- PROB (Possible): Reserves prone to exist primarily based on close by knowledge, however much less certainty in quantity or industrial viability.

- POSS (Attainable): Extremely speculative reserves with the least supporting knowledge—the riskiest classification.

When valuing mineral rights, professionals low cost every reserve class primarily based on danger. PDP is most beneficial resulting from money circulate certainty. PUD, PROB, and POSS are assigned decrease current values resulting from improvement danger, commodity worth volatility, and timeline uncertainty.

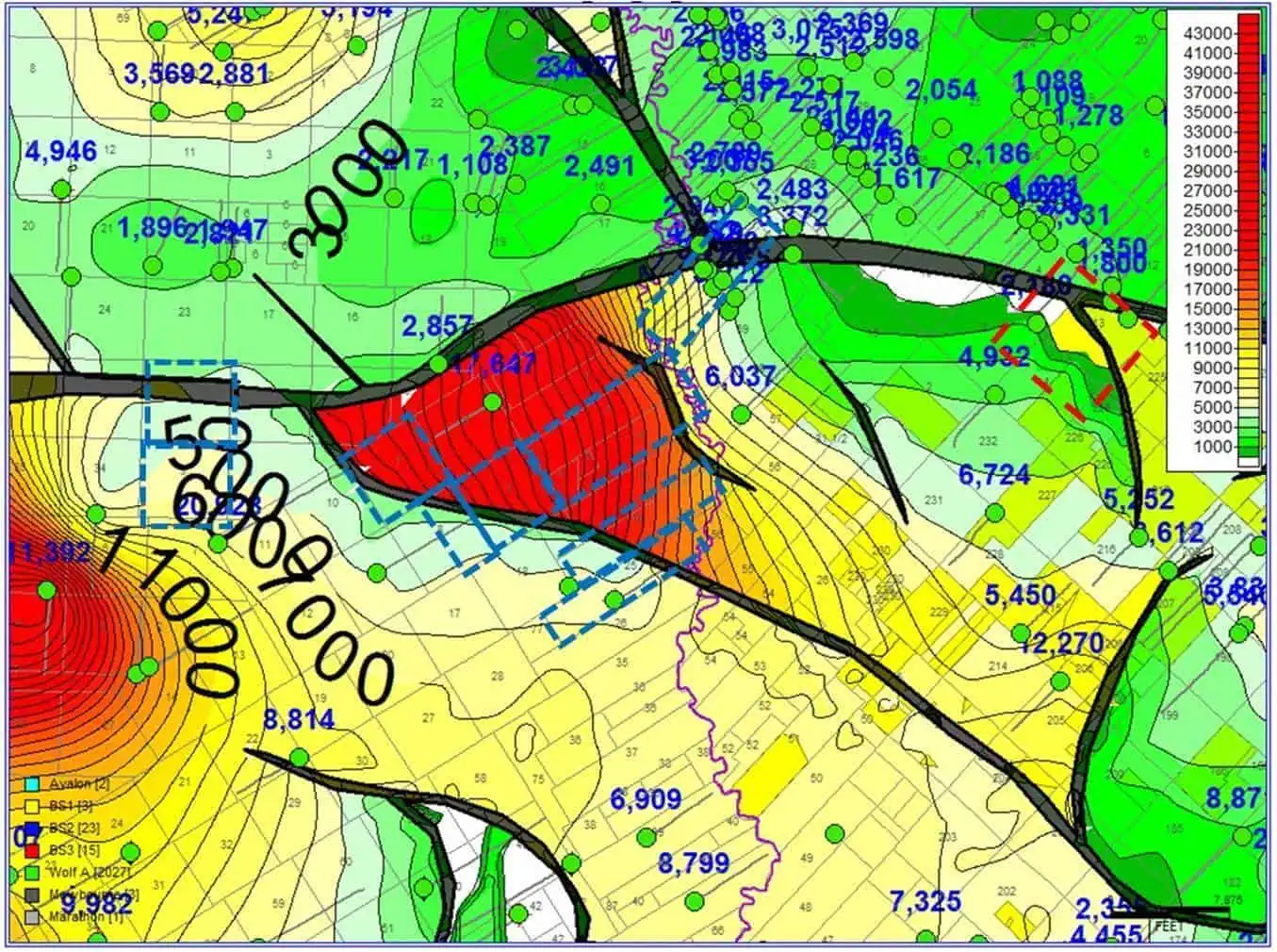

In mature, uniform basins just like the Midland Basin, Delaware Basin, or Bakken, even PUD reserves carry comparatively low geologic danger. In such areas, the larger variables are timing and oil/fuel costs. Mineral consumers in these areas usually buy rights at a reduction to projected future earnings, assuming danger in change for upside potential.

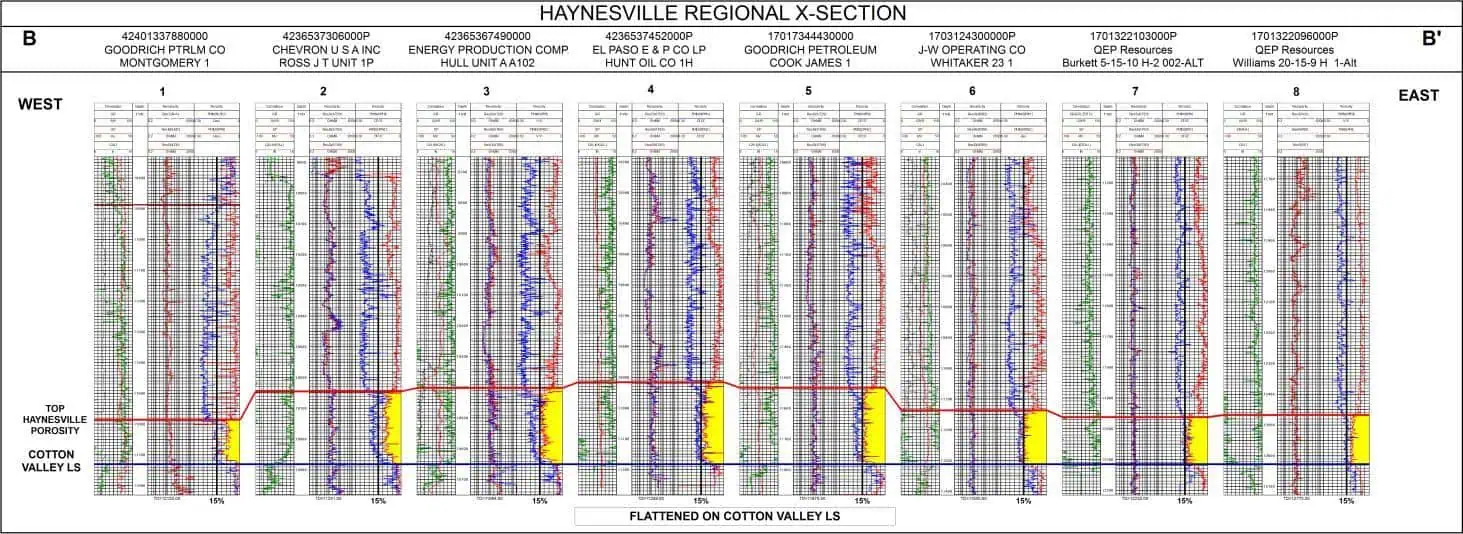

How does the sonar/seismic factor work?

What you are referring to is known as a seismic survey, and it is one of the crucial vital instruments geologists use to search out oil and fuel underground—earlier than drilling.

Seismic would not work precisely like sonar, but it surely’s related in idea. Here is the way it works:

- Sound waves are despatched into the bottom utilizing managed vitality sources like small explosive expenses or vibrating tools (referred to as vibroseis vans).

- These waves bounce off layers of rock underground, and receivers (geophones) on the floor choose up how lengthy it takes for these waves to replicate again.

- Utilizing hundreds (or thousands and thousands) of information factors, computer systems course of the timing and energy of those wave reflections to create a 3D mannequin of the subsurface geology.

That is crucial for exploration as a result of it:

- Helps establish geologic constructions like faults, folds, and trapped layers—which could maintain oil and fuel.

- Lets geologists map the doubtless dimension, form, and depth of reservoirs.

- Dramatically reduces drilling danger—particularly when wells value $5–10 million or extra every.

Give it some thought this fashion: oil corporations do not simply poke random holes within the floor and hope for one of the best. That will be wildly costly and inefficient. Seismic knowledge permits them to focus on the highest-probability areas and keep away from losing cash on dry holes.

That mentioned, seismic knowledge would not let you know precisely what’s down there. It exhibits constructions that appear to be they might include hydrocarbons—but it surely will not say how a lot oil or fuel is definitely current or how properly it should circulate. It is a chance instrument, not a assure.

So in abstract:

- Seismic helps discover the “the place”—the place to drill

- It helps de-risk exploration

- And it saves thousands and thousands by avoiding unhealthy wells

Which minerals are folks most involved with?

In most components of the U.S., when folks confer with “mineral rights,” they’re usually speaking about oil and fuel rights—and people are by far probably the most generally leased and developed mineral pursuits at this time.

However that is only one piece of the image.

Throughout the nation, relying on geology, demand, and technological development, there are lots of different varieties of useful minerals, together with:

- Coal and lignite (particularly within the Midwest and Appalachia)

- Arduous rock minerals like gold, silver, copper, and zinc

- Industrial minerals akin to limestone, sand, and gravel (used for development)

- Uncommon earth components (utilized in electronics, magnets, and navy tools)

- Lithium (more and more useful resulting from demand for lithium-ion batteries in electrical autos and vitality storage)

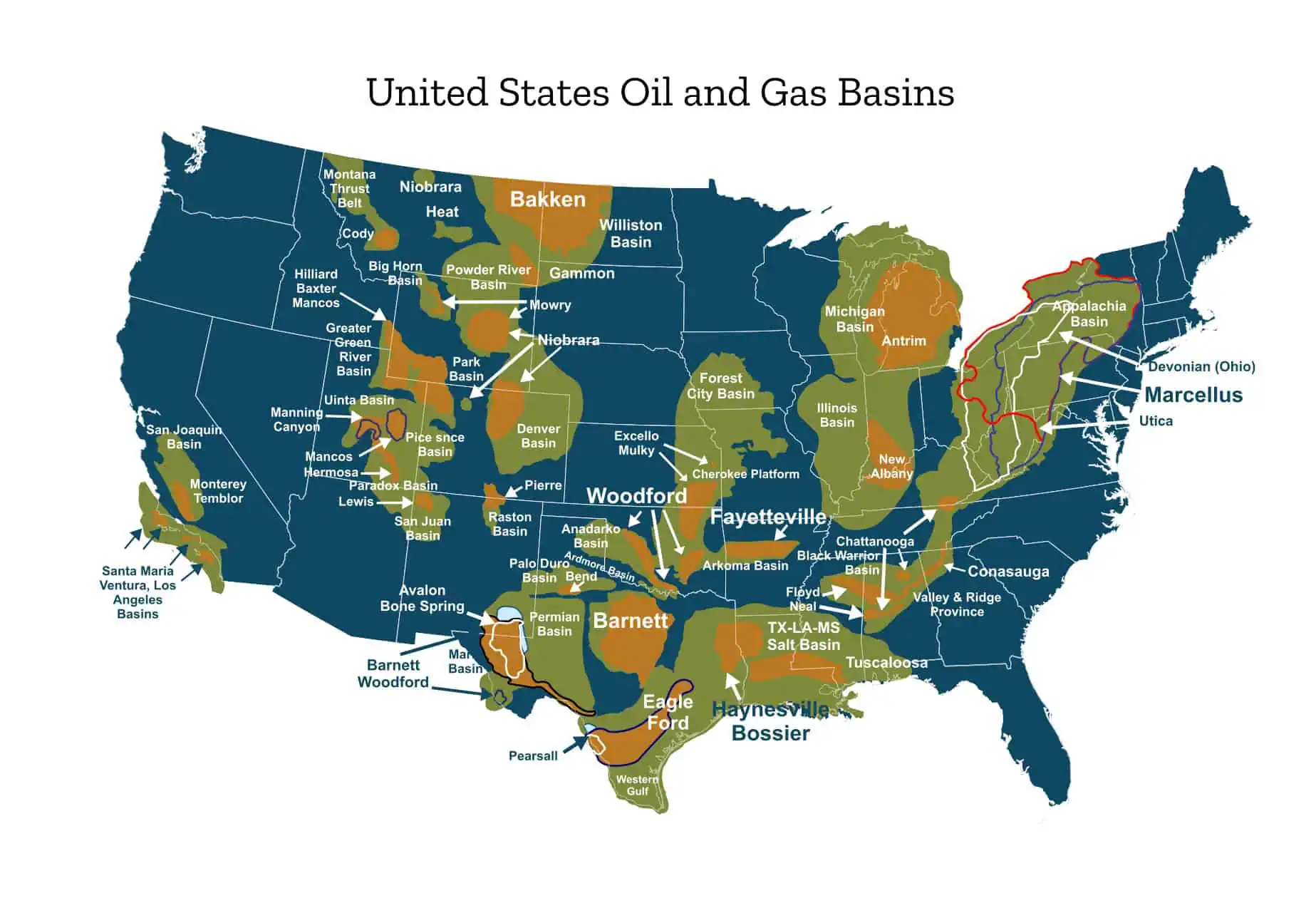

The secret’s location and geology. Every area of the nation has its personal geologic profile. For instance:

- Oil and fuel dominate within the Permian Basin (TX/NM), Bakken Shale (ND/MT), Marcellus Shale (PA/WV), and Eagle Ford (TX).

- Lithium is being explored within the Clayton Valley of Nevada and components of Arkansas.

- Coal and lignite are outstanding in Wyoming’s Powder River Basin and components of North Dakota and Texas.

- Uncommon earth minerals are being explored in areas of Utah, Wyoming, and California.

As expertise improves and the economics of extraction change, beforehand uneconomic sources might turn out to be viable. What wasn’t value drilling or mining 10 years in the past might now be extremely worthwhile—particularly as new industries (like electrical autos and inexperienced tech) create contemporary demand for various minerals.

For landowners:

- It is vital to grasp what pure sources are usually present in your area.

- Examine your state’s geologic or mineral useful resource maps.

- Take a look at historic information to see if any minerals have been beforehand explored, mined, or drilled in your land or close by.

- Think about using a platform like LandGate or reaching out to a geologist or land skilled if you happen to suspect your property might have untapped potential.

Even when your property is not presently leased or producing, it could nonetheless carry mineral worth primarily based on its location, geology, and surrounding exercise.

Are there states the place mineral rights do not have worth?

Sure—mineral rights solely have worth if the subsurface comprises one thing that may realistically be extracted and offered for a revenue. That depends upon a mixture of geology, location, market demand, and expertise.

Whereas oil and fuel rights are extremely useful in sure areas (like Texas, Oklahoma, and North Dakota), there are lots of components of the nation the place mineral rights presently maintain little to no worth, particularly for oil and fuel. That is frequent in components of the Higher Midwest, the Northeast, and sure inside areas the place no confirmed productive formations exist.

However the actuality is extra nuanced than simply “state by state”—in actual fact, it is usually county by county, and even part by part inside a county.

Key components that affect worth:

- Geologic formations do not comply with county or state strains. Subsurface rocks have been fashioned over thousands and thousands of years, lengthy earlier than property boundaries existed. In consequence, one a part of a county would possibly sit on a extremely productive shale layer, whereas the following part over has no reservoir rock in any respect.

- Worth relies on future productive potential. If no drilling or mining is occurring close by—and nobody’s leasing—the market is telling you there’s doubtless little worth there at the moment.

- Know-how and economics matter. Even when there may be some useful resource underground, it is likely to be too deep, too tight, or too dispersed to be extracted economically with present expertise. That may change over time, as we have seen with shale improvement and uncommon earth components.

That mentioned, some areas that do not have oil or fuel potential should still have worth in different methods:

- Aggregates like gravel, sand, or limestone

- Arduous rock mining (gold, copper, lithium, and so forth.)

- Coal or lignite (although in decline in lots of areas)

- Carbon credit score leasing or geothermal potential

The underside line is massive swaths of the U.S. have mineral rights with little to no present market worth. However that is not all the time everlasting. Worth is pushed by geologic potential, operator curiosity, commodity costs, and technological developments. Even in non-producing areas at this time, sure minerals may turn out to be useful sooner or later.

Mineral Rights Q&A: Valuation and Funding

How do you appraise the worth of mineral rights?

Valuing mineral rights requires a mixture of monetary modeling, comparable gross sales, and geologic evaluation. The principle approaches embody:

- Revenue strategy: That is primarily based on the discounted money circulate (DCF) of projected royalty earnings. For instance, if an operator drills a properly anticipated to supply 500,000 barrels of oil over its life, and also you personal a 1/8 royalty curiosity (12.5%), your share can be 62,500 barrels. At a $70 oil worth, that equals $4,375,000 in gross royalty income. Making use of a reduction charge of 15% over the projected decline curve permits traders to calculate the web current worth (NPV) of these future royalties in at this time’s {dollars}—presumably nearer to $2.5–$3.2 million relying on timing and danger profile.

- Reserve classes and danger discounting: These future revenues are weighted primarily based on their classification:

- PDP (Proved Developed Producing): Low danger; already producing. Discounted at 8–12%.

- PDNP (Proved Developed Non-Producing): Behind-pipe or shut-in wells. Barely extra danger at 12-15%.

- PUD (Proved Undeveloped): Drillable however not but drilled. Discounted at 20–25%.

- PROB (Possible): Much less sure than PUDs; might depend upon spacing or market circumstances. Discounted at 25–40%.

- POSS (Attainable): Excessive danger, extremely speculative. Typically discounted closely or excluded.

- Geological potential: Traders consider whether or not the minerals lie inside a recognized productive basin—just like the Midland Basin, Bakken, or Delaware—the place formations are steady and properly understood. In these areas, a lot of the chance is diminished to timing and commodity pricing fairly than geological uncertainty.

- Market comps: Latest comparable gross sales provide perception into present market sentiment. These are usually expressed in {dollars} per internet mineral acre (NMA). In energetic areas, PDP-heavy tracts might promote for $15,000–$30,000/NMA, whereas undrilled, speculative tracts commerce for considerably much less relying on location and operator exercise.

What if you happen to purchase mineral rights, and the properly runs dry the following day?

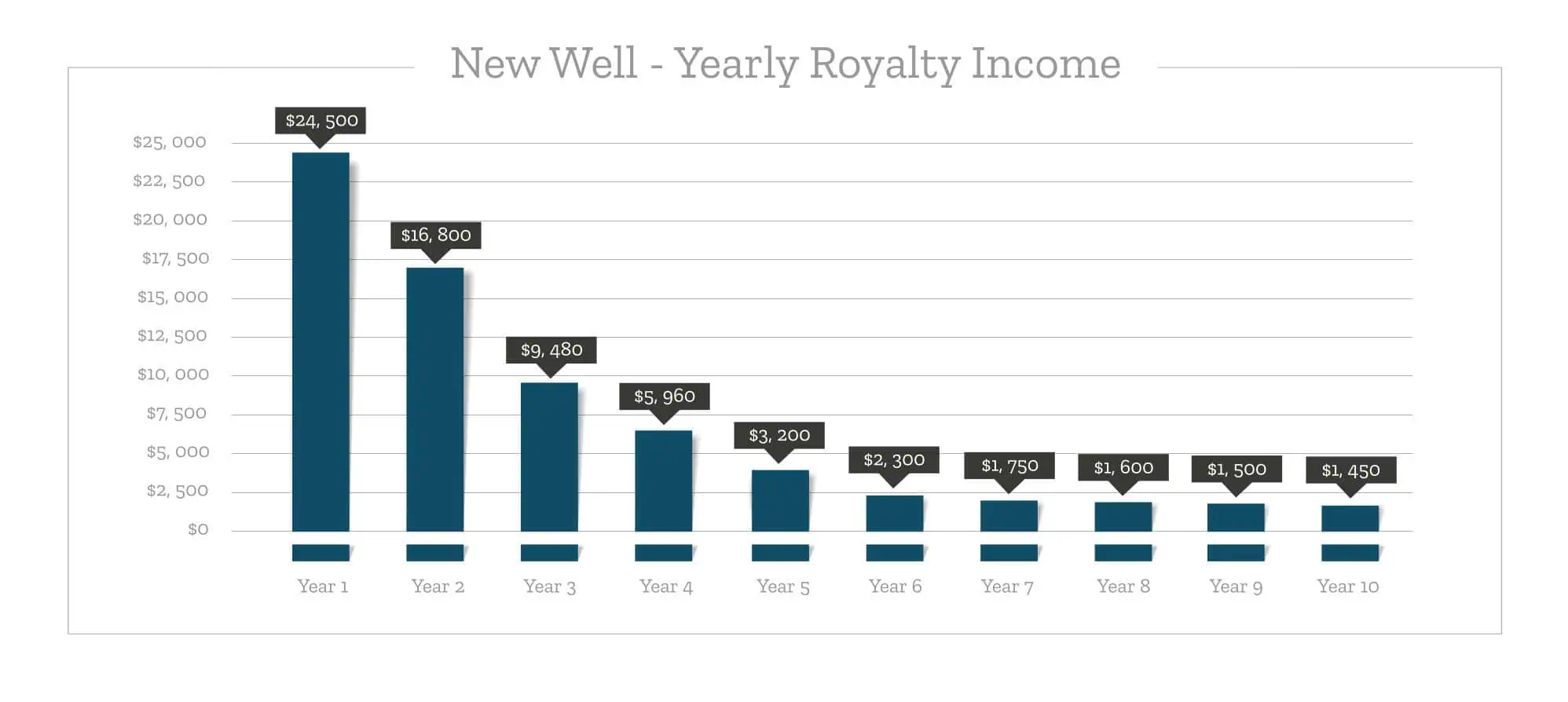

That is one of many core dangers of shopping for mineral rights—and it is why valuation should be primarily based on future money circulate, not simply present manufacturing. Whenever you purchase mineral rights tied to a producing properly, what you are actually shopping for is a share of the income that properly will (hopefully) generate going ahead. If that properly stops producing, your earnings stream can disappear in a single day.

Here is why that occurs and what to grasp:

- Wells decline over time. Each properly has a manufacturing curve—it usually produces lots early on after which declines, typically sharply. That is referred to as a decline curve, and it’s a key instrument used to mannequin future manufacturing.

- Gear and economics matter. Older wells use getting old tools, and manufacturing prices usually rise over time. If the anticipated remaining oil or fuel isn’t useful sufficient to cowl the price of getting it out of the bottom, the operator would possibly shut the properly in (briefly) or plug it (completely abandon it).

- Reserve life is restricted. Engineers can often estimate how a lot recoverable useful resource stays primarily based on manufacturing knowledge. If a properly doesn’t have sufficient “life” left to justify upkeep or rework, it should doubtless be shut-in or plugged.

- Mineral homeowners don’t management the operator. As a mineral rights proprietor, you aren’t in control of operations—the oil or fuel firm is. Meaning they determine whether or not to reinvest within the properly, promote to a different operator, shut it in, or drill one other one close by. Nonetheless, staying in contact with the operator (or checking public information) might help you perceive their improvement plans.

- Know what you’re shopping for. Earlier than shopping for mineral rights, particularly in a producing space, attempt to evaluation:

- Properly historical past: When was it drilled? What’s its manufacturing pattern?

- Operator conduct: Are they energetic within the space?

- Remaining reserves: How a lot oil or fuel is probably going left?

- Offset drilling: Are different wells being drilled close by?

Backside line: if you happen to purchase right into a properly late in its life and it will get shut in proper after, you’ll have overpaid. That is why sensible mineral consumers use decline curves, manufacturing historical past, and financial modeling to estimate future income—and apply a reduction to replicate the chance that issues do not go as deliberate.

Might an absence of mineral rights damage my resale worth?

Sure—particularly with knowledgeable consumers in actively explored areas of oil and fuel, coal and different minerals.

That mentioned, worth depends upon market context. In case you’re shopping for and the vendor would not assign worth to the minerals, you are probably not paying for them. If the property is in an space with no recognized manufacturing, there is likely to be little or no if any worth.

However if you happen to’re promoting in a recognized oil and fuel space and also you personal mineral rights, it is sensible to separate the worth of the floor from the minerals—because the minerals might signify future income from leasing, royalties, or manufacturing.

Good sellers in producing areas usually reserve the minerals or negotiate a separate sale, particularly when there’s clear geologic and operator curiosity.

Is there a market for getting/promoting mineral rights?

Sure. Examples: EnergyNet, LandGate, MineralWare, US Mineral Alternate, Vitality Area, unsolicited mail presents, brokers, and public sale platforms. Personal fairness additionally actively buys minerals.

How do you consider mineral rights as an funding?

Estimate potential:

- Royalty % and lease phrases

- Chance of leasing

- Drilling permits close by

- Historic manufacturing Then mannequin projected money flows, apply a reduction charge (usually 10–25%), and examine to buy worth.

Mineral Rights Q&A: Leasing and Royalties

How massive of a priority is it when mineral rights are reserved?

If there is not any present mineral improvement within the space, it could be a minor concern. In energetic basins, it may possibly have an effect on land use, improvement, and property worth. All the time examine to see what sorts of exercise have traditionally occurred round your space.

How do I calculate how a lot my royalty ought to be? (Understanding Division of Curiosity)

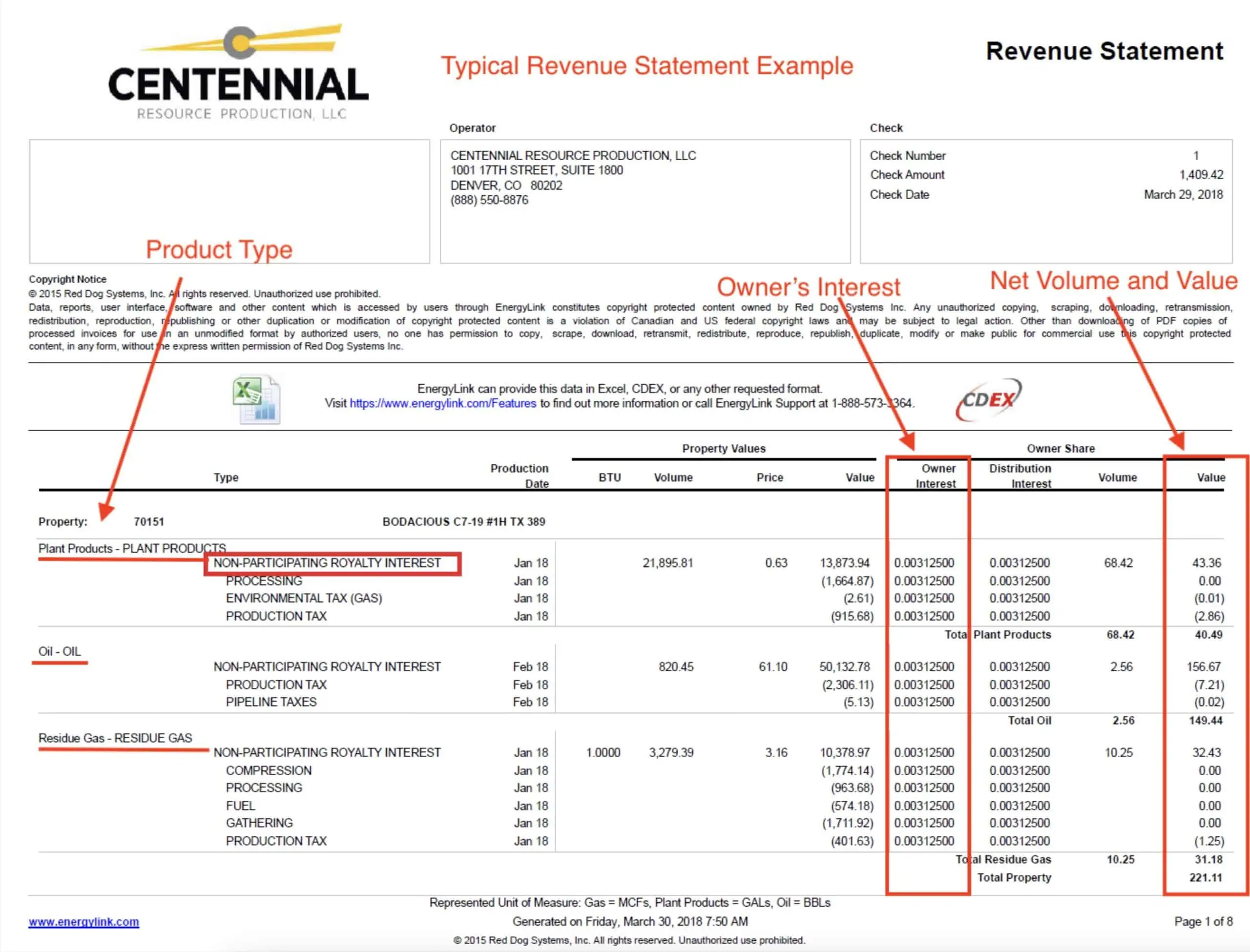

Your royalty examine relies in your Division of Curiosity (DOI)—which represents the fraction of complete manufacturing you are entitled to from a properly or unit. To calculate this, it’s good to know:

- What number of internet mineral acres (NMA) you personal

- The dimension of the unit the properly is drilled in

- The lease royalty charge (usually between 12.5% and 25%)

Instance state of affairs:

You personal 50% of the minerals underneath a 20-acre tract, and that tract is a part of a 640-acre pooled unit. You signed a lease with a 20% royalty.

Step-by-step calculation:

- Calculate your Web Mineral Acres (NMA). You personal 50% of the 20-acre tract: 20 acres × 0.50 = 10 NMA

- Divide your NMA by the whole unit dimension. You’re a part of a 640-acre pooled unit: 10 NMA ÷ 640 acres = 0.015625

- Multiply by your lease royalty charge. You signed a lease at 20% (0.20): 0.015625 × 0.20 = 0.003125

Ultimate end result:

Your Division of Curiosity (DOI) is 0.003125. Meaning you’ll obtain 0.3125% of the income from that properly’s manufacturing.

So if the operator sells $1,000,000 of oil and fuel in a given month, your share can be: $1,000,000 × 0.003125 = $3,125

Why this issues:

Even a small DOI can add up over time, particularly when costs are excessive or if you happen to’re a part of a number of wells. Understanding this math helps you confirm royalty checks and consider what your minerals is likely to be value if you happen to select to lease or promote.

Let me know if you wish to present how a number of tracts or leases affect the calculation, or if we must always transfer to the following query in your listing.

What’s a pooled unit, and the way does it have an effect on my royalty funds?

A pooled unit is a authorized mechanism utilized in oil and fuel to mix a number of tracts of land—usually owned by completely different folks—into one unit for the aim of drilling a single properly. As a substitute of drilling a separate properly on every tract (which might be inefficient and dear), the operator drills one properly and shares the manufacturing income proportionally amongst all of the mineral homeowners within the unit.

This course of is known as pooling, and it is usually licensed within the oil and fuel lease by means of a pooling clause. In some states, if not all mineral homeowners comply with lease, the operator can nonetheless kind a unit by means of pressured pooling with regulatory approval.

Why pooling issues:

- Protects mineral homeowners. Pooling ensures you receives a commission your share of manufacturing—even when the properly is not positioned instantly in your tract. Income is split primarily based on how a lot acreage you contribute to the unit and your lease phrases.

- Protects operators. It prevents authorized disputes over drainage and permits operators to drill probably the most environment friendly properly, usually saving thousands and thousands in improvement prices.

- Preserves the worth of the reservoir. Pooling avoids drilling pointless or competing wells that might cut back stress and waste the useful resource.

How royalties are affected:

Your Division of Curiosity (DOI) is calculated utilizing this system: (Web Mineral Acres ÷ Unit Dimension) × Royalty Price

For instance, if you happen to personal 10 internet mineral acres in a 640-acre unit with a 20% royalty: (10 ÷ 640) × 0.20 = 0.003125 or 0.3125%

That is your share of all income from the properly within the pooled unit.

Mineral Rights Q&A: Authorized Points and Laws

Who regulates mineral rights on the state stage?

Mineral rights are thought-about actual property, and their possession is ruled by state property legal guidelines and a long time of courtroom precedent. These authorized frameworks evolve over time as new instances check previous interpretations—particularly round conveyance, severance, and title disputes.

In the meantime, exploration and manufacturing actions, akin to drilling, pooling, allowing, and floor affect, are usually regulated by a state company. For instance:

- Texas: Texas Railroad Fee (RRC)

- North Dakota: Industrial Fee

- Colorado: Colorado Vitality & Carbon Administration Fee (ECMC)

There’s usually interaction between the courts and businesses. Here is the way it usually breaks down:

- Dealt with by courts/authorized precedent:

- Who owns what (title disputes)

- Mineral vs. floor rights interpretation

- Deed language and reservations

- Government rights and royalty claims

- Dealt with by state regulatory businesses:

- Properly spacing and allowing

- Pressured pooling guidelines

- Floor use and environmental compliance

- Flaring, manufacturing reporting, and abandonment

A mineral proprietor would possibly find yourself in each methods: leasing or pooling disputes might undergo the company, whereas possession or income share disagreements are resolved in courtroom.

How does a floor use settlement work?

A Floor Use Settlement (SUA) is a personal contract between the floor proprietor and the mineral rights holder (or their lessee). It outlines how the operator can entry and use the land to drill for minerals.

Typical phrases embody:

- Ingress and egress entry factors

- Pad website and street placement

- Fee for floor damages

- Cleanliness and upkeep obligations

- Restoration necessities after operations are full

Whereas the mineral property is dominant, SUAs assist make clear rights, keep away from disputes, and guarantee honest compensation to the floor proprietor.

What is the distinction between floor rights, mineral rights, royalty pursuits, and different varieties of possession?

Consider the payment easy property (full possession of land) as a bundle of sticks—every stick represents a distinct proper that may be separated, conveyed, or retained. Over time, these rights are sometimes break up amongst completely different events. Here is how the important thing parts break down:

- Floor rights – The proper to make use of and occupy the floor of the land (e.g., farming, constructing, entry). Does not embody subsurface rights except particularly retained.

- Mineral rights – Possession of the subsurface minerals (oil, fuel, and so forth.) and the proper to discover, drill, and produce—or lease these rights to another person.

- Government rights – The authority to barter and signal oil and fuel leases on behalf of all or a part of the mineral curiosity.

- Royalty curiosity – The proper to obtain a share of manufacturing income, with out bearing drilling or working prices. Often expressed as a share of manufacturing.

- Non-participating royalty curiosity (NPRI) – A royalty curiosity that doesn’t embody government rights. The holder will get paid royalties however can not negotiate or signal leases.

Every of those will be break up off and offered or inherited individually. That is why clear title and deed language are crucial in mineral transactions.

If I personal floor however no minerals, do I get compensated for drilling?

In a roundabout way. You could be compensated for floor damages, however not royalties except negotiated individually.

How are lease presents dealt with when a number of folks personal the identical minerals?

When a number of folks personal undivided pursuits in the identical mineral tract, every particular person owns a share of your entire property, not a selected part. In consequence, every proprietor has the proper to barter and signal their very own lease with the operator.

In some instances, members of the family or co-owners select to barter collectively underneath a single lease. However extra generally, every proprietor indicators a separate lease, usually with completely different phrases. An proprietor with a bigger curiosity—or one strategically positioned inside a deliberate drill website—might have extra leverage to barter for a better royalty, higher floor protections, or operational restrictions.

If most homeowners lease and some maintain out, pressured pooling legal guidelines in some states (like Oklahoma and North Dakota) permit the operator to pool these unleased pursuits underneath regulatory oversight.

Can mineral rights be deserted from non-use?

In some states, sure—but it surely’s uncommon. A number of states have Dormant Mineral Acts that permit floor homeowners to reclaim severed mineral pursuits after an extended interval of non-use.

For instance, Louisiana has a “prescription of nonuse” rule: if mineral rights aren’t used (e.g., leased, produced, or explored) for 10 years, they mechanically revert to the floor proprietor except motion is taken to protect them.

Different states like North Dakota, Ohio, and Indiana have Dormant Mineral statutes, however the course of is not computerized. Floor homeowners should file affidavits or courtroom actions and provides discover to the mineral homeowners or heirs. If no response is made, the minerals could also be cleared and transferred.

These legal guidelines fluctuate extensively when it comes to timing, course of, and enforceability, they usually’re not acknowledged in most main producing states like Texas or Oklahoma.

Can consumers discover shock encumbrances after closing?

Sure—it’s normal to find unrecorded leases, outdated manufacturing nonetheless holding a lease, fractional pursuits handed by means of generations, or prior conveyances that weren’t correctly documented. These points can cloud title, delay leasing, or cut back your precise curiosity. To keep away from this, conduct a full mineral title evaluation, not simply floor title—ideally with a landman or title legal professional accustomed to oil and fuel.

What due diligence steps ought to I soak up mineral-rich areas?

In case you’re shopping for property in an oil- and gas-producing space—and also you’re uncertain whether or not mineral rights are included—comply with this plan:

- Begin with the title firm. Ask if they will suggest a title abstractor to tug a full chain of title for the mineral property. This can assist you to see if any prior homeowners reserved or conveyed mineral rights.

- Rent a landman. A certified landman can put together a Mineral Possession Report (MOR), exhibiting what mineral curiosity, if any, remains to be connected to the property.

- Examine for leases and manufacturing. If the minerals are leased and presently producing, the lease could also be held by manufacturing (HBP). Ask the vendor in the event that they’re receiving royalties — this could come up throughout negotiations.

- Confirm royalty standing. Contact the proprietor relations division of the operator listed on close by wells. Ask in the event that they’re paying royalties on the tract and request affirmation of possession.

- Overview royalty statements. If the vendor is receiving royalties, request a current paystub. It should present their division of curiosity and month-to-month funds. This helps you estimate present and future worth.

- Assess future upside. Use public drilling information or seek the advice of an area landman to guage whether or not extra wells are doubtless. This will considerably affect worth.

This course of helps you keep away from surprises and decide whether or not the mineral curiosity is value pursuing—or if you happen to’re simply shopping for the floor.

Are there protections in opposition to harmful extraction if I do not personal minerals?

Some protections exist, however they fluctuate by state. Many states require operators to barter a Floor Use Settlement (SUA) or pay floor damages. Nonetheless, if you buy land after an SUA is already in place, you will be sure by the phrases your vendor agreed to.

Operators should usually confine exercise to an outlined floor pad, and whereas drilling will be noisy and disruptive, many of the mess stays inside the pad boundaries. City areas usually have stricter zoning, setbacks, and allowing necessities, however none of this overrides the truth that mineral homeowners retain the proper to develop their sources.

If no SUA exists, you continue to have the proper to cheap use protections and should search compensation for extreme damages—however enforcement often requires authorized motion.

What ought to be in a lease to guard the landowner?

In case you personal each the floor and mineral rights, you’ve extra leverage to barter lease phrases that shield your land and forestall long-term encumbrances. Key provisions to incorporate:

- Floor Use Restrictions – Restrict the place roads, pads, and tools can go. Require fencing, noise management, and website restoration.

- Pugh Clause – Ensures solely producing acreage is held by the lease, releasing any undeveloped parts after the first time period.

- Royalty Clause – Specify royalty share and limit or prohibit post-production deductions.

- Shut-in Clause – Requires well timed shut-in funds if a properly is just not producing, and units limits on how lengthy the lease will be held with out exercise.

- No Project With out Consent – Lets you approve or deny lease transfers to 3rd events.

- Depth Severance Clause – Releases deeper or shallower zones that aren’t drilled.

- Many different clauses are wanted to correctly assemble an oil and fuel lease. It is suggested you’re employed with a educated oil and fuel legal professional that can assist you with guaranteeing you’ve a properly negotiated lease that protects you because the mineral proprietor, in addition to shield the floor property.

If the operator desires to drill in your property, you will additionally wish to negotiate a separate Floor Use Settlement (SUA) to cowl compensation, website format, and floor restoration.

Ought to I get title insurance coverage masking minerals?

Most title insurance coverage insurance policies exclude mineral rights. If you wish to confirm mineral possession, the usual strategy is to rent a landman to run mineral title and produce a Mineral Possession Report.

To take it additional, you may have an oil and fuel legal professional challenge a title opinion primarily based on that report. Whereas this is not the identical as title insurance coverage, a title opinion gives a legally reviewed evaluation of possession and can be utilized to assist your place in case of a dispute. It is the closest equal to title insurance coverage within the mineral world.

Can I 1031 change mineral rights?

Sure—mineral rights qualify as actual property for 1031 change functions, so long as they’re perpetual (not leasehold pursuits). This implies you may defer capital features taxes by exchanging mineral rights for different qualifying actual property, or vice versa. Nonetheless, the properties should be “like-kind,” and the change should comply with strict IRS timelines and procedures. All the time seek the advice of a 1031-qualified middleman and tax advisor earlier than continuing.

What occurs to mineral rights in a tax sale or foreclosures?

It depends upon how the rights are severed. If the mineral rights are separate from the floor, a tax sale of the floor usually doesn’t embody the minerals—they continue to be with the unique mineral proprietor. But when the mineral rights have been by no means severed, they could switch with the floor except individually protected. All the time examine the chain of title and any recorded severances when evaluating tax sale properties.

Share Your Ideas

Assist out the present!

Thanks once more for listening!